From the New York Yankees to a Little Caesars franchise near you, RedBird Capital Partners plays the long game. With offices in Dallas, New York, and Los Angeles, the private equity firm manages $5 billion of capital across its sports, financial services, consumer, and telecom/media/tech verticals.

RedBird—a play on the last name of the company’s founder and CEO, Gerry Cardinale—has made big-splash investments in everything from the New York Yankees’ YES Network (a 2019 transaction with a total enterprise value of $3.47 billion, also backed by Amazon, Sinclair Broadcasting, and the team’s parent company) to a reported $750 million investment last March for 10 percent of Fenway Sports Group, owner of the Boston Red Sox and England’s Liverpool soccer club.

RedBird’s investments in Texas may not be as sexy—they range from energy companies to data centers to QSRs and family entertainment franchises—but they add up to a big chunk of the firm’s portfolio.

To get insight into RedBird’s Texas footprint and way of doing business, we spoke with Dallas-based partner Andrew Lauck.

Lauck led RedBird’s recent participation in a $230 million funding round of construction tech solutions startup EquipmentShare, and said that deal is a window into the RedBird way of investing—identifying founders, entrepreneurs, and family firms that are poised for the next level.

More than just passive money

“Typically our partners are not just looking for passive money—they’re looking for an operating partner,” Lauck told us, “The concept of scaling up businesses is pretty straightforward at the outset, but the complexities are nuanced. They want a partner like RedBird that can help them think about the evolution of the team, help them think about the capital structure, and be involved in the strategy decisions.”

EquipmentShare: transforming an “antiquated” industry

Headquartered in Columbia, Mo., EquipmentShare was founded in 2014 by brothers Willy and Jabbok Schlacks. Its fleet management tech is transforming what Lauck calls one of the last holdouts to digital adoption.

The company has more than 80 full-service locations in 29 states, including three in Dallas-Fort Worth.

“The construction industry is at the top of the list of what I’ll call one of the more antiquated industries within the U.S.” Lauck said. “The primary story around EquipmentShare is really simple: it’s that ultimately the adoption of technology, both from a software and hardware side, is going to drive transformative change, improvement, and value creation for the construction industry more broadly.”

EquipmentShare’s benefits start as simply as controlling equipment, keypads for access, and making sure equipment doesn’t leave lots uninvited. It evolves to managing data, predictivity, pinpointing liability, and operating fleets more efficiently. All of that drives efficiency while significantly reducing costs.

“Guys like Willie and Jabbok are exactly what we look for,” Lauck said—”entrepreneur founders that started a business that’s got a good thesis, where our capital can help take it to the next level”

RedBird’s big Texas footprint

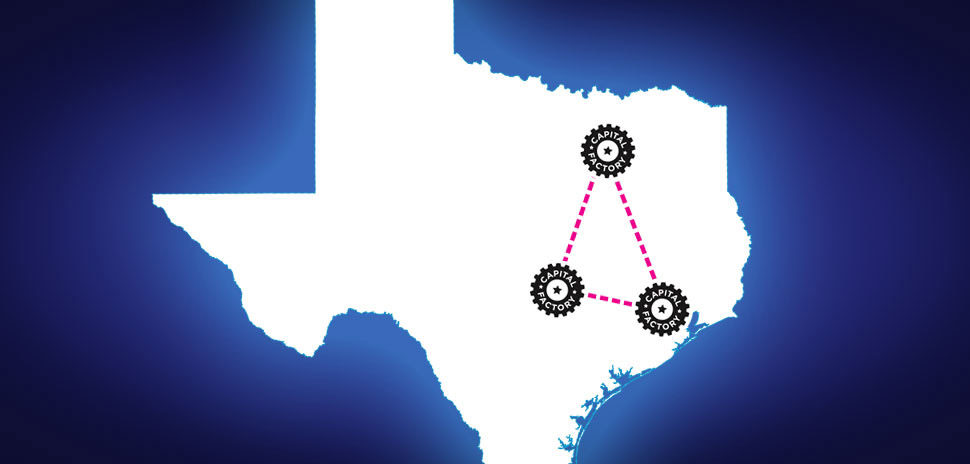

“Dallas has been a part of the RedBird story since day one,” said Lauck, who opened the Dallas office when RedBird was founded in 2014. “We’re one of the few large-scale private equity operators with a real presence in this market.”

