Tango—a next-gen real estate and facilities management software provider headquartered in Coppell—made a splash last week when it acquired WatchWire, an industry leader in data and analytics.

The deal’s financial terms weren’t disclosed. But Tango Founder, President, and CEO Pranav Tyagi has a lot to say about what the acquisition means for his company.

Founded in 2000, WatchWire is based in New York, operating what Tango calls “the deepest and most comprehensive integrated energy management and sustainability platform in the industry.”

WatchWire enables companies to automate the collection and validation of sustainability and energy-related data. It then “operationalizes” that data for reporting and compliance—while identifying additional ways to meet environmental, energy, and climate targets.

Countless companies worldwide are pursuing such targets—and now Tango and WatchWire will be teaming up to target them.

Acquisition ‘was a long time coming’

Tango’s Tyagi told Dallas Innovates the acquisition “makes Tango the only end-to-end solution that allows customers to gain a deep understanding of their energy consumption and carbon footprint—and equally important, develop and execute emission reduction efforts across site selection, design and construction, lease management, and facilities maintenance.”

“The acquisition of WatchWire was a long time coming,” Tyagi added. “We identified energy and sustainability as a strategic imperative for our solution set more than a year ago, driven by an articulated need of our customers and a strong regulatory tailwind where our experience and expertise in regulatory compliance would be a competitive advantage.”

Combining to serve over 500 companies in 140-plus countries

Through a one-two punch, Tango and WatchWire’s combined business will serve over 500 customers in more than 140 countries from primary offices in both the Dallas suburb of Coppell and New York City.

Founded in 2008, Tango has 250 employees. In 2022, it snapped up two other companies—acquiring AgilQuest, a workplace reservation platform, and billie, a digital workplace software solution that helps organizations streamline and simplify their hybrid workplaces. Those deals further expanded Tango’s suite of tools to focus on the “people” side of real estate, ensuring employees are engaged and productive in hybrid workplaces, Tango said.

Tyagi says that adding WatchWire to its mix strengthens Tango’s “overall standing” in the real estate and facilities space.

“The acquisition of WatchWire actually expands Tango’s footprint,” he said, “as it brings us into the owner/landlord side of the market. This new segment needs all the same capabilities as the tenant/occupier market, and we’re excited to leverage WatchWire’s strong position in this market to continue to grow the Tango brand.”

Meeting a growing need for sustainability and energy management

WatchWire CEO Andy Anderson [Photo: LinkedIn]

“Faced with a rapidly changing macro and regulatory environment, active sustainability and energy management has become essential to long-term organizational success,” Tyagi said in statement last week. “Tango has a longstanding reputation for solving the complex, location-based compliance and reporting needs of our customers, as well as helping companies effectively manage and control occupancy costs. With the addition of WatchWire, we’ll provide customers information that arms them to understand their environmental impact and deliver on energy and sustainability management initiatives.”

WatchWire CEO Andy Anderson said his company is excited to be joining what he calls “the preeminent real estate and facilities management solution in the industry.”

“Combining the vast amount of validated energy data available in the WatchWire platform with Tango’s real estate and facilities management capabilities will enable companies to support the accurate tracking and reporting that customers require, and operationalize insights about how to lower costs and improve sustainability,” Anderson said in a statement. “WatchWire customers will also benefit from the end-to-end real estate and facilities solution that Tango offers.”

Berkshire managing director lauds acquisition

Jon Nuger, a managing director at Berkshire Partners—which made a growth investment in Tango in 2021—lauded the acquisition last week.

“Since our initial investment in Tango, we have been focused on adding a sustainability and energy reporting capability, as these offerings will help Tango extend its leadership position in the real estate management software market,” Nuger said in a statement. “We’re excited to partner with Pranav and the management team as they harness Tango’s and WatchWire’s combined capabilities to empower organizations to improve energy efficiency, enhance sustainability and reduce cost.”

Scoping out ‘new joint capabilities’ that don’t exist in the market

Tyagi told us that while Tango and WatchWire brought a lot to the merged entity, “we are well down the path of scoping out new joint capabilities that do not exist in the market today.”

That said, he called out one of WatchWire’s existing, unique capabilities: “their proprietary and patent-pending data ingestion engine, which accumulates accurate, granular and verified energy and utility data which is critical for the optimization of energy use and the calculation and reporting of emissions.”

Tyagi said WatchWire’s engine uses AI and machine learning to extract, classify, and audit invoice data.

“Tango has extensive depth and breadth of AI capabilities, which we will bring to bear in optimizing and enhancing the capabilities WatchWire’s technologies bring,” the Tango CEO noted.

Additional recent moves

Earlier this year, Tango announced additional offerings and expanded capabilities, including an integration with Crestron’s new desk touch scheduling hardware and new solutions including Tango Visitor, Tango Lease Transactions, and Tango Portfolio Strategy.

Also in 2023, Tango achieved FedRAMP authorization, demonstrating its ongoing commitment to federal and municipal government markets, the company said.

‘Bridging the gap between landlords and tenants’

So what’s next for Tango?

“We’re looking forward to leveraging this acquisition to bridge the gap between landlords and tenants by unifying the push towards more sustainable practices and reporting,” Tyagi said. “As well as expansion in the owner/landlord market.”

Given the growing global momentum toward sustainability and a shifting regulatory environment both in North America and worldwide, the CEO said Tango is focused on helping customers measure their current state along with helping them to plan and execute projects to help them reach their goals, “and remeasure and report against those goals.”

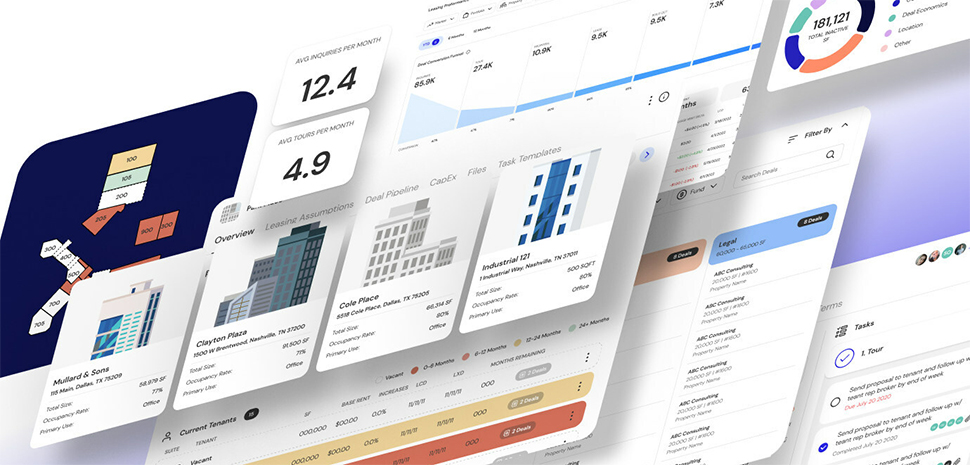

Tango is a leader in store lifecycle management and integrated workplace management system software, delivering a single solution in real estate, design & construction, lease administration & accounting, facilities, desk booking, visitor and space management.

Harris Williams acted as exclusive financial advisor to Tango and Berkshire Partners on the acquisition of WatchWire. GrowthPoint Technology Partners, a San Francisco-based technology investment bank, acted as exclusive financial advisor to WatchWire.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.