Susannah Pedigo has been named head of government and regulatory affairs by Irving-based Vesper Energy, a role in which she will support Vesper’s continued growth and leadership in the renewable energy sector by directing advocacy efforts for policy and regulatory issues related to the energy industry.

“Susannah brings extensive technical knowledge combined with skills in policy, industry regulations, diplomacy, and business strategy to the Vesper team,” Vesper CEO and President Craig Carson said in a statement. “Policy and regulation play an outsized role in the energy industry, and we are confident that Susannah will help us navigate market opportunities and changes as we advance clean, reliable energy for our communities.”

Previously, Pedigo advanced business development and commercial efforts as Vesper’s senior director of origination. Pedigo will focus on advancing fair and balanced federal and state energy policies and informing thoughtful business strategies to speed the energy transition nationwide, the company said.

She has more than 25 years of experience across the renewables industry and in policy and government affairs.

Pedigo’s experience includes leadership roles at Xcel Energy and the National Renewable Energy Laboratory for the U.S. Department of Energy. She also was a U.S. delegate to the International Energy Agency and served as a city planner both in public and private sector roles in real estate development and construction.

Vesper Energy’s pipeline includes over 49 renewable energy and energy storage projects with a generating capacity of 16 GW; enough to power more than 2 million homes.

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

R E A D N E X T

-

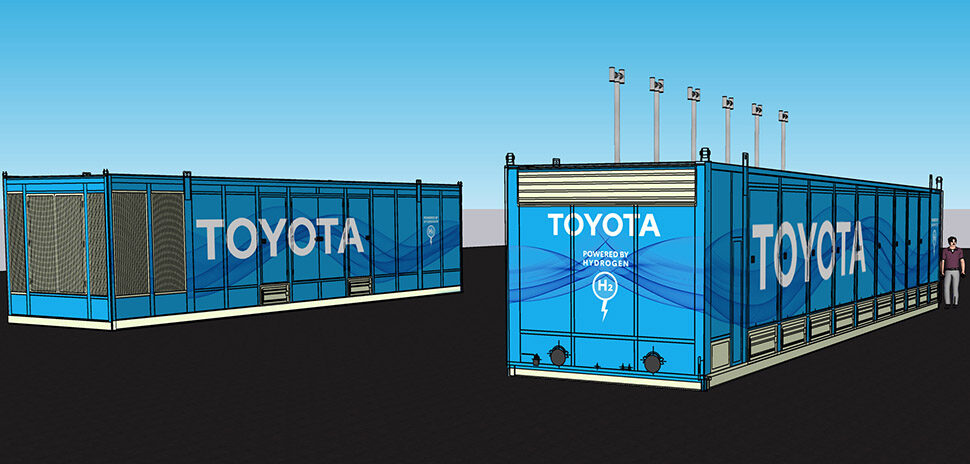

Fuel cells for cars? Think bigger—because Toyota sure is. After developing hydrogen fuel cell technology for over 25 years, mostly aimed at carbon-zero vehicles, the company is scaling up the tech for uses far beyond cars. Now it's working with the U.S. government to build a system that can add energy to the grid, power things like data centers, and more.

-

Kenneth Hersh, president and CEO of the George W. Bush Presidential Library and a renowned investor and philanthropist, will be honored with the 2023 H. Neil Mallon Award from the World Affairs Council of Dallas/Fort Worth. The announcement comes on the heels of the publication of Hersh's recently released book, "The Fastest Tortoise: Winning in Industries I Knew Nothing About," which offers readers a glimpse into the life lessons that have influenced his success, from co-founding a private equity investment firm to managing his family investment office.

-

SMU researchers aim to help address problems in the broad area of computational mathematics for sustainability—such as the management of the energy grid under intermittent renewable power. The research is aimed at developing new algorithms for materials design, bioengineering, and power grid applications. Researchers will use SMU's high-performance computing system—enhanced with an NVIDIA DGX SuperPODTM—as well as the supercomputing resources at Argonne National Laboratory.

-

Energy Transfer LP, a Dallas-based midstream energy company, will acquire Lotus Midstream Operations LLC, based in Sugar Land, for $1.45 billion in a deal that includes $900 million in cash and approximately 44.5 million newly issued Energy Transfer common units. The acquisition will add Centurion Pipeline Company LLC, an integrated, crude midstream platform in the Permian Basin, to Energy Transfer's portfolio.

-

Pearl manages roughly $1.9 billion of cumulative capital commitments across a series of energy-focused funds. Its newest fund, which was raised from "a diverse group of existing and new investors," represents the largest investment vehicle in Pearl’s history.

![]()