Only seven of RedBird’s 60 employees are in Dallas, but they play an outsize role. Lauck ticked off several of RedBIrd’s key investments across Texas:

“Aethon Energy, a natural gas producer based here in Dallas—we partnered with a family that started that platform. Compass Datacenters based here in Dallas—we partnered with Chris Crosby, who started that business and brought us in as his first institutional capital partner. FireBird Energy based in Fort Worth was a new company that we started alongside an entrepreneur and a group of executives that we’d backed in a previous business. Four Corners Petroleum is headquartered in Denver, but all of their operations are in West Texas. Lambda Energy’s based in Houston.”

The list of Texas investments kept on coming.

“Main Event [family entertainment centers] is based in Plano. Half of Majority Strategies‘ executive team sits in Dallas. Perdure Petroleum is based in Allen, Texas. Vida Capital‘s based in Austin. TierPoint, our data center, one of their largest centers is in Dallas, and they’ve got operations up in Allen as well.”

“Probably half the [RedBird] portfolio is either based in or has material operations in Texas, with most of that being the DFW Metroplex,” Lauck said.

RedBird has a lot of investments in quick-service restaurants as well.

“Almost half of our 450 fast-food restaurants are in Texas,” Lauck said. “We own everything from Little Caesars in the west side of Dallas and Fort Worth to Church’s Chicken all the way down to Austin.”

“We believe in Texas,” he said. “Texas is going to be not just important where we’ve been historically, but an absolute anchor in our strategy going forward.”

How Dallas works with N.Y., L.A., and beyond

“Our physical presence in Texas is to make sure we remain close to families, entrepreneurs, and business owners in this market,” Lauck said. “That gives us access to an ongoing dialogue for interesting opportunities here.”

Despite having offices in New York, Los Angeles, and other places in the U.S., “at the end of the day, it’s just RedBird,” Lauck said. “We talk weekly, we meet on a regular basis, we’re in each other’s offices constantly. I’m in New York all the time, my partners from New York are in Dallas all the time. We cross-staff in almost everything that we do.”

“Most of my teams that work on these deals with me sit in multiple offices. We do that by design. We do everything possible to make it a one-integrated-firm approach. We don’t deploy capital by any bifurcated means. It’s one investment committee, one approach to capital deployment, and one overarching view as to how we do it.”

Family, founders, and above all, trust

Investing with the brothers at EquipmentShare was no outlier—connecting with family-owned businesses seems to be a RedBird specialty.

“We invested in a business last year called Jet Linx,” Lauck said. “I serve on the board of that business and led that investment for RedBird. It’s a wonderful business started by a family out of Omaha. The family, up until RedBird investing, was the largest shareholder. We spent months talking to them, we spent years evaluating the aviation industry”

“I’ve invested in multiple aviation businesses before—I’m a pilot by background so it’s a sector I know—but ultimately the family brought us in after 20 years of owning and operating the business, and trusted us to have the scalable capital to help them continue to think about how to grow.”

Seizing opportunities in the pandemic

“Last year a lot of capital partners were taking a step back, were kind of waiting to see what happened,” Lauck said. “We remained very true to the way we underwrite, and the way we think about opportunities: We didn’t slow down.”

Main Event is a great example. The company has 44 family entertainment centers in 17 states, offering everything from mini golf to laser tag to karaoke to climbing walls. When COVID lockdowns hit, Main Event got slammed hard.

That’s when RedBird stepped in, acquiring a 24.2% stake in Main Event last June for $80 million in a deal with its Australia-based parent company, Ardent Leisure Group.

