For years, Uber Freight and Aurora Innovation have partnered on self-driving truck runs between Dallas and Houston and Fort Worth and El Paso, with safety drivers behind the wheel monitoring operations. That human in the cab may not be needed as soon as late this year, when Aurora plans to launch fully “driverless” operations. Now, to help carriers of all sizes jump on the driverless bandwagon, the two companies have launched a new program called Premier Autonomy.

Announced today, Premier Autonomy provides early reservation access “to over 1 billion of Aurora’s driverless miles to Uber Freight carriers through 2030.” The program will continue to integrate and deploy autonomous trucks on the Uber Freight network to enable carriers “to improve utilization and enhance business efficiency through autonomous technology,” the partners said.

Chicago-based Uber Freight said it will be one of Aurora’s first customers on its Dallas-to-Houston freight route when those fully driverless hauls for shippers are expected to launch at the end of 2024.

‘Democratizing’ autonomous trucking

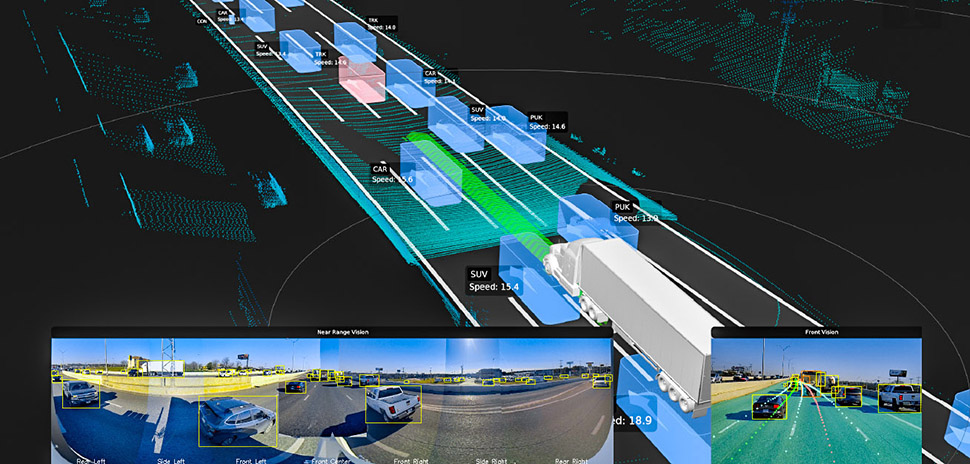

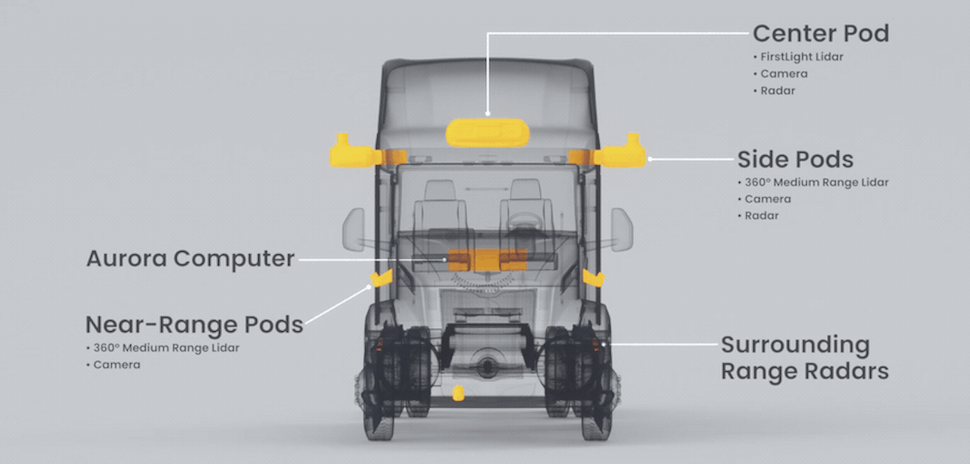

Video still of Aurora Driver hardware animation [Image: Aurora]

