John Musgrave, CEO of Cushing Asset Management [Photo: Cushing Asset Management]

Dallas-based closed-end management investment companies NXG Cushing Midstream Energy Fund and NXG NextGen Infrastructure Income Fund announced that John Musgrave has been appointed president and chief executive officer of Cushing Asset Management LP, the funds’ investment adviser, as well the funds themselves.

The board of trustees of the funds also appointed Musgrave to serve as chief executive officer and president of the funds.

Musgrave has been a portfolio manager of the investment adviser since 2007 and has served as managing director and co-chief investment officer of the Cushing Asset Management since 2016.

Cushing Asset Management, a subsidiary of Swank Capital, is an SEC-registered investment adviser based in Dallas. It serves as investment adviser to affiliated funds and managed accounts providing active management in markets where inefficiencies exist.

Before joining Cushing Asset Management, Musgrave worked in Citigroup’s investment banking division where he focused on corporate finance and mergers & acquisitions in a wide range of industries, including energy infrastructure companies.

He also worked as an analyst for UBS Investment Bank’s Global Energy Group.

Musgrave has served as portfolio manager for SRV since 2020 and, effective immediately, has also been appointed as the portfolio manager for NXG.

Also serving as portfolio manager for each Fund is Todd Sunderland, who is chief risk officer and chief operating officer of the investment adviser. Sunderland joined Cushing Asset Management in 2007. Before that, he was portfolio analyst at Spinnerhawk Capital Management. Previously, he was programmer and risk analyst for Hunt Financial Ventures.

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

R E A D N E X T

-

Elevate Credit Inc., a Fort Worth-based tech-enabled provider of innovative and responsible online credit solutions for non-prime consumers, has been acquired in a deal valued at $67 million by Dallas-based Park Cities Asset Management LLC, an alternative asset manager focused on providing flexible capital solutions. “Elevate is pleased to join Park Cities as we embark on an exciting new chapter, one that will allow us to better serve our customers and drive innovation within our business,” Elevate CEO Jason Harvison said in a statement. “I want to express my gratitude to our employees, partners, and shareholders for their support throughout…

-

Dallas-based Cresta Fund Management has promoted John Skrinar to partner in its sustainable investing strategy. Skrinar, who joined Cresta in early 2021 and has been working in the renewable fuels industry for more than 15 years, will continue with his key role in transaction sourcing, transaction execution, fundraising, and portfolio management, the firm said. "We have been privileged to have John as an integral part of our team. His promotion reflects both our firm's confidence in him and our ongoing success in establishing our sustainable investing strategy," Managing Partner Chris Rozzell said in a statement. "John's deep industry relationships and…

-

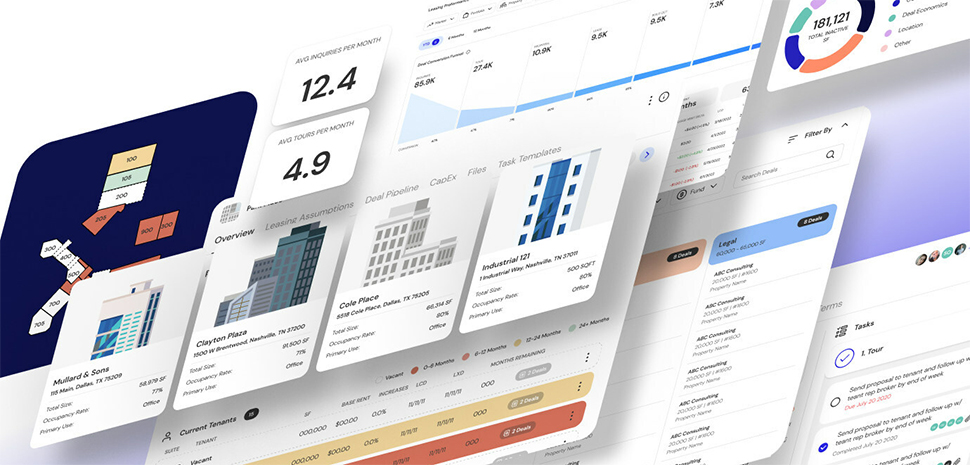

Dottid, a fast-growing startup founded in 2018, aims to disrupt the $2.3T commercial real estate industry. Its latest technology could save asset managers and dealmakers both time and money by consolidating multiple platforms into a single operations solution.

-

Grants totaling $8.5 million will be made available in the initiative's first year, focused on helping children with traumatic brain injuries. "With the guidance of our expert advisors, we want to help strengthen and expand access to support systems for children with traumatic brain injuries as well as their families," said Tellis Bethel (above), chief social innovation officer for Toyota Motor North America.

-

Common Ground Capital says it builds wealth through acquiring, renovating, leasing, and exiting well-located single-family homes. The firm currently owns and operates 45 properties throughout the Dallas-Fort Worth area. With its second fund, Managing Director Ty Lee aims to acquire over 300 more—initially in DFW before expanding its portfolio across Texas and the U.S.

![]()