Dallas startup accelerator Tech Wildcatters—founded in 2009—has one of the longest-running programs of its type in the world. The seed-stage VC just opened its eighth fund, raising an undisclosed round last week, and has invested in 150 startups with eight exits to date.

Yesterday, Managing Partner and CEO Ricky Tejapaibul went online with Tech Wildcatters’ first virtual event to talk about the impact of the COVID-19 outbreak on its portfolio companies and venture capital.

With a background in management consulting and finance, Tejapaibul has tips for startups and investors to “weather the storm” right now. He also shares a view of light at the end of the tunnel: Strong businesses will survive, and for others, the pandemic can prove to be an opportunity.

“There may be a panic going on, but there are also experienced investors and people who are ready to plan for the next move. It’s not about what they could have done yesterday, but it’s about what are the opportunities going forward.”

He admits that “the world may never be the same,” with nearly every startup and industry affected by the crisis.

“Some impacts will be temporary, some will be permanent,” he said. But there are positives we can look at to help companies come out winners.

During a market crisis, there are big impacts on the economy, Tejapaibul said. But looking to the future, he noted that an important question to ask is, “How do we capitalize on that?”

“There may be a panic going on, but there are also experienced investors and people who are ready to plan for the next move. It’s not about what they could have done yesterday, but it’s about what are the opportunities going forward,” he said.

Tech Wildcatters aims to do just that.

“Our early investors are starting to jump on board for our eighth fund,” Tejapaibul told Dallas Innovates. “It may partially be due to the transition to alternative investments since the stock market has proven (again) to be too volatile for many to stomach.”

“Our early investors are starting to jump on board for our eighth fund.“

These are unprecedented times, he says, but Tech Wildcatters remains busy with investor meetings (virtually) due to the interest in capitalizing on ground floor investments with an appropriate time horizon and solid fundamentals.

Tejapaibul moved to Dallas from Pittsburgh in 2016 after seeing North Texas’ potential as a hub for entrepreneurs, he says, joining Tech Wildcatters a year later as its new majority owner. The Thai native, whose resume has multiple master’s degrees from Carnegie Mellon University, brings a broad perspective to the current market conditions.

“In my previous life, I had a chance to work with some of the larger corporates. Relating to the situation right now, I was working with General Motors and doing corporate finance structuring during the big financial crisis in 2009-2010,” he said.

In addition, Terjapaibul has been an angel investor, he noted.

Tejapaibul shared his researched information for startups, investors, and the business community at large in a virtual forum with some 30 entrepreneurs and business leaders on March 26.

Here’s an edited transcript of his online talk.

On market conditions:

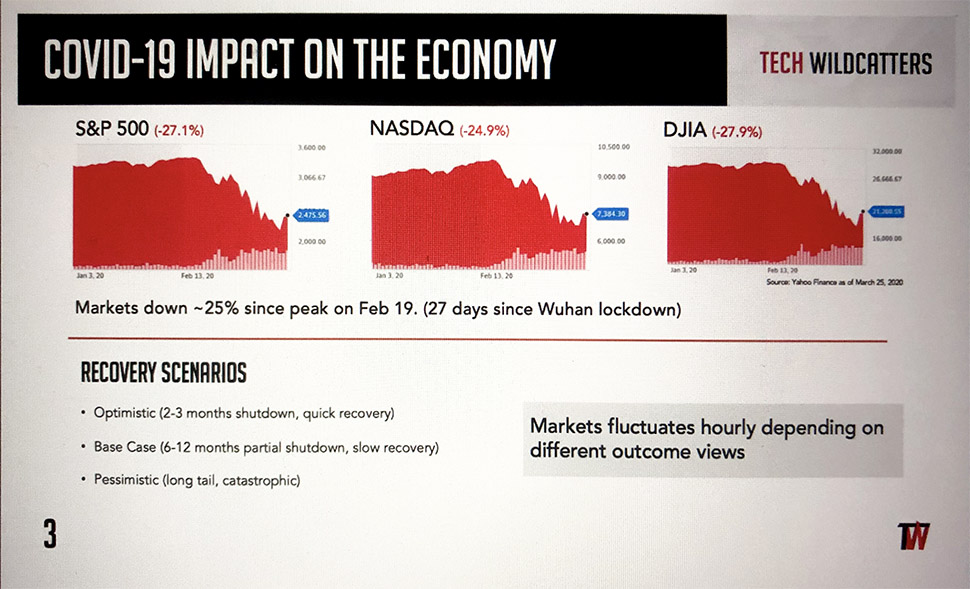

If you look at the stock market—and I’m sure it’s impacted a lot of your personal portfolios as well—the markets are down around 25 percent. We all know that.

