Global alternative asset management solutions provider GCM Grosvenor has committed to invest up to $100 million in Irving-based Vesper Energy over the next 12 months, acquiring a minority ownership stake in the company.

Vesper Energy’s Craig Carson

Vesper is a developer, owner, and operator of utility-scale renewable energy assets.

“This partnership represents an exciting development for Vesper,” Vesper Energy President and CEO Craig Carson said in a statement. “We look forward to combining our experienced team and a growing pipeline of renewable energy projects with the strength of our partners at Magnetar and GCM Grosvenor to further accelerate the execution of our strategic business plan.”

A global alternative asset management solutions provider, Chicago-based GCM Grosvenor joins the existing investor group for Vesper Energy led by Magnetar Capital, an alternative asset manager.

Vesper said that GCM Grosvenor’s investment is part of its Infrastructure Advantage Strategy that focuses on unlocking value in infrastructure through close partnership between labor, government, and private capital.

The company said the investment will advance Vesper Energy’s growing portfolio of utility-scale solar, solar and energy storage, and standalone energy storage projects.

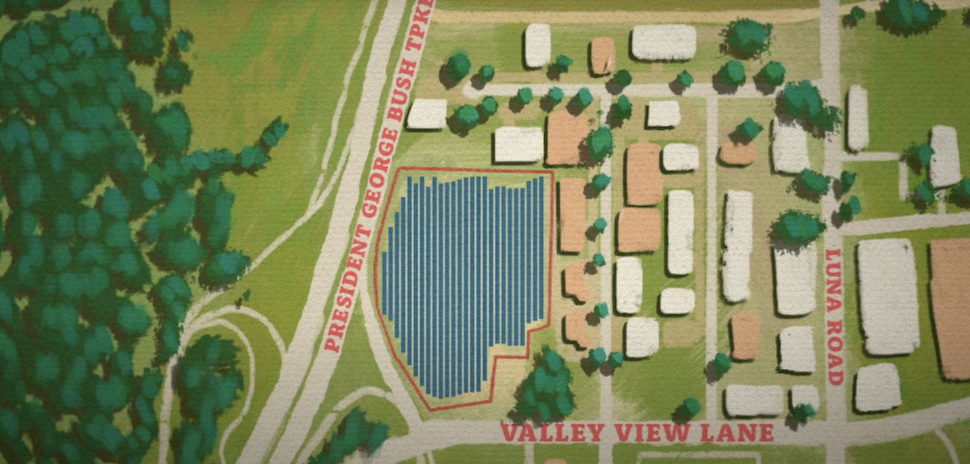

North American solar and energy storage projects

Vesper Energy said it has a 17 GW pipeline of solar and energy storage projects in North America, including 1.5 GW of de-risked, advanced-stage assets in the high-growth energy markets of CAISO, ERCOT, PJM, and MISO.

“We believe the Vesper Energy management team is uniquely positioned to capitalize on a significant clean energy market opportunity given their proven track record of developing, operating, and commercializing utility-scale carbon-free generation and energy storage facilities,” GCM Grosvenor Managing Director Matt Rinklin said in a statement. “Our joint future developments will leverage strong responsible contractor policies in looking to enhance the value of the portfolio and platform.”

Eric Scheyer, head of energy and infrastructure at Magnetar, said his firm has been working with Vesper for three years since acquiring a majority stake in the company.

“Since our initial investment in 2020, we have continued to be very excited about Vesper’s growth,” Scheyer said in a statement. “Over the last three years, we have worked closely with Vesper to successfully grow their team, advance their project pipeline and backlog, and expand the platform’s capabilities. We look forward to further accelerating Vesper’s growth alongside GCM Grosvenor as a new partner in the business.”

Thorndike Landing LLC was GCM Grosvenor’s financial adviser on the transaction with Allen & Overy acting as its legal adviser. Vesper Energy’s and Magnetar’s financial advisers were BofA Securities and Marathon Capital with Eversheds Sutherland acting as legal adviser.

Vesper Energy was founded in 2015 as Lendlease Energy Development. It rebranded as Vesper Energy in 2020 after Magnetar Capital’s majority-stake investment.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.