What companies are finding funding or having a big exit? From startup investments to grants and acquisitions, Dallas Innovates tracks what’s happening in North Texas money. Sign up for our e-newsletter, and share your deal news here.

![]()

Island Co-Founders Mike Fey and Dan Amiga. [Photo: Island]

Dallas Unicorn Adds Cisco Investments as New Backer

⟫ After raising more than $200 million since its launch in February, Dallas-based enterprise browser platform startup Island announced a new investment by Cisco Investments for an undisclosed amount.

Formed in 2020, Island’s enterprise-focused browser is built upon Chromium, which powers names like Google Chrome and Microsoft Edge. The browser protects a company’s SaaS tools and internal web applications from data leaks with security features like web filtering and isolation, exploit prevention, and zero-trust network access.

In March, when Island unveiled its $115 million Series B round led by Insight Partners, the company was valued at $1.3 billion.

—

Photo: Rhino Health USA.

Fort Worth Glove Maker Lands $58M for Facility, HQ Upgrades

⟫ Following Fortune 100 multinational Honeywell’s acquisition of ownership interest in Fort Worth nitrile glove maker Rhino Health USA in early July, Rhino has landed $58 million from New Markets Tax Credit and a handful of community development entities to help the only maker of the product in the U.S. expand its local operations. The company plans to use the funding to invest in the 400,000 square-foot site that will also house its headquarters and create 520 new jobs, Fort Worth Business Report says. Expected to open later this year, the facility, which will be able to produce about 3 billion gloves annually, will help the company meet demand from a contract with the U.S. Department of Defense that it landed last year

—

Danyel Surrency Jones, co-founder and CEO of POWERHANDZ; a pair of the company’s weighted training gloves. [Photo: POWERHANDZ]

POWERHANDZ Lands ‘Multimillion-Dollar Investment’

⟫ In an all-Frisco deal, PH Innovation Holdings (PHI), the operator of fitness gear and tech platform company POWERHANDZ, announced landing a “multimillion-dollar” investment from Vanguard Holdings Group. In addition to the funding, Vanguard says it has issued a private tender offer to acquire all issued and outstanding minority shares of PHI. POWERHANDZ

Co-founder and CEO Danyel Surrency Jones, the largest shareholder, said the move will allow the company to “deliver a 360-degree performance model focused on innovation, wealth building, and serving our community.” As a portfolio brand of Vanguard, the firm’s principal Kenneth Alexander, III, said it plans to grow the company organically and through future M&A deals.

POWERHANDZ announced its merger with PHI last July—a move that came with a partnership deal with then NBA Rookie of the Year LaMelo Ball, who plays for the Charlotte Hornets.

PLUS

TestFit co-founders Clifton Harness, CEO (left), and Ryan Griege, CTO (right).

Building Configuration Startup Lands $20M Series A

⟫ Following up on a seed-stage investment in early 2020, Dallas building configuration software company TestFit has landed a $20 million Series A funding round led by New York-based firm Parkway Venture Capital. It will use the funding to take on what it calls an abundance of “opportunity in the market.”

Focusing on architectural, real estate development, and general contracting clients—of which it has more than 200—TestFit’s technology uses algorithms to produce design prototypes, architectural analysis, and simulated feasibility studies.

TestFit plans to use the new funding to invest in research and development, as well as expanding its sales reach. The 17-person company also aims to grow its team to around 50 people and move them into a new physical office it’s planning to build.

“There is so much opportunity in the market, and we want to be there to create even more value for our customers,” said Clifton Harness, TestFit co-founder and CEO, in a statement.

—

John Green, Nada co-founder and CEO. [Photo: Nada]

Real Estate Startup Closes $8.1M Seed Round

⟫ With the aim of “democratizing access” to real estate investments, a Dallas startup has raised new funds.

Adding to seed funding that it has been raising since at least 2020, real estate-focused fintech Nada, which provides an investment, finance, and banking platform, announced closing the round—led by Austin’s LiveOak Venture Partners—with $8.1 million in backing. The announcement comes as the company has seen recent growth through new product offerings.

Nada’s new funding was joined by Revolution’s Rise of the Rest Seed Fund, Capital Factory, 7BC Venture Capital, Sweater Ventures, LFG Ventures, Badra Capital, and Stonks Fund. As part of the round’s close, LiveOak Founding Partner Krishna Srinivasan and Jesse Stein, co-founder of metaverse-focused investment and development company Everyreal, will join Nada’s board of directors.

In addition to scaling its index-like Cityfunds offering, the new funds will help Nada expand other investment products. CEO and co-founder John Green said the company will be looking to launch a mobile app by the end of next month. After that, he said the company is planning to launch a debit card that will allow homeowners who have purchased through Nada’s platform to access the equity in their homes without taking on debt and allow Cityfunds users to receive dividends from their investments.

—

Image: HYWARDS/IStockPhoto

Southlake PE Firm Is Raising Two Biotech-Focused Funds

⟫ Southlake-based Trinity Private Equity Group reported raising $7.78 million out of a $15 million offering across two biotech-focused funds titled Trinity Nuclein Rd II QP Investors LLC and Trinity Nuclein RD II Investors LLC.

While SEC filings are limited in their information, the funds appear to be tied to Austin-based medical device company Nuclein, an “all-in-one” PCR diagnosis platform. Last March, the private equity firm led a $14 million Series B funding round in the company in an effort to help the company bring its product to market.

