![]() A new report form Goldman Sachs 10,000 Small Businesses shows participating entrepreneurs continue to add jobs and revenue, receive external funding more frequently, and take their businesses to the next level.

A new report form Goldman Sachs 10,000 Small Businesses shows participating entrepreneurs continue to add jobs and revenue, receive external funding more frequently, and take their businesses to the next level.

The fourth edition Babson College report on 10,000 Small Businesses takes a look at approximately 6,000 small business owners who have completed the program across the United States. The resulting data demonstrates the program’s lasting impact on small business growth and provides insight into how America’s small businesses can create jobs and drive opportunity.

“I went from financing my cash flow with my personal credit cards, to getting a $250K working capital loan from a local bank, to purchasing my own facility through a SBA loan.”

— Enrique Torres

The course is designed for established businesses that need guidance and resources to grow. The program reports that within six months, over two-thirds (67.2 percent) of program alumni reported revenue growth.

Longer term results furthermore reinforce widespread revenue growth. Thirty months after completing the program, almost four out of five (77.8 percent) alumni increased revenues. To place this into the context of the broader economy, slightly less than half of U.S. small businesses surveyed by the National Small Business Association (NSBA) for its 2016 Year-End Economic Report reported increasing their revenues.

In addition, program data consistently shows that over time, 10,000 Small Businesses alumni both apply for and receive external funding more frequently after completing the program.

Alumni seeking funding from banks or other financial institutions were approved 69.2 percent of the time within six months. At 18 months, the bank loan approval rate increases to 77.5 percent and then to 79.7 percent at 30 months. Program alumni who are approved for external funding receive a larger percentage of their request, resulting in a lower incidence of shortfalls and a lower shortfall amount when compared to the industry average. Data consistently underscores that acquiring capital leads to more frequent revenue growth and job creation.

“The Goldman Sachs 10,000 Small Businesses program has been instrumental to our growth path, helping me organize our business, focus on the right issues and adjust to changes,” said Enrique Torres of Excellent Fruit & Produce in Miami. “I went from financing my cash flow with my personal credit cards, to getting a $250K working capital loan from a local bank, to purchasing my own facility through an SBA loan.”

[Image: 10,000 Small Businesses]

Advisory Council co-chair Dr. Michael Porter played a key role in establishing the target participant profile and works with both national and local partners across the country to reach those businesses.

The selection process is designed to identify small business owners who have both passion and desire to grow their businesses. It also assesses an applicant’s willingness to engage in peer learning.

Characteristics of qualified businesses include revenues greater than $150,000 in the most recent fiscal year, a minimum of four employees, owner or co-owner of the business, and being in operation for at least two years.

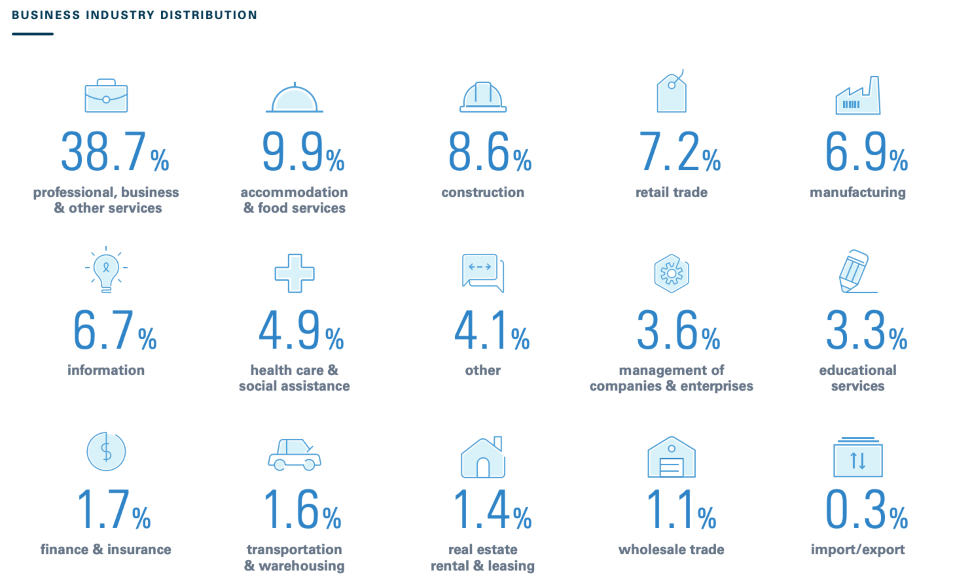

10,000 Small Businesses participants are distributed among these sectors. [Image: 10,000 Small Businesses]

The program has empowered entrepreneurs from all 50 states, Washington, D.C., and Puerto Rico. Data shows that participating businesses have earned a total of $9 billion in revenue added around 130,000 new employees. Click here to read the report in full.

Goldman Sachs 10,000 Small Businesses is currently taking applications in Dallas for the 2019 Summer Cohort. Applications are accepted through Feb. 5, 2019. Interested businesspeople can apply online here.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.