Dallas-based CollateralEdge emerged from stealth today with a fintech platform that could boost local economies across the U.S. by helping commercial banks increase lending capacity for small to mid-sized companies nationwide.

The startup has already raised an oversubscribed $3.5 million round from a “stellar group” of capital partners in Texas including VC firm Perot Jain, Capital Factory CEO Josh Baer, and Kneeland Youngblood, the founding partner of Pharos Capital Group.

Innovating debt capital delivery

Co-founders Joe Beard and Joel Radtke are the driving forces behind the new fintech platform, which offers a credit risk mitigation tool for mid-size and community commercial banks. CollateralEdge gives lenders a convenient tool to expand credit to new and existing customers and overcome collateral shortfalls that otherwise would have scuttled the loan opportunities.

Until recently, the duo has operated in stealth, building their secure online portal and refining their risk-pricing algorithmic tools. Their goal is to help banks improve credit risk management and drive profitable, long-term customer relationships in a highly competitive middle market lending environment.

A new model: partnering with the bank

Banks have faced challenges for years from disruption by non-bank lenders and fintech players who “go around the bank” to provide direct financing to companies—often at much higher costs for the borrower.

Beard and Radtke took another approach in their direct partnership model with banks.

“Our platform is simple—we empower community and regional banks to increase lending capacity without compromising credit quality,” Beard said in an interview with Dallas Innovates.

“The net effect of our product directly benefits the bank’s bottom line and provides a great way for relationship bankers and credit officers to find solutions for new loan requests as opposed to rejections,” Radtke added.

A high-powered—and supportive—investor group

CollateralEdge is emerging with a group of highly supportive capital partners that includes prominent Texas investors.

Early-stage VC Perot Jain is one of them.

“We tend to invest in industry-transforming, tech-enabled companies that are led by extraordinary entrepreneurs, and CollateralEdge possesses both of these attributes,” said Ross Perot, Jr.

Kneeland Youngblood, who’s been called “the most interesting man in private equity,” says the founders are “uniquely qualified to take on the challenge” with their deep experience as advisors, operators, and investors. CollateralEdge is “solving a massive problem for community banks that will positively impact thousands of hard-working entrepreneurs,” Youngblood says.

Capital Factory founder Josh Baer says he’s excited to watch Beard and Radtke “create the next fintech unicorn—right here in Texas.” The CEO and investor says CollateralEdge “embodies all the elements of an explosive growth opportunity: experienced founders, strong and deep investor support, a compelling customer value proposition, and a truly massive addressable market.”

From West Point to Credit Suisse, two Ivy Leaguers join forces

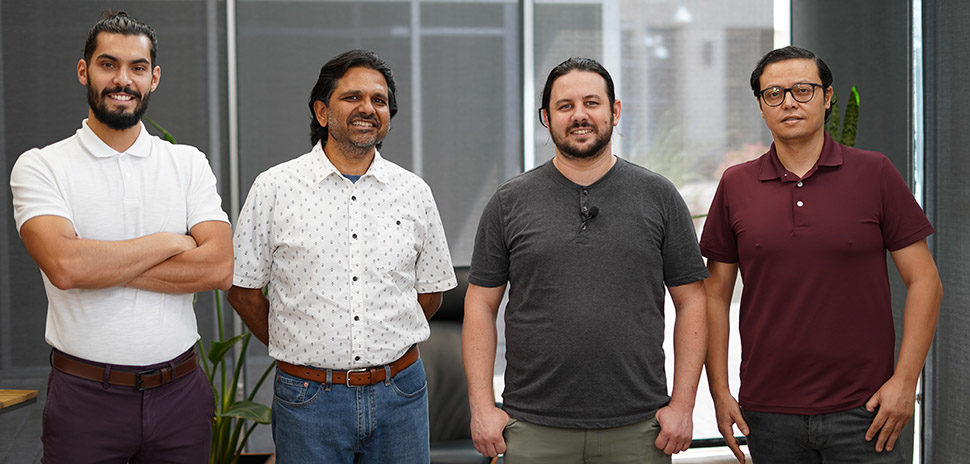

Joe Beard and Joel Radtke [Photo: CollateralEdge]

Beard, who is CEO of CollateralEdge, and Radtke, who serves as President and COO, met eight years ago in a classic coffee shop convergence. It was an ideal match: Both had backgrounds in finance, and a casual conversation quickly morphed into ideation. Two entrepreneurial minds, armed with caffeine and decades of direct experience, saw a path to transform a massive industry.

