Solutions by Text (SBT), a Dallas-area company headquartered in Addison and founded in 2008, has raised $110 million in new growth financing, co-led by Edison Partners and StepStone Group, with Stifel Venture Bank providing a lending facility. The funds will support the company’s pioneering work in FinText, integrating real-time payments into text messaging channels.

The platform, which enhances the bill pay experience for businesses and consumers, has already drawn significant investor interest. This latest funding round follows a $35 million investment led by Edison Partners in 2021, aimed at accelerating the adoption of SBT’s compliant text-based solutions.

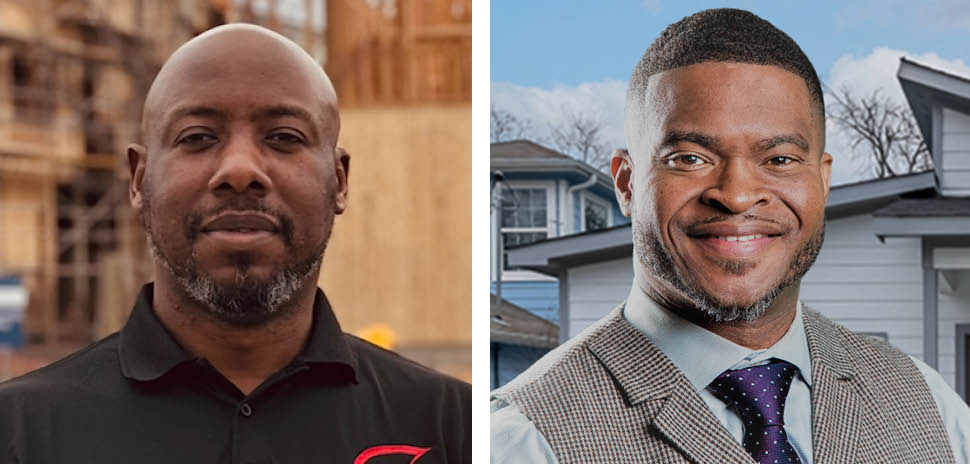

David Baxter

David Baxter, SBT’s CEO since 2021, emphasized the importance of the company’s compliance-first approach in the highly regulated consumer finance sector. “Texting is ubiquitous with consumers, but it has not matched up with the rigorous business requirements of finance regulators and carrier networks,” Baxter said in a statement.

According to the CEO, Solutions by Text has “bridged this divide to drive massive returns for our financial customers and put us on an accelerated upward growth trajectory.”

Baxter added that “consumers want an alternative to endless emails, confusing web portals, and lengthy rounds with call centers when engaging their financial providers.”

The CEO said that the company is “pleased that Edison Partners and StepStone share our conviction about the vast potential for an enterprise-scale compliance platform to orchestrate text messaging and payments in consumer finance.”

SBT said the investment will help the company accelerate growth with large financial institutions, boost its payments and artificial intelligence capabilities, and explore inorganic opportunities.

Since Edison Partners’ initial investment in November 2021, both the company’s bookings and revenue have grown more than 3X through compliant messaging and payment solutions built for consumer finance businesses across origination, servicing, marketing, and accounts receivable use cases.

In 2023, Solutions by Text’s messaging volume increased 95% from the prior year, the company said. This year, SBT is on pace to more than double messaging volume growth.

The company noted its growth metrics. Since Edison Partners’ initial investment in November 2021, SBT’s bookings and revenue have grown more than threefold through compliant messaging and payment solutions built for consumer finance businesses across various use cases. In 2023, the company reported a 95% increase in messaging volume compared to the previous year and is on pace to more than double messaging volume growth this year.

Bringing texting and finances together

According to SBT, text messaging is one of the most effective ways to reach consumers. 90% of consumers prefer text over other forms of communication, with the majority of text messages received and read in under five minutes, it said.

Despite that, and in the face of increasing regulatory complexity and carrier policies, SBT noted that 60% of new customers were not using text messaging for fear of violations over the last 12 months. Compliance difficulty also has forced some customer engagement and messaging providers to exit the financial services sector, SBT said.

The SBT marketing team [Photo: SBT]

Currently, SBT is the only end-to-end enterprise compliance platform for messaging and payments solutions serving the consumer finance industry, the company said. SBT’s compliant-forward platform also allows its customers to discover new opportunities such as payments, where the dynamics work well with messaging. Almost 17 billion bills are issued each year in the United States, growing at an annual rate of 7% and comprising nearly $6 trillion in spending, according to SBT.

Of that, 40% of bills focus on consumer finances, the company said. However, while 88% of Gen Z and Millennial consumers say they would make a text payment, only 9% have been given the opportunity, according to Solutions By Text.

SBT’s unique positioning as the only end-to-end enterprise compliance platform for messaging and payments solutions serving the consumer finance industry has attracted partners and investors alike. In January 2024, SBT partnered with Lightico to enhance customer journeys and compliance in consumer lending and auto finance.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.