TPG, a global alternative asset firm that’s based in Fort Worth and San Francisco, is shaking up its leadership structure to continue its evolution and growth initiatives.

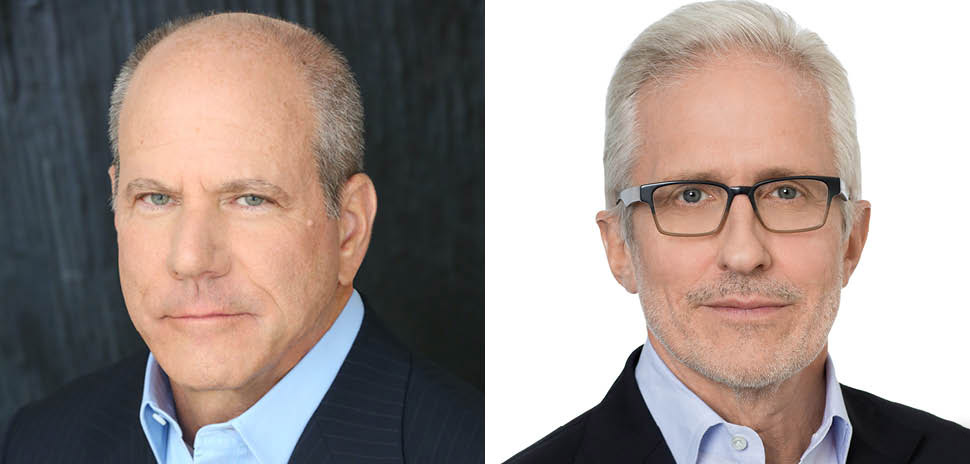

Jim Coulter, who is the co-founder and current co-chief executive officer, is transitioning to the role of executive chairman. Jon Winkelried, Coulter’s fellow co-CEO, will now serve as the sole chief executive officer. Co-Founder David Bonderman will continue in his role as chairman.

TPG said that the change “streamlines the executive function,” allowing it to focus on extending its impact investing franchise to launch more new businesses and strategies.

“David and I are pleased to have a leader of Jon’s caliber as the firm sets the course for TPG’s next chapter,” Coulter said in a statement. “On a personal level, Jon’s perspective and expertise have been incredibly valuable to me as we led the firm together over the last five years. On an organizational level, every aspect of the firm has benefitted from the experience, enthusiasm, and rigor he has brought to TPG.”

TPG, founded in 1992, announced a new executive strategy in 2015 when Winkelried joined the firm to helm it alongside Coulter. As the former president and co-chief operating officer of Goldman Sachs, Winkelried had experience collaboratively working to build and transform a company.

Winkelried and Coulter had complementary skillsets, according to TPG, which led to a cohesive period of significant expansion for the firm. Together with TPG’s global team of senior leaders, the CEOs were able to nearly double the firm’s assets over the past five years. Currently, that amounts to more than $91 billion under management.

They also launched more than a dozen distinct investment strategies with an increased focused on transformative industries.

“I am grateful to Jim for his friendship and partnership and look forward to continuing our work together in his new role,” Winkelried said. “I joined TPG because I fully believed in the TPG team’s ambitions to grow the firm into a diversified alternative investment platform that enables value through specialization, growth through innovation, and insight from a broad ecosystem.”

In his new role as sole CEO, Winkelried will be tasked with maintaining oversight of TPG’s day-to-day management. He hopes to continue delivering on the firm’s vision, maintaining its hallmark entrepreneurial spirit, and capitalizing on emerging opportunities.

Coulter will increase his focus on investing activities; including TPG Rise Climate, a newly formed climate initiative that Coulter will become managing partner of.

Coulter will also continue serving as co-managing partner of The Rise Fund. Launched in 2016, the fund is today an industry-leading impact investing platform that has grown to be one of the largest in the global private market. He will spend his time building these platforms while still playing a key role in TPG’s investment decision processes, client relationships, and strategic direction.

“Nearly 30 years ago, TPG leadership set out to build a unique firm with a distinctive culture and a hands-on approach to value creation,” Coulter said. “It has been immensely fulfilling and inspirational to see our vision come to life.”

The firm said it has been working to boost its leadership and investment teams to innovate new platforms to serve clients.

TPG has investment platforms across a wide range of asset classes, including private equity, growth equity, impact investing, real estate, secondaries, and public equity. The firm’s goal is to build “dynamic products and options” for investors while instituting operational success across its portfolio.

In addition to Fort Worth and San Francisco, TPG has offices in Beijing, Hong Kong, London, Luxembourg, Melbourne, Mumbai, New York, Seoul, Singapore, and Washington D.C.

Recent deals include TPG Growth, the firm’s middle market and growth equity platform, acquiring a significant minority stake in Ideal Image, a leading aesthetics brand, and joining forces with Francisco Partners via TPG Capital to acquire Boomi, a provider of cloud-based integration platform as a service, from Dell.

“TPG has continued to succeed because of the trust we put behind leadership; the firm’s future under Jon’s direction will be no different,” Bonderman said. “Jim and Jon have done an exceptional job of strengthening the firm’s position together and we look forward to continuing to benefit from their leadership and experience as they divide their responsibilities in this new way.”

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.