What’s in a credit report? That which we call a score by any other name would be as confusing.

But, thanks to a new platform from Dallas-based One Technologies, LLC’s ScoreSense, understanding the components that affect one’s credit score could be as easy as opening a computer and logging in.

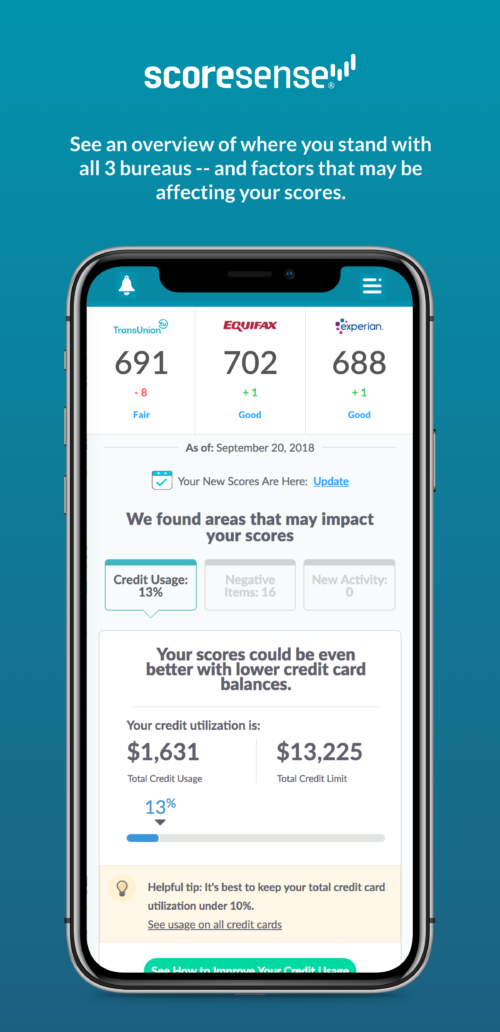

ScoreSense said in a statement that the technology, Credit Insights, can identify any account-reporting differences that can lower an individual credit score. That report is then presented in a straightforward way that lets customers easily identify issues and work to fix them.The new Credit Insights feature rounds up scores from all three main credit bureaus—TransUnion, Equifax, and Experian—to give customers an understanding of the things that are most affecting their credit.

Image courtesy of ScoreSense

“Errors in credit reports can have serious repercussions for consumers, causing them to potentially pay higher interest rates, lose out on home or auto loan approval, or even affect job opportunities. Correcting inaccurate credit data is often an extremely frustrating and costly experience,” Sanjay Baskaran, CEO of One Technologies said in a statement.

The technology not only identifies customers’ roadblocks to good credit, but it also offers five distinct features—Payment History, Outstanding Debt, Account Types, Credit Age, and New Activity—and a breakdown of how spending activity in each category affects an overall score.

ScoreSense also offers a customer service component that allows answer-seeking customers to find solutions to issues on their scores, reports, and the process of disputing and correcting errors or account-reporting differences.

“Even when all their data is completely accurate, many consumers have trouble making sense of how the information in their credit reports translates into actual credit scores,” Halim Kucur, Chief Product Officer for One Technologies said in a statement. “We consistently look for new ways to help consumers clear up any credit confusion they may have, and better position them to achieve their long-term financial goals.”

The headline of this post was updated at 5:40 p.m. on Friday, January 18.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

![ScoreSense [Image courtesy of ScoreSense]](https://s24806.pcdn.co/wp-content/uploads/2019/01/ScoreSenseIpad.jpg)