Interestingly, the market peaked on February 19, which is actually 27 days after the Wuhan lockdown. It took 27 days for the market to react to that: To say, “Alright, this is global.” But there are traders and there are people, who take positions or change positions, even during the early days of the outbreak.

So it’s about how to stay ahead of the curve of the market, both on the downside and also on the upside. The market changes. I was going to say daily, but it’s much more frequent than that—hourly or minute-by-minute based on different outcome views—what people think.

On COVID-19 economic impact:

We’re looking at three recovery scenarios: Optimistic (two- to three-month shutdown with a quick recovery), Base Case (six- to 12-month partial shutdown with a slow recovery), and Pessimistic (long tail, catastrophic).

We’re already in week two of a national shutdown, and it’s probably going to run for another month or two. In an optimistic scenario, in three months, companies may pick up and start running. People who are directly impacted may realize that the impact is not as much as they thought it would be or the government’s stimulus and all that kicked in, and we’re getting good recovery.

The base case is where it could take a little bit longer—maybe six to 12 months. I say “partial shutdown” because while “yes, this is running,” behavior will be more cautious, which could be a good thing. Also, lifestyle and everything will be different. People will be directly impacted. Discretionary spending will be a lot slower.

The pessimistic case, more long-tail and catastrophic—that’s something you can think about all day long.

What we want to look at today is tech startups, and how do we quantify and justify what we’re looking at.

On industry impact:

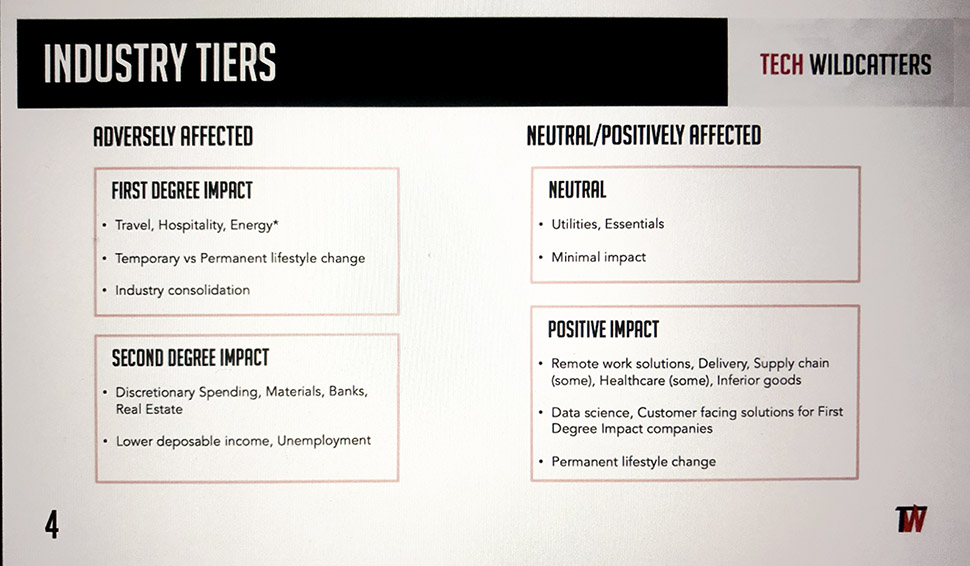

I like to work in industry tiers. This chart shows four different tiers: first degree, second degree, neutral, and positive impact.

The first two, first- and second-degree (including travel, hospitality, energy, discretionary spending, materials, banks, real estate), are adversely affected.

The third and fourth categories, neutral and positive impact (including utilities, essentials, remote work solutions, delivery, supply chain, data science, customer solutions for first-degree companies, some supply chain, and healthcare), are not as much affected.

