The mission behind Dallas-based real estate startup Nada is as simple as it sounds: Sell your home online, pay nada.

Nada was created to disrupt the residential real estate model. Not only is the platform easily accessible online, but homeowners are able to save thousands against the traditional buy-finance-sell model.

Unlike 95 percent of the industry, Nada has integrated all services—realty, mortgage, insurance, escrow—into a single digital solution. In doing so, a real estate transaction is completely transformed into a complete homeowner service relationship.

It’s also a more affordable and less stressful experience for both the buyer and the seller.

Nada works like this: When a homeowner lists their home with Nada, they receive a full-suite of real estate services for a $4,000 flat fee paid at close and receive a full refund of the fee when they buy their next home with Nada.

That’s where the payment of “nada” comes in.

For customers that are using Nada to buy their home, they are rewarded with up to $2,000 cash back in the form of closing cost credits that help lower the money needed to close and become a homeowner.

Nada is able to this based on the team’s support structure and use of automation to streamline the home buying process. Costs are reduced, and traditional commission fees, which can sometimes be as high as 6 percent, are avoided.

Nada touts its totally transparent model. All flat-fees and services are listed up-front, and Nada is only paid if the home sale successfully closes.

When selling with Nada, one of the startup’s local licensed realtors meets the seller at their house for a free pricing and listing consultation. From there, Nada provides professional photographs, a “For Sale” sign and lockbox, coordinates all showings, advertises the home on online listing sites, and acts as a trusted advisor to negotiate an offer.

Those behind Nada say the idea stems from past statistics.

Residential real estate is a massive market, with a recent study valuing every home in the U.S. at $33.6 trillion.

According to Nada, in 2018, nearly $1.7 billion was paid in traditional real estate commissions for the 112,000 homes sold in North Texas. Nearly $1 billion of that equity could be saved—and that’s where John Green, co-founder and CEO, and his team became inspired.

“One of our customers had been living in their first home for just a couple of years and due to a few unexpected major maintenance issues (costs) and lack of transparency with new home build property tax fees, they found themselves trapped in an investment that just wasn’t working out,” Green told Dallas Innovates. “We were able to prepare a full-service listing for them and actually sold their home in just two weeks, while saving them nearly $7,000. If they had not sold their home with Nada, they actually would have still owed money on the home post-closing.”

The growth track behind Nada

John Green

Green points to the startup’s fast growth and rising investments as a testament to the model’s success.

Nada launched in late 2018 after raising $500K in pre-seed capital from a private investor. In mid-June, the startup announced a new seed round of up to $2MM from private and public investors on a SAFE note.

In the first month of this round, Nada received more than $450K from new investors.

“Two of our core values aligned with a public offering. Transparency, demonstrated by making our records, financials, plans, model, etc. fully available for anyone to see, and commitment,” Green says. “We believe everyone involved in Nada should be committed and accountable to each other and Nada’s mission. With this public offering, we were able to create an opportunity for Nada team members to share in the ownership of Nada. I am thrilled to share that today, nearly all of our team members have invested in Nada—strengthening our commitments to each other and the future of Nada.”

Earlier this year, Nada absorbed fellow Dallas-based discount brokerage SubZero Realty.

The move made Jeremy Males, broker and owner of SubZero, Nada’s Head of Realty service, and was able to boost the startup’s culture, experience, and overall performance.

“[Jeremy] recognized the value in Nada’s platform and business model and reached out to me to discuss joining forces,” Green says. “The SubZero Realty team had been operating for a few years and already helped hundreds of homeowners save on real estate commissions. With Jeremy leading the charge, we knew it was time to move into growth mode.”

And go into growth mode they did.

Behind the scenes

Launched so far is Nada Services, a title and settlement business; Nada Loans, a mortgage brokerage; and Nada Insured, an insurance agency with co-brokerage agreements. That makes four business verticals under parent Nada Holdings.

“Nada is very fortunate to have a business model that actually realized an increase in demand for our services, being a more affordable and online service model for homeowners,” Green says. “We’re confident that we will close on this round of fundraising quickly and plan to deploy this new capital and fully move into growth mode.”

Green and his “pretty lean” team consist of four employees with Nada Holdings and nearly 20 contract sales and tech team members. But with this next period of expansion, Nada is looking to actively grow its realty and mortgage sales teams.

The COVID-19 pandemic doesn’t seem to have slowed down the startup, either.

In late March 2019, Nada launched its MVP version of Nada Realty operations and generated more than $250K in revenue by year-end. This past June, it closed out a record month at $90K with a run rate of over $1MM.

“From a greater industry perspective, I believe that the impact from COVID-19 will result in an accelerated change to consumer behavior and breaking down barriers to enable a more digital home buying and selling experience across multiple sectors,” Green says. “In addition, we have realized homeowners are looking for more suburban and rural homes.”

Green compares what Nada does to Carvana for the auto industry. Customers are able to search, tour, purchase, finance, insure, and settle on their home—and do it all online. When the pandemic hit, the team quickly pivoted from in-person home tours to video, from traditional open houses to Facebook and Instagram live events, and from in-person closings to electronic and mobile paperwork.

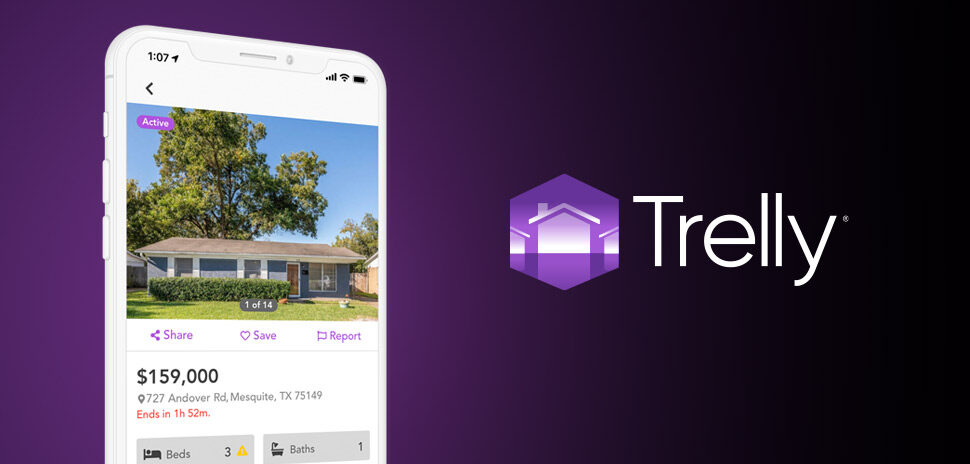

Much of the customer interaction occurs through a digital, AI-powered concierge called Indi.

Throughout the home buying or selling process, Indi acts as a “personal home concierge” through Nada’s Home Eco app. It provides personalized property recommendations, gets customers pre-qualified with a mortgage, and offers an intuitive, conversational journey.

“The Nada Platform fuses human and machine intelligence to power a mobile-first, consumer experience from discovery to financing through to closing and owning of a home,” Green says. “We’re proud to be able to serve our community today and help folks unlock more of their equity through a low stress process.”

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.