“There was a lot of capital retreating from what was going on with out-of-home entertainment, family entertainment centers, and even sports,” Lauck recalled. “We stepped back and said, what’s the long-term view? What’s the opportunity for these businesses…despite the temporary dislocation that came from COVID?”

“Main Event today is in my mind a perfect example of a situation that came about last year, and we couldn’t be more proud of that business and how well it’s been recovering since COVID. Stepping into a business at a time when most of their centers are closed…there weren’t a lot of capital partners that were willing to do that. I think we really differentiated ourselves in our strategy by taking a look at and deploying capital with opportunities like that last year.”

Investing…then investing again. And again.

Redbird’s biggest differentiator may be its view on investing—and reinvesting.

“One of the most important things that we try to do as a partner is remain flexible and be willing to reunderwrite the business,” Lauck said. “We don’t know the future every time we write a check. But we try to step back and be evolutionary in how we approach it.”

“I think that ability to be focused on not just one-time static evaluation, but being an operating partner that’s willing to reunderwrite the business—every month and year that goes by—is absolutely core to how we approach investments.”

That’s paid off in attracting companies RedBird seeks.

“If we’re having a dialogue with a founder and entrepreneur, it’s because they believe in our platform, they believe in our network and the expertise we bring in the sectors that we cover,” Lauck said. “We’ve proven time again through the types of platforms that we back, to the investments that we’ve made, that we really think differently about how we approach things.”

Cutting checks and making exits

When the deal is done, the check gets cut—usually with a lot of zeros.

“Our typical equity check is probably $75 to $100 million on the low end to $250-plus million on the high end,” Lauck said. “Sometimes there may be an opportunity to put $75 million in a business, but we underwrite it knowing that we want to put another $75 to $100 million in [later]. So our average investment is probably more in the $150-plus million range on capital deployed.”

All that investment pays off in returns. The company has had four publicly disclosed exits. It sold insurtech platform Constellation Affiliated Partners to Truist Insurance Holdings last May, adding $160 million in annual revenue to Truist’s wholesale division. RedBird sold tech-driven B2B sales firm N3 to Accenture last October. Terms of those two deals were not disclosed.

In July 2020, RedBird sold its stake in insurance asset manager Avmont to Vida Capital Partners, which RedBird itself co-owns with Reverance Capital. Terms were not disclosed.

At the beginning of 2020, RedBird sold its stake in On Location Experiences, a travel and hospitality business partly owned by the NFL, as part of a $660 million acquisition by talent agency giant Endeavor.

Lauck said RedBird has also had a number of undisclosed “partial exits.”

Lauck really hits the boards—and one is special

Lauck is a board member of several companies RedBird is invested in, including Jet Linx, Aethon, FireBird Energy, Four Corners Petroleum, Lambda Energy, Vida Capital, and RedBird’s QSR investment.

But the one closest to his heart is the board of Vogel Alcove, a Dallas charity that provides an array of services to homeless children.

Vogel Alcove and a pandemic surprise

“Each night somewhere close to 3,000 kids go to sleep in Dallas without a home,” Lauck said. “And one of the things that I think is really misunderstood about homelessness is the long-term implications of the trauma associated with it. [Vogel’s mission] is serving and helping them across the board with the long-term implications of the trauma. It’s physical health, it’s mental health, and developmental assistance.”

During the pandemic, when many of RedBird’s restaurants had slowed down, Lauck seized the chance to help in more ways than one. RedBird—and Lauck and his wife as well—bought thousands of meals from the firm’s QSRs to donate to Vogel Alcove, UT Southwestern hospital, and other organizations.

“That effort that we did with our QSR business really kind of got me very close with Karen [Hughes, Vogel Alcove’s CEO]. And I’ve gotten more and more involved. It’s just a wonderful organization,” Lauck said.

The Yankees and Red Sox can battle for all the billions they want. But seeing those kids light up when pizzas arrived in a dark, scary time—that was a whole different kind of payoff.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.