“Uber Freight and Aurora see a tremendous opportunity to democratize autonomous trucks for carriers of all sizes, enabling them to drive more revenue, scale their fleets, and strengthen their bottom lines,” Lior Ron, founder and CEO of Uber Freight, said in a statement. “Autonomous trucks will make moving goods more efficient, and this industry-first program will help facilitate and accelerate the adoption of autonomous trucks with our carriers. We’re proud to work alongside the amazing team at Aurora to bring this technology into the hands of carriers and ultimately usher in a new era of logistics.”

The two companies’ “industry-first program” offers carriers “an early and streamlined path” to purchase and onboard the Aurora Driver—the autonomous trucking technology that Aurora called “feature complete” last year.

Per Uber Freight, the benefits of the Premier Autonomy program include a subscription to the Aurora Driver for autonomous freight hauling; the opportunity to access over 1 billion driverless miles through 2030; and high utilization of autonomous trucks via a planned, seamless integration of the Aurora Driver into the Uber Freight platform.

Aurora’s Dallas-based president aims to see ‘thousands of driverless trucks on the road’

Ossa Fisher

Last year, Aurora reinforced its North Texas ties by appointing Ossa Fisher as its Dallas-based president. Aurora itself is based in Mountain View, California and Pittsburgh, Pennsylvania.

The company has a corporate office in Coppell northwest of Dallas, and terminals for its trucking product, Aurora Horizon, in suburban Palmer south of Dallas and in Fort Worth. Aurora has also done autonomous trucking runs out of DFW for FedEx, Werner, and Schneider, and unveiled its test fleet of autonomous, ride-hailing Toyota Siennas in Dallas in 2022.

“With Uber Freight, we can provide hundreds of carriers priority access to autonomous truck capacity that they wouldn’t otherwise have,” Fisher said in a statement today. “Working with carriers of all sizes is one of the many ways we will transform the industry and see thousands of driverless trucks on the road. It’s exciting and validating that companies like Uber Freight are reserving our long-term capacity for their customers. We all see collective value in this offering.”

No stopping for driver to sleep along the way—and ‘32% more energy-efficient’

Uber Freight noted that a human-driven truck takes “two to three days” to move freight from Dallas to Los Angeles. With the Aurora Driver, “that trip has the potential to be completed in a single day,” the company said.

Aurora says its research indicates that autonomous trucks have the promise of being “up to 32% more energy-efficient than traditional trucking by optimizing highway speeds, reducing deadhead miles and idling, increasing vehicle utilization and off-peak driving, programmed eco-driving, and more.”

Uber Freight and Aurora said they’ve hauled “millions of pounds of cargo” since pilots began in 2020, “unlocking critical learnings about how to effectively move goods autonomously.”

For middle-market carriers looking for an AV solution, ‘this is it’

To scale their businesses, both Aurora and Uber Freight aim to do for driverless trucking what Uber did with its ride-sharing app: leverage vehicles owned by someone else.

Zac Andreoni, VP of business development at Aurora, told Transport Topics some of the thinking behind the move.

“It’s not a secret that the freight market is in recession,” Andreoni told Transport Topics. “There’s overcapacity, prices are depressed, costs are up and the promise of AV [autonomous vehicles] is to deliver this supercharged asset that can run more efficiently in excess of hours of service,” Andreoni said. “So it’s already a pretty compelling value proposition. With our program, if you’re a middle-market carrier who’s been wondering how you’re going to get your hands on it, this is it.”

“We’re still pursuing our commercial launch and removal of the driver by the end of this year, so we expect to haul driverless for our customers after that as a third-party carrier,” Andreoni added. “So we’ll own assets, and we’ll operate them for our customers as any third-party carrier would, and the economies will reflect that. But that’s really a temporary model.”

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.