Trez Capital, one of the largest private commercial real estate debt and equity financing solutions in the United States and Canada, announced that firm founder Morley Greene will transition into the role of executive chairman after nearly 26 years as chairman and chief executive officer.

Trez Capital is headquartered in Dallas and Vancouver, British Columbia.

Executive leaders John D. Hutchinson and Dean Kirkham, will serve as co-chief executive officers, taking over day-to-day leadership of the firm.

“Building Trez Capital has been the greatest, most fulfilling and transformational professional experience of my life,” Greene said in a statement. “It has been an incredible 26-year journey for me, but the story does not stop here — the new chapter for Trez Capital is about to begin.”

Trez Capital said its partnership continues to undergo changes that bring new perspectives, skills, and broad expertise.

‘Next chapter of growth and success’

After 13 years with the firm holding progressively senior positions and 20 years of experience in the home building business, Hutchinson joined the partnership in fall 2021.

Kirkham joined Trez Capital in 2016 as chief credit officer and has since taken on increasingly senior roles, culminating in his most recent position as president and chief operating officer.

More recently, in early 2023, Kirkham and John Maragliano came aboard as partners.

Maragliano joined Trez Capital in 2021 as chief financial officer, bringing 25 years of experience in the financial services industry.

“My confidence to transition leadership at this time is a testament to the strength and vision of the firm, creating space for our leaders to emerge, fostering innovation and paving the way for Trez Capital to spread its wings and soar higher in the next chapter of growth and success,” Greene said.

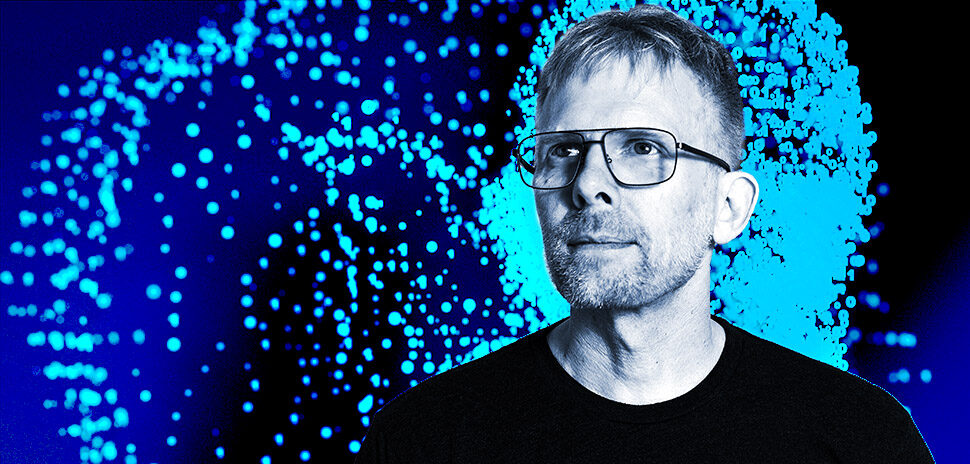

Trez strategic meeting. [Image: Trez Capital]

‘Innovative financing for commercial properties’

In his new role as co-CEO and global head of origination, Hutchinson will continue focusing on the firm’s debt and equity origination business. As co-CEO and president, Kirkham will continue focusing on the key pillars of risk and capital raising for the firm.

The firm said that together, they will set the mission, vision, values and strategic direction of the firm. Additionally, Maragliano will become chief operating officer, paired with his current role as CFO.

“We are focused on growing the firm which will continue to come from our core financing business and the new offerings we have recently brought to the market under our joint leadership,” Hutchinson said.

In his new role, Greene will continue providing mentorship to the executive team, while also actively contributing to key strategic initiatives. And he will prioritize fostering strong relationships with borrowers and investors, which have been an essential component of the organization’s success over time.

“For several years now, Trez Capital has strategically expanded our team of talented leaders who will uphold and build upon the legacy established by Morley, driving our organization forward with purpose and vision. Most importantly, we will continue to put our investors first in everything we do,” Kirkham said.

“Trez Capital’s future has never been clearer, and this sound executive leadership team will continue building upon our reputation of providing innovative financing for commercial properties in major centers throughout Canada and the U.S. while providing exceptional returns for our investors,” Greene said.

Canadian funds and Texas developments

Founded in 1997, Trez Capital is a diversified real estate investment firm and preeminent provider of commercial real estate debt and equity financing solutions in Canada and the United States.

In April, Trez Capital announced the successful closings of its seventh Opportunity Fund in Canada and sixth Opportunity Fund in the United States. The Canadian fund, with a total capitalization of $27 million, is projected to deliver a return of 19% to Canadian investors. The U.S. fund, with a capitalization of $21 million, will grant Canadian investors access to exciting equity developments in the U.S. real estate market.

In January, Trez Capital announced the portfolio sale of two major developments in Austin, The Beacon and The Dalton, to a single purchaser. The projects are the fourth and fifth respectively that Trez Capital has built in partnership with Richardson-based Thompson Realty Capital. Last August, Trez partnered with Thompson on the companies’ ninth collaboration—A 50-acre mixed-used development in Flower Mound.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.