Dallas-based global real estate firm Lincoln Property Co. announced that Maria Stamolis has been appointed as chief investment officer and head of investment management.

It’s a role in which she will oversee the company’s investments across its global portfolio, which includes roughly $3 billion in assets under management invested in over $6 billion in assets for separately managed pension fund portfolios.

“With institutional investor demand for real estate increasing significantly in recent years, there is substantial focus on the growth of our investment management business,” Lincoln’s Co-Chief Executive Officers David Binswanger and Clay Duvall said in a joint statement. “Maria has a long track record of success in launching and managing both debt and equity platforms and portfolios across a broad spectrum of real estate property types, and we are thrilled to add such a high-caliber leader to our team to drive the growth of a critical part of our business.”

Stamolis also will be responsible for strengthening and growing Lincoln’s relationships and offerings with institutional investors, the company said.

Expertise in real estate investment platforms

Stamolis brings more than 30 years of experience in commercial real estate to Lincoln, after spending 16 years at Canyon Partners, where she most recently served as partner and co-head of real estate.

At Canyon, Stamolis contributed significantly to the growth of the company’s real estate investment platform, helping to oversee approximately $5.5 billion of debt and equity capital across two hundred transactions over the last 10 years.

Stamolis also was integral to establishing the real estate emerging manager platform, the Canyon Catalyst Fund, in partnership with the California Public Employees’ Retirement System (CalPERS). The fund invested across commercial real estate product types in the Western U.S. alongside early-stage, high-performing emerging managers within a framework of mentorship.

Before Canyon Partners, she held senior roles at real estate firms Karney Management Co. and R+B Realty Group/Oakwood Worldwide. She started her career as a project manager for the Developer Center for Housing Partnerships in New York City, going on to serve as a portfolio manager at both GE Capital and MBL Life Assurance Corporation.

“I am honored to join the Lincoln team as the company embarks on its next-generation growth plan while building on its long-standing history of success,” Stamolis said. “Lincoln has deep roots and significant relationships across the real estate landscape, and I am thrilled about the opportunity to lead the growth of its investment management platform.”

Growing the investment management team

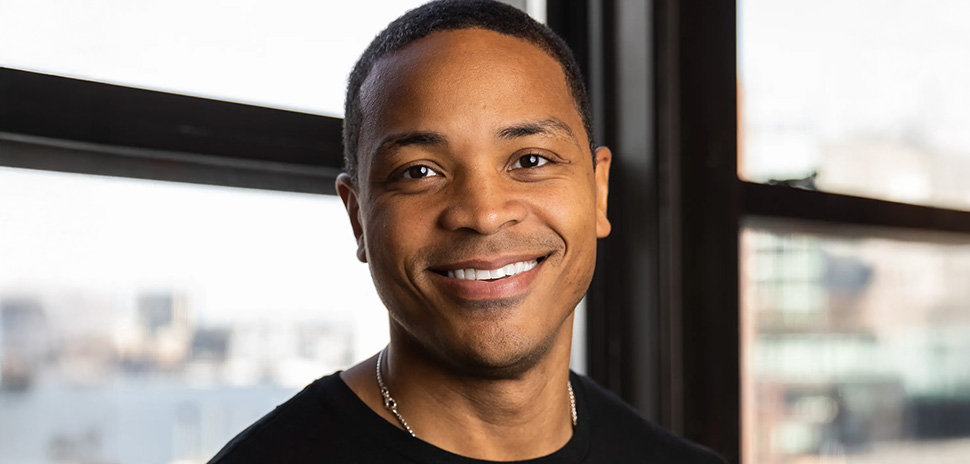

Lincoln also announced that in addition to Stamolis’ appointment as CIO, three additional senior executives will join Lincoln’s investment management team.

Vernon Chin, senior managing director; Rob Bilse, managing director; and Carly Marano, director, collectively have more than 50 years of experience in capital markets and investment management, and they will contribute to fundraising and the development of asset management strategies, as well as transaction activity, the company said.

Chin and Marano worked with Stamolis at Canyon Partners and were key members overseeing the CalPERS emerging manager program, as well as investment management more broadly. Bilse previously was director and head of capital markets at PATRIZIA Property, where he led the North American business and brand strategy.

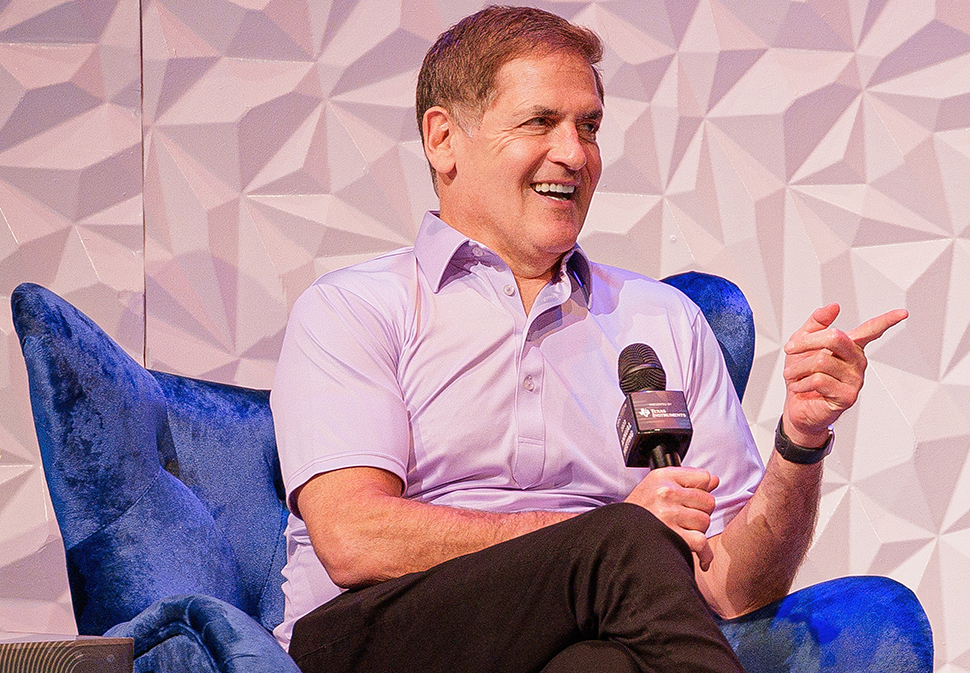

The company said the growth of its investment team follows the appointment of Binswanger and Duvall as co-CEOs. Both of them have spent their careers at Lincoln and were promoted from their previous roles as senior executive vice president of Lincoln West and executive vice president of finance, respectively.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.