On first-degree impact industries:

Industries that are affected by the first-degree impact include travel and hospitality. People are not moving around much. And for a company that runs with fixed costs and employees, there’s almost no remedy. These companies are going to run out of cash. I looked at airlines, even the strongest of the biggest airlines, with negative bookings going on. Just by their own balance sheet, they’re not going to survive the year or even a half year. That’s why there are stimulus packages out there.

[Post-pandemic], people may realize that they don’t have to travel as much anymore because they can get things done while working remotely. Or maybe people are going to be more scared to travel. The cruise industry may or may not ever recover. We’re also going to see a lot of industry consolidation. The stronger players may end up surviving, and they may end up merging. But the weaker player is also going to drop away.

The energy sector is a little bit different. There’s a steep decline with prices, which is also caused by geopolitics between Saudi Arabia and Russia, so I grouped them with first-degree causes. What we’re seeing here are some impacts that will be temporary, and some that will be permanent.

On second-degree and neutral impact industries:

The second-degree impact tier shows companies that are not directly getting hit. But if you have less discretionary spending, there’s less to go around, so those companies will get impacted for a while, but there will be some that are strong.

The neutral category includes utilities and essentials. You will see very little impact on that.

On positive impact industries:

The fourth group I will focus on are the areas that may have a positive impact.

For example, people are working at home more, so is there a need for additional solutions to collaboration and bandwidth. Other types of companies that may actually benefit include delivery and logistics. We have some portfolio companies that may see their business spike up because people are not going to shop out in stores anymore. Parts of the supply chain can benefit from that as well.

Health care companies that are directly related to essential health care also may benefit, but nonessential health care may take a hit for a while.

Finally, inferior goods could benefit from this type of economy. [Historically,] we’ve seen certain low-priced goods [have an uptick].

“The other positive impact could be for companies that will sell solutions…first-degree companies know that they’re in trouble: They’re scrambling to look for ways to cope.”

The other positive impact could be for companies that will sell solutions that can help the first-degree impact companies. Because the first-degree companies know that they’re in trouble: They’re scrambling to look for ways to cope.

Let’s say restaurants are doing less sit down and have more delivery: They’re bottlenecked. They don’t have enough staff [for delivery] or take out windows and all that. We can use technology, and we can use self-ordering platforms. We can also use data science that, to help understand customers so we can shift our business.

The companies that provide these types of solutions will see a positive impact.

In this scenario, we may see permanent lifestyle changes. The world might never be the same because people realize that they can do things differently. They are scared or less inclined to do certain things, and customer behavior will change permanently from this.

On capitalizing on the positive factors:

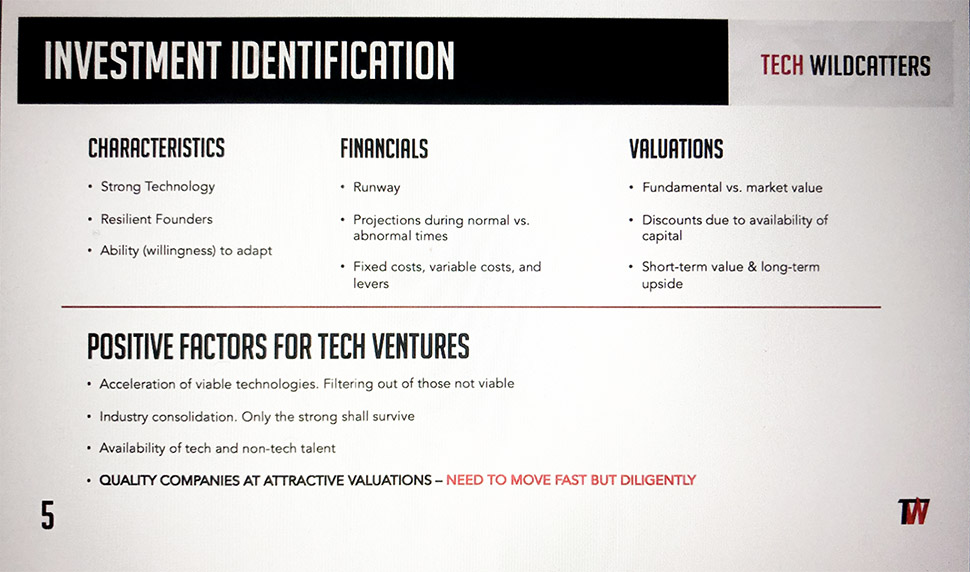

We looked at investment identification for positive factors for technology ventures. Three things we look at are characteristics, financials, and valuations.

