A recent transplant to North Texas says it’s close to becoming the area’s newest unicorn—a designation given to startups worth more than $1 billion.

Plano-based InfStones, a company with a goal of bringing the “AWS experience to Web3,” announced landing a $66 million funding round led by SoftBank Vision Fund 2 and GGV Capital.

“Our vision is to provide a rugged, easy-to-use Web3 environment to build a more transparent, intelligent world,” said Zhenwu Shi, CEO of InfStones, in a statement. “We intend to drive rapid adoption of Web3 decentralized applications worldwide.”

Building on the blockchain

InfStones CEO Dr. Zhenwu Shi. [Photo: InfStones]

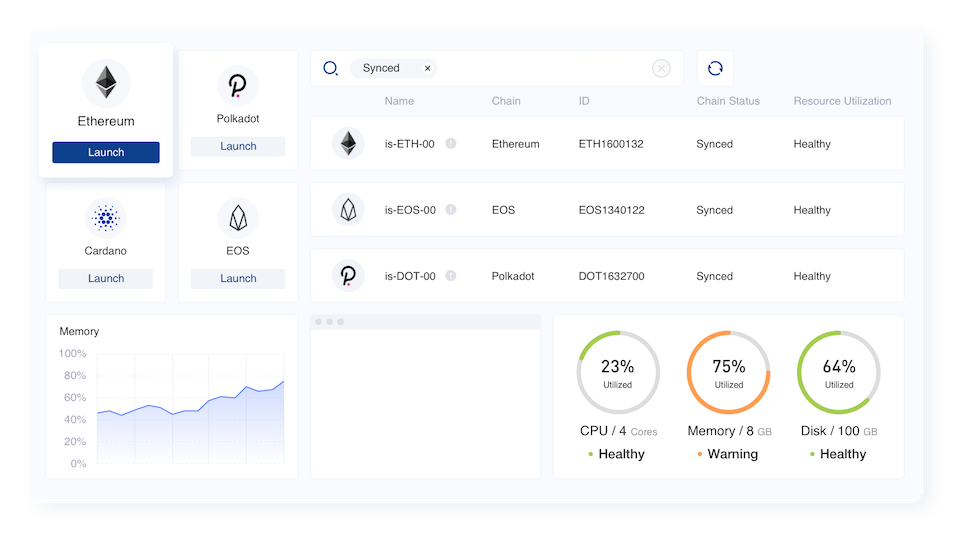

Launched in 2018, InfStones bills itself as a platform-as-a-service, helping users build applications on a number of blockchain platforms, with the goal of making participation in the Web3 and decentralized finance ecosystems more accessible. The blockchain infrastructure company says it has more than 10,000 nodes supported on more than 50 blockchains, including large players like Ethereum and Solana.

“InfStones provides the foundational infrastructure layer for the Web3 era, offering an enterprise-grade node management and staking platform that makes it painless for customers to participate in Web3 and [decentralized finance],” said Dennis Chang, managing partner at Softbank Investment Advisers, in a statement.

From Palo Alto to Plano

[Image: InfStones]

Initially formed in Palo Alto, Calif., InfStones moved its headquarters to Plano last year, housing about eight of the company’s 40 employees, who are spread across its two U.S. offices and others it operates in Montreal and Beijing, according to the The Dallas Morning News.

InfStones business development director Sili Zhao told the DMN the move was spurred by Texas’ welcoming of companies in the cryptocurrency and blockchain spaces and the presence of Richardson-based lobbying group the Texas Blockchain Council. Other companies moving to the state have cited its low energy costs, low cost of doing business, and availability of space, in addition to China’s crackdown on the crypto mining industry.

InfStones could become DFW’s second unicorn this year

Joining SoftBank, whose Vision Funds reported losing $27.4 billion last fiscal year, and GGV—a backer of Airbnb, Alibaba, and DraftKings—on InfStones’ most recent fund was INCE Capital, 10T Fund, SNZ Holding, and A&T Capital. It builds upon the $33 million Series B round InfStones unveiled in February, bringing its total funding to $111 million, according to TechCrunch.

With the new funding, InfStones said it plans to grow through new hires, market expansions, and future acquisitions.

If it’s able to reach unicorn status, InfStones would become the second local startup to earn that milestone this year, alongside Island, a Coppell-based enterprise browser startup. In March, Island landed a $115 million Series B round led by Insight Partners, just a month after emerging from stealth with nearly $100 million in backing.

However, InfStones’ funding comes as public tech stocks have fallen, numerous startups have seen valuation cuts, and the crypto market has lost around $2 trillion since hitting a $3.1 trillion high last November.

“The next phase of blockchain will be focused on ease of use, not only for end-users but also for the builders,” said Michael Yuan, partner at Susquehanna International Group, in a statement following InfStones’ Series B. “InfStones is simplifying a process that has been historically complex, without compromising reliability, security, scalability, and control. This will lead the way for a new era of blockchain growth that will change the way companies across a variety of verticals enter and build in the space.”

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.