Homebuyers nationwide have been experiencing turbulence in the housing market from rising mortgage rates to fluctuating home prices. Even the act of applying for a mortgage is an undertaking these days.

Now, digital platform Opendoor is expanding the Opendoor Finance app to Dallas-Fort Worth, Georgia, Arizona, and the rest of Texas to help people navigate those turbulent real estate waters with more control over the mortgage process.

Opendoor is a digital “iBuyer” platform that makes cash offers on homes, does repairs, then sells the homes directly to buyers online.

Here’s how it works:

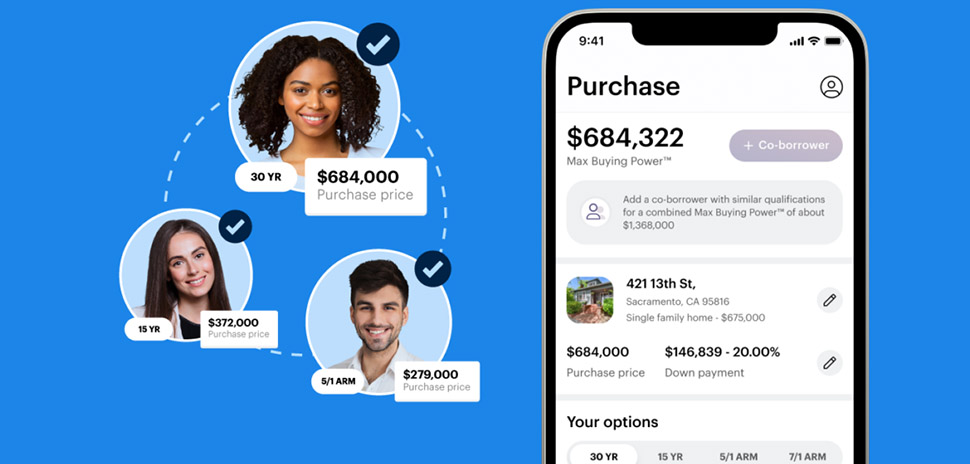

Customers download the app and answer four simple questions. In as little as 60 seconds, no matter where they are they will see their purchasing power and loan options.

The company’s proprietary technology identifies available loan options — including mortgage rates, guidelines, and terms — based on the customer’s needs and with their criteria. In minutes, the app provides what the company calls individualized Max Buying Power.

Unlike a traditional pre-approval, there’s no impact on the person’s credit score, and Opendoor will help customers buy any home listed on the market.

Opendoor said in a statement that its vision is to enable everyone to buy, sell, and move at the tap of a button — all while streamlining a long-broken process to be digital-first. The company said that the expansion of its mortgage team’s finance app is another step in that direction.

Once the app is downloaded, customers answer four questions and in less than two minutes, no matter where they are, they will see their purchasing power and loan options.

The company said for example, that it had a mother get pre-approved while she was at Disneyland with her kids, a young professional got pre-approved while waiting to board a flight, and a doctor got pre-approved on his break at work.

Because even a small change in interest rates can impact a person’s buying decision and cause buyers to scramble, an app such as Opendoor Finance is a stress reliever. With its mortgage app, buyers can refresh their Max Buying Power any time to account for a shift in rates, providing more control over and visibility into a home search.

Knowing where you stand in an instant as the market moves is a huge shift in empowerment that this mortgage technology delivers, Opendoor said in a statement.

The app is available on iTunes or Google Play or you can visit opendoorfinance.com to understand your loan options and your buying power.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.