Dallas-based Energy Transfer is set to acquire Lotus Midstream Operations, located in Sugar Land, in a cash and stock deal worth $1.45 billion from EnCap Flatrock Midstream’s affiliate. As part of the transaction, Energy Transfer will pay $900 million in cash and issue approximately 44.5 million newly issued common units.

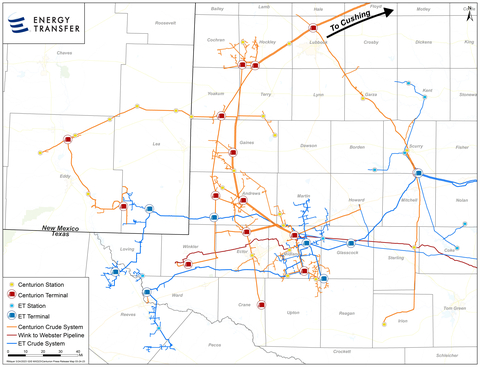

Lotus Midstream owns and operates Centurion Pipeline Company LLC, an integrated, crude midstream platform in the Permian Basin. The companies said the deal is expected to close in the second quarter this year.

Lotus Midstream’s Centurion Pipeline Company provides a full suite of midstream services including wellhead gathering, intra-basin transportation, terminalling, and long-haul transportation services.

Energy Transfer LP acquired thousands of miles of pipeline in its recent deal. [Courtesy image]

Its large system encompasses roughly 3,000 active miles of pipeline and covers major production areas of the Permian with nearly 1.5 million barrels per day of capacity.

Lotus Midstream’s Midland Terminal offers 2 million barrels of crude oil storage capacity and additional supply and demand connectivity, the companies said. The acquisition also includes a 5% equity interest in the Wink to Webster Pipeline, a 650-mile pipeline system transporting more than 1 million barrels per day of crude oil and condensate from the Permian Basin to the Gulf Coast.

Increasing footprint in key markets

Energy Transfer said the acquisition will increase the partnership’s footprint in the Permian Basin and provide increased connectivity for its crude oil transportation and storage businesses.

The Centurion assets, located across some of the most active areas of the Permian Basin, provide important gathering volumes from key producers while enhancing Energy Transfer’s access to key downstream markets with consistent sources of demand.

The assets provide direct access to major hubs including Cushing, Midland, Colorado City, Wink, and Crane, the company said.

Also, upon closing, Energy Transfer said it expects to begin construction on a 30-mile pipeline project that will allow it and its customers the ability to originate barrels from its Midland terminals for ultimate delivery to Cushing.

That project is expected to be completed in the first quarter of 2024.

Sixth largest publicly traded company in North Texas

Energy Transfer was formed by the merger of what was once Dallas pipeline giant Energy Transfer Partners with the owner of its general partner Energy Transfer Equity.

It ranks as the sixth largest publicly traded company in North Texas.

Energy Transfer owns and operates one of the largest and most diversified portfolios of energy assets in the nation, with roughly 120,000 miles of pipeline and associated energy infrastructure.

Its strategic network spans 41 states with assets in all of the major U.S. production basins.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.