First, we look at companies. There are a lot of companies and a lot of industries.

We look at the industries and start to drill down into individual companies. The strong survive. Looking at technology companies—whatever it’s deep tech or technology solutions that will help on customer interface experience or data and all that technology is for—the founders are important.

At Tech Wildcatters, when it comes to our investment philosophy, we look at the founders first.

We ask: Is this someone who we believe has vision? Who really wants to go big, and take the company long term? And, in this time—even more importantly—does the founder have the willingness to adapt?

Because the business plan they’ve been writing from four weeks ago will now have to adapt to what’s going on. It could be positive, it could be negative. But they will have to adapt.

“Financially, runway cash is king.”

Financially, runway cash is king. That runway is more important than ever, however positive, however strong fundamentals are — if you don’t have the cash to survive until you reach that point of recovery, you’re going to go out of business.

So we have to look at the company itself before investing. We ask: Is there enough runway? If we provide this additional capital as we invest in a new funding round, does that give the path to success?

We’re looking at runways, and we’re also looking at projections.

A company with a pathway to profitability can survive on its own during normal times, and if this is a temporary shock, it may survive once things recover. We can seed those companies back to value. But if the company itself is not viable even in normal times, and nothing’s changed, it’s very difficult to support those companies. That comes back to our fundamentals when we look at companies.

“…if the company itself is not viable even in normal times, and nothing’s changed, it’s very difficult to support those companies.”

We try to pick companies that can survive and grow slowly on their own but are getting venture money to grow and scale faster. We try to stay away from companies that are just buying market share, without a pathway to profitability. So, even in these times, you have to go back and reiterate this.

Fixed costs, variable costs, and levers: These are increasingly important because companies that have high fixed costs don’t really have the flexibility to adapt, like the companies with variable costs, such as contractors and shorter-term contracts where they can scale up and scale down. These can make companies more flexible because these are levers that can play with.

So, right now, a company’s business may be slow, and they can reduce their costs, extend their runway, and shift their resources towards building up technology. While customer demand may not be back for the next two months, if you’re building security technology, for example, when demand does come back in three months or six months you’ll be in a better position.

We also look at the numbers and whether they can scale up rapidly.

Our third metric is valuations.

“…more experienced [investors] already have a strategy in mind: They look at what sectors are going to benefit, and how do they want to deploy capital.”

The valuations you can look at from a fundamental value, which, theoretically, is what the company should be valued at. But the market is abnormal right now due to scarcity of capital. There are traditional investors and even venture capitalists that are pulling back. A lot of funds are in a more wait-and-see mode. Some of them are still confused to see what they do. But some of the more experienced ones already have a strategy in mind: They look at what sectors are going to benefit, and how do they want to deploy capital.

And it’s a buyers market.

VCs could be in a position to see which companies that are now looking for investments, when not as many VCs are investing. There could be good companies at good terms.

When we’re looking at valuations, I look at this from a short-term value and a long-term upside. Short term, meaning we’re benefiting from the conditions. For example, three weeks ago, companies that were trying to raise around 10 million valuation—right now that takes 5 million.

If the fundamentals are solid and the technologies are solid, you could see appreciation from a market uptick. But that’s not what we’re aiming for. That’s more short term trading. When we’re investing in venture capital, we’re looking for long-term upside, so not only getting the short term good, but we’re looking for companies that are going to grow 10x or more in the next several years. Then we’re going to get the long-term upside.

[Market conditions] allow us to have access to good companies that we might otherwise be priced out of.

On positive factors for tech investing

We’re going to see an acceleration of viable technologies that the market is going to need. And there’s going to be more capital deployed towards faster development. We’ll see industry consolidation from a vertical standpoint and also from within the industry. The stronger ones will survive, and others will emerge from this crisis.

“Valuations going to be attractive, even many of them that are not suitable for investing right now, but might be in the future.”