—

Image: Butusova Elena/Shutterstock

Jones Family-Backed Investment Firm Acquires Travel Software Company

⟫ Frisco’s Blue Star Innovation Partners, the investment capital fund founded by Dallas Cowboys owners the Jones family and Rob Wechsler, has acquired a majority stake in Minnesota-based TravelNet Solutions, a property management software provider for the hotel and vacation rental industries. According to Skift, the 120-person TravelNet estimated its 2022 revenue at approximately $27.5 million. The Blue Star investment will help the company further product development while enhancing its sales, marketing, and support efforts.

—

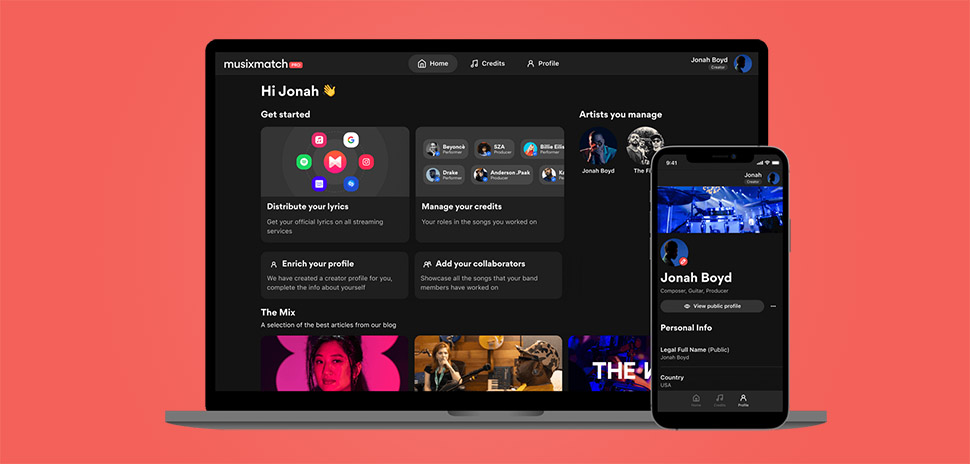

Photo: Musixmatch

TPG Invests in Italian Music Data Platform

⟫ Through its mid-market and growth equity platform, Fort Worth- and San Francisco-based alternative asset giant TPG has made a “significant investment” in Italian music data platform Musixmatch. The company provides lyrical and meta data to streaming platforms like Apple Music and Spotify. With the funding from TPG, the company said it plans to expand into new verticals, while growing its international reach.

—

Arlington-Based GracoRoberts Combines with Fellow Aerospace Equipment Distributor

⟫ GracoRoberts, an Arlington-based distributor of specialty chemicals for the aerospace industry, has merged with e-commerce aerospace hardware and chemical distributor Styles Aviation, which does business as SkyGeek, after acquiring the New York-based company. As part of the move, SkyGeek will maintain its operations in New York, making it a distribution hub in the Northeast for the combined business. CM Equity Partners-backed GracoRoberts said the move will help it provide more products and services to clients amid supply chain issues.

—

Southlake SPAC to Take Financial Services Firm Public

⟫ Southlake blank check company DHC Acquisitions Corp is set to take financial services company With Purpose, Inc., public via a SPAC deal. With Purpose does business as GloriFi. When the deal closes in Q1 next year, GloriFi equity holders will received nearly $279 million in proceeds. The move will give the combined companies a pro forma enterprise value of about $1.7 billion. GloriFi is expected to list on the Nasdaq under the ticker GLRI.

—

Digital Marketing Firm Cloudmellow Expands to Atlanta with New Acquisition

⟫ In its second acquisition this year, Dallas-based technology and digital marketing company Cloudmellow has scooped up Atlanta web design firm The Creative Momentum, marking Cloudmellow’s expansion into that market. Company co-founders Shreyans Jain and Vijay Konda said the move continues Cloudmellow’s strategy to “bolster services, join people, and provide exceptional expertise” to clients.

—

Insurance Distribution Giant Makes New Acquisition

⟫ Dallas life and health insurance distributor Integrity Marketing Group has acquired local financial services marketing organization PHP Agency from Ambina Partners for an undisclosed amount. According to Ambina, PHP has more than tripled its revenue since it first invested in the company.

—

Photo: Bellagreen

Plano-Based Original ChopShop Spins off Bellagreen, Expands to Atlanta

⟫ Plano-based Original ChopShop sold off its eight Bellagreen fast casual restaurants last week to Richardson-based Ampex Brands, owner of Au Bon Pain and franchiser of more than 400 fast food restaurants and 7-Eleven stores. “We want to have the team singularly focused on one brand,” Original ChopShop CEO Jason Morgan told Nation’s Restaurant News. ChopShop aims to grow from 17 to 23 restaurants by March 2023, including an expansion into Atlanta in Q4 of this year. “We’ve got top-notch technology in place,” Morgan added, noting that more than 35% of sales are made through a loyalty program run through Paytronix. Morgan was previously CFO of Zoës Kitchen.

David Seeley contributed to this report.

Want more?

Sign up for our e-newsletter, and share your deal news here.

Read more in Kevin Cummings’ recent Follow the Money deal roundup:

Airmen learning how the BILT instruction app provides the capability to rotate, zoom in, and interact with 3D animations. [Photo: BILT]

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.