Beard, a West Point graduate and former U.S. Army Captain, received an MBA from Columbia University and went on to investment banking posts at Bank of America, Bear Stearns, and Merrill Lynch. Later, as a venture capitalist at Perot Jain, Beard invested in over 45 deals across five years.

Radtke is a Harvard graduate who worked in investment banking roles at Credit Suisse and Alex Brown & Sons before shifting to private equity. He later co-founded PE-backed healthcare company United Orthopedic Group, where he served as CFO.

The financiers-turned-entrepreneurs are a rare breed. With experience ranging from investment banking to private equity to venture capital, they’ve long had a seat at the deal-making table—gaining direct exposure to the structural issues they’re addressing with CollateralEdge.

Dallas fintech addresses big problem in middle-market lending

In their combined 40 years of experience, Beard and Radtke have seen firsthand the “structural inefficiencies” that plague middle-market lending—making traditional bank debt financing difficult, inefficient, and often frustrating for all parties.

“When Joe and I started talking about the debt market and our similar backgrounds and experiences, the problem that we saw was a consistent pattern of good companies that should be great bank customers not quite making it through a bank’s risk evaluation process,” Radtke said.

READ NEXT: Dallas Fintech Names Industry Heavyweights to Advisory Board After Oversubscribed $3.5M Seed Round

In many cases, the core credit metrics of a loan request may be sound and even conservative, but the risk of loss to the bank from common middle-market features—such as customer concentration, limited years of operating history, limited personal guarantor comfort, and “asset-light” business models—are difficult to overcome, the co-founders say.

“I think we came up with a very unique way of solving this,” Beard says.

“What really struck us, is that there is a plumbing problem,” Radtke said. “There’s a pipe missing in the system. We provide that pipe—we provide a way for banks to satisfy their customers’ needs in a way the credit officer can get comfortable with. And we do it in a way where the bank remains in control of the entire process.”

The co-founders say their easy-to-use software portal fits cleanly within a bank’s workflow, meaning no extra time is added onto a transaction. By being “very slick” on the backend, CollateralEdge is able to minimize pricing to the banks, which in turn reduces their pricing to the customer. The tool adds up to a serious competitive advantage for banks trying to differentiate themselves in a crowded market.

“We make the banker the hero of the story for their borrower,” Radtke said.

Former FDIC regulator sees positive impact

Jim Watkins, who previously served as the senior deputy director of supervisory examinations at the Federal Deposit Insurance Corporation (FDIC), is an early CollateralEdge advisor and supporter. Now the senior managing director of Isaac-Milstein Group, Watkins sees the positive impact of CollateralEdge on the financial sector and economy.

With CollateralEdge, a bank can deliver additional capital to the borrower while remaining the sole lender to the business, Watkins told Dallas Innovates. “Importantly, a bank can provide this additional capital without raising the bank’s risk of loss,” he says.

Watkins points to the CollateralEdge toolset as a benefit to both banks and customers.

He says the solution solves a key underwriting obstacle that’s “most pronounced in rapidly growing businesses, business acquisitions, and companies with large intangible assets.”

The expanded access to credit fuels economic growth and employment, according to Watkins. “Many of the businesses that benefit from getting their bank loan in place are leading job creators in their local communities,” he says.

The next move: scaling up

Though Texas and Dallas are their home base, the co-founders have the right backing and plan to go big, Beard says.

“We can help so many communities and so many small businesses, our impact can be massive,” Beard says. “Our goal right now is to go out and prove this model, work with great customers, and help middle-market businesses.

“Then, we figure out how to do this on a very, very large scale.”

David Seeley contributed to this report.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.