Amusement park juggernauts Six Flags Entertainment and Cedar Fair have agreed to merge, creating a combined company valued at roughly $8 billion that will be headquartered in Charlotte, North Carolina, with significant finance and administrative operations in Cedar Fair’s home of Sandusky, Ohio.

Six Flags Entertainment is the operator of Six Flags Over Texas in Arlington, where the company’s current headquarters is located. The combined company will operate under the Six Flags name but will use Cedar Fair’s stock ticker symbol of FUN on the NYSE.

Six Flags Entertainment moved its headquarters and more than 120 full-time employees to Choctaw Stadium (formerly Globe Life Park) in 2020 after the Arlington City Council agreed to reimburse Six Flags up to $6 million to renovate the offices behind center field.

The merger is expected to close in the first half of 2024,

Unlocking ‘new potential’

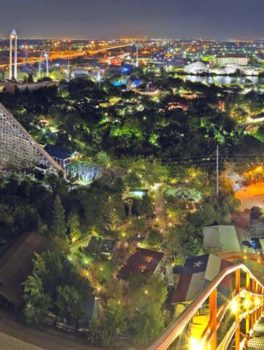

Cedar Fair’s Cedar Point theme park in Sandusky, Ohio [Photo: Cedar Fair Entertainment Company]

“The combination of Six Flags and Cedar Fair will redefine our guests’ amusement park experience as we combine the best of both companies,” Selim Bassoul, president and CEO of Six Flags, said in a statement. “Six Flags and Cedar Fair share a strong cultural alignment, operating philosophy, and steadfast commitment to providing consumers with thrilling experiences.”

“By combining our operational models and technology platforms, we expect to accelerate our transformation activities and unlock new potential for our parks,” Basoul added. “We’re excited to unite the Cedar Fair and Six Flags teams to capitalize on the tremendous growth opportunities and operational efficiencies of our combined platform for the benefit of our guests, shareholders, employees, and other stakeholders.”

In addition to Cedar Point, Cedar Fair’s flagship theme park in Sandusky, Cedar Fair owns Knott’s Berry Farm in California, Schlitterbahn water park in Texas, and Wonderland in Ontario, Canada. Six Flags, meanwhile, operates roughly 20 parks in the U.S., two in Mexico, and one in Canada.

The companies said the merged operation will be a leading amusement park operator in the highly competitive leisure space with an expanded and diversified footprint, a more robust operating model, and a strong revenue and cash flow generation profile.

Under the terms of the merger, Cedar Fair unitholders will receive one share of common stock in the new combined company for each unit owned, and Six Flags shareholders will receive 0.5800 shares of common stock in the combined company for each share owned.

Cedar Fair unitholders will own roughly 51.2% and Six Flags shareholders will own roughly 48.8% of the combined company.

Portfolio of parks and IP

Cedar Fair President and CEO Richard Zimmerman said his company’s merger with Six Flags “will bring together two of North America’s iconic amusement park companies to establish a highly diversified footprint and a more robust operating model to enhance park offerings and performance.”

“Together, we’ll have an expanded and complementary portfolio of attractive assets and intellectual property to deliver engaging entertainment experiences for guests,” Zimmerman added in a statement. “The combination also creates an enhanced financial profile with strong cash flow generation to accelerate investments in our parks to delight our guests, driving increased levels of demand and in-park value and spending. I have great respect for the Six Flags team and look forward to joining forces as we embark on this next chapter together.”

27 amusement parks, 15 water parks, and 9 resorts, just for starters

The combined company will operate a portfolio of 27 amusement parks, 15 water parks, and nine resort properties across 17 states in the U.S., Canada, and Mexico. Its portfolio will include some of the most iconic parks in North America with significant brand equity and loyalty, the companies said.

The combined company will also have entertainment partnerships and a portfolio of intellectual property such as Looney Tunes, DC Comics, and PEANUTS to develop “engaging new attractions enabled by compelling characters, environments, and storytelling,” the companies added.

There’s little market overlap between Cedar Fair and Six Flags and the combined company’s complementary geographic footprint is expected to mitigate the impact of seasonality and reduce earnings volatility through a more balanced presence in year-round operating climates.

And it’s a diverse portfolio, the company said, including such experiences as safaris and animal experiences, campgrounds, sports facilities and luxury lounges—enabling the combined company to better meet rising consumer demand for varied and engaging entertainment options.

Combining company leadership

Upon closing of the transaction, Zimmerman will serve as president and CEO of the combined company and Bassoul will serve as executive chairman of the combined company’s board of directors.

Cedar Fair CFO Brian Witherow will serve as chief financial officer of the combined company and Six Flags CFO Gary Mick will serve as chief integration officer of the combined company.

The newly formed board of directors of the combined company will consist of 12 directors, six from the Cedar Fair board and six from the Six Flags board.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.