A year ago this month, fiber broadband giant Frontier Communications relocated its corporate headquarters to Dallas from Norwalk, Connecticut. At the time, President and CEO Nick Jeffery said Dallas was Frontier’s “home base for Building Gigabit America.” The move established Frontier as one of the largest publicly traded companies to be based in the Dallas market, and the company has since become the first company in North America to demonstrate 100G broadband network speeds.

The HQ move to Dallas was slated to bring 3,000 jobs and $3.8 billion in economic impact to the region over the next 10 years.

Flash forward to today, and Frontier has made even bigger news: It’s being acquired by New York-based Verizon in an all-cash transaction valued at $20 billion.

Verizon said the strategic acquisition of “the largest pure-play fiber internet provider in the U.S.” will significantly expand Verizon’s fiber footprint across the country—while accelerating the its delivery of premium mobility and broadband services to current and new customers.

Verizon said the acquisition will also expand its intelligent edge network for digital innovations like AI and IoT.

There’s no word as yet on how the acquisition will impact Frontier’s Dallas HQ. But as the Dallas Morning News has noted, Verizon’s presence in Irving’s Las Colinas is slated to triple in size via a $285 million expansion first reported in 2020.

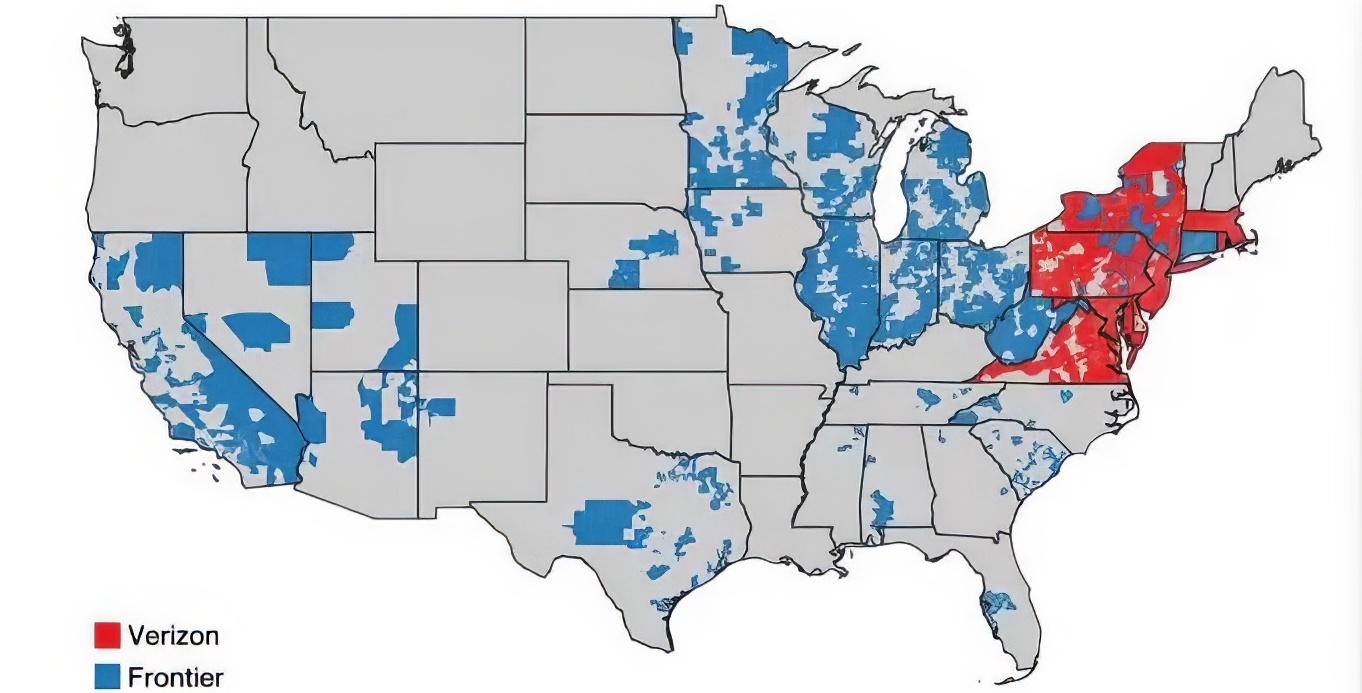

Verizon and Frontier account for 25 million fiber passings in 31 states and D.C. [Graphic: Verizon]

Paying a 43.7% premium to snag Frontier

Under the deal’s terms, Verizon said it will acquire Frontier for $38.50 per share in cash, representing a premium of 43.7% to Frontier’s 90-Day volume-weighted average share price at the close of trading Tuesday. While the transaction is valued at around $20 billion of enterprise value, the cash handoff has been pegged at $9.6 billion, along with around $11 billion in Frontier debt.

“Less than four years ago, we set out an ambitious plan to Build Gigabit America, the digital infrastructure this country needs to thrive for generations to come,” Jeffery, Frontier’s CEO, said in a statement. “Today’s announcement is recognition of our progress building a best-in-class fiber network and delivering reliable, high-speed broadband to millions of customers across the country. It’s also a vote of confidence for the future of fiber.”

“I’m confident that this delivers a significant and certain cash premium to Frontier’s shareholders, while creating exciting new opportunities for our employees and expanding access to reliable connectivity for more Americans,” he added.

For his part, Verizon Chairman and CEO Hans Vestberg called the acquisition “a strategic fit.”

“It will build on Verizon’s two decades of leadership at the forefront of fiber and is an opportunity to become more competitive in more markets throughout the United States, enhancing our ability to deliver premium offerings to millions more customers across a combined fiber network,” Vestberg added in a statement.

Putting the big pieces together

The combined company will integrate Frontier’s “cutting-edge fiber network” into Verizon’s “leading portfolio of fiber and wireless assets, including its best-in-class Fios offering,” the companies announced.

Frontier has invested $4.1 billion in upgrading and expanding its fiber network over the last four years, the announcement noted, and now makes more than 50% of its revenue from fiber products.

With the combination, Frontier’s 2.2 million fiber subscribers across 25 states will join Verizon’s approximately 7.4 million Fios connections in 9 states and Washington, D.C. In addition to Frontier’s 7.2 million fiber locations, the company said it’s committed to its plan to build out an additional 2.8 million fiber locations by the end of 2026.

“Connectivity is essential in nearly every part of our lives and work, and no one delivers better than Verizon,” Vestberg said. “Verizon offers more choice, flexibility and value, and we continuously look for ways to provide the best product and network experience to our customers as we bolster our position as the provider of choice.”

The team behind the dealmaking

Centerview Partners and Morgan Stanley & Co acted as financial advisors to Verizon and Debevoise & Plimpton LLP acted as legal counsel in the acquisition. PJT Partners served as financial advisor to the strategic review committee of the board of directors of Frontier, and Barclays served as financial advisor to Frontier. Cravath, Swaine & Moore served as legal advisor to Frontier, and Paul, Weiss, Rifkind, Wharton & Garrison served as legal advisor to the Strategic Review Committee of the Board of Directors of Frontier.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.