A benefit for the companies is that there’s going to be talented staff available. Non-tech and tech companies alike are starting to cut staff. Some of those people are very talented—developers, programmers, engineers, and others.

There are a lot of quality companies out there. Valuations going to be attractive, even many of them that are not suitable for investing right now, but might be in the future.

That’s why Tech Wildcatters wants to be in a good position to invest.

Audience participation

Terjapaibul invited discussion from the virtual attendees.

One attendee asked, “What are you hearing from Tech Wildcatter portfolio companies? What are you concerned about, and what advice are you giving them?”

Terjapaibul noted that Tech Wildcatters portfolio companies are span all four of the different industry impact tiers described previously.

“…there’s going to be no growth in the next three months.”

“Some of the ones that are in Impact Tier One which are the most impacted,” he said.”But fortunately, a lot of them have recently raised capital before all this messiness happened. They’ve revised their plans substantially. They look at cutting nonessential growth staff because there’s going to be no growth in the next three months. And they need to focus on positioning themselves in technology or positioning as the market leader.”

There are going to be other things that will go on at this time, he said. “Entrepreneurs need to be ready to hop on that market share. And if they need capital that’s something that we may help with.”

Tejapaibul cited the example of Tech Wildcatter portfolio company, Meowtel. “They do cat-sitting for people who are traveling or busy people going to work. But now, people are at home and they don’t need it as much. But because of the company’s cost structure, they’re able to scale back. All their counselors are contractors. As things pick back up, they’re ready to ramp up. Some of the company’s smaller competitors in certain cities may not be in that position.”

Cash flow and burn rate, along with valuations, was another topic attendees wanted to dive deeper into.

“I had one entrepreneur call yesterday to tell me her proposed cap for her current fundraising. It was set really high, and I said, ‘Well, why don’t we talk again in a week.'”

“[Entrepreneurs] are talking about cash flow and burn rate much more seriously than they have before, which is good,” noted one investor. “I had one entrepreneur call yesterday to tell me her proposed cap for her current fundraising. It was set really high, and I said, ‘Well, why don’t we talk again in a week.’ I think she’ll be talking different numbers a week from now. We’ll see.”

Tejapaibul noted that he’s seen several companies that have come back with shifted numbers from just a couple of weeks ago. And sometimes, “they don’t do a straight-up change in valuation, but they’ll give additional equity or certain other ‘sweeteners’ that would back up the valuation substantially,” he said.

The wait-and-see approach that some investors are taking may settle down a bit, said Terjapaibul, emphasizing that some investors are already strategizing which companies they want to move into.

“This is a good opportunity to think about and strategize what they want to do in terms of an investment portfolio and take the most advantage out of it,” Terjapaibul said.

“…sometimes a startup may be due for a down round. So now it’s a good excuse: Let’s just blame it on market conditions. People understand that, but it’s more about, how do you emerge from this?”

When asked, “Do you think the stigma of a down round will be less in this new environment?” Tejapaibul responded: “It’s a good excuse, but sometimes a startup may be due for a down round. So now it’s a good excuse: Let’s just blame it on market conditions. People understand that, but it’s more about, ‘how do you emerge from this.'”

In terms of dilution after a down round, Tejapaibul said Tech Wildcatters would still invest if they believe in the company, and if they think it’s is an opportunistic play where the company will emerge strong. But, he cautions, “we’re not throwing good money after bad. If it’s just going to prolong things—kicking the can down the road—and you’re not going to make it, we need to impose fundamental changes.”

That might mean the business model or even from a balance sheet standpoint to see what needs to be cleaned up or restructured, he said.

Another attendee noted, “Lots of people were saying the world would never be the same after 9/11 and after the 2008 recession—little business travel and no conventions, all teleconferencing.”

But things did go back to normal for the most part, the attendee said: “Why is this different?”

“Even without an external shock like this one, the new normal is going to keep changing.”

Terjapaibul noted that things could go back to normal. But, “it might also take a year, two years, three years. And the world itself is also changing with the type of work that’s needed. “Even without an external shock like this one, the new normal is going to keep changing.”

That accelerates the change even faster and also creates this new void where new products are introduced to help solve or help substitute.”

That can mean new opportunity, he emphasized.

This online discussion was edited for brevity and clarity. Updated March 28, 2019 with additional details.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.