What companies are finding funding or having a big exit? From startup investments to grants and acquisitions, Dallas Innovates tracks what’s happening in North Texas money every Thursday. Sign up for our e-newsletter to stay in the loop.

Have a deal we should know about? Tell us here.

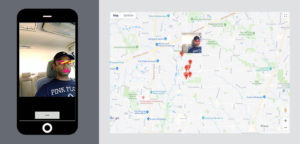

Dallas AI startup Edgetensor Technologies gets VC funding

[Courtesy EdgeTensor]

Dallas-based artificial intelligence startup Edgetensor Technologies has received an undisclosed amount from early-stage venture capital firm SRI Capital.

Edgetensor produces software development kits (Face SDK) for cameras, including ones in smartphones with facial-tracking capabilities. We reported on the company in September. It was founded last year by Rajesh Narashima and Soumitry J Ray.

Its technologies are applicable in in-vehicle monitoring to prevent distracted drivers and enhance video security in public places, VCCircle said.

SRI Capital, with offices in Philadelphia and Hyderabad, India, has supported roughly 30 companies in optics, hardware, sensors, and other technologies, with investments ranging from $500,000 to $3 million.

Stryve Biltong closes on $16.5M Series B funding

Plano-based Stryve Biltong has received $16.5 million in a series B fund round that the company said will be used for education, awareness, trial among consumers, investment in talent, and operations.

The round was led by Meaningful Partners, Pendyne Capital, and Murano Group.

“We have an aligned strategy for growth and are rapidly moving to put all the pieces in place to achieve it,” co-founder and Chairman Ted Casey said in Meat + Poultry.

Stryve Biltong produces a portfolio of meat snacks that includes chicken and turkey bites, beef and turkey sticks, and biltong—a type of dried, cured meat.

The funding comes after Stryve closed on a $10 million funding round in September. Stryve was founded by Casey, a sports nutritionist, along with former NFL player Gabe Carimi and sports nutritionist Joe Oblas.

Neiman Marcus invests in pre-owned merchandiser Fashionphile

Dallas-based luxury retailer Neiman Marcus said it has bought a minority stake in Fashionphile, an online buyer and seller of pre-owned merchandise such as handbags, accessories, and jewelry.

Fashionphile has showrooms in Beverly HIlls, San Francisco, and Carlsbad, California, and on Madison Avenue in New York City, the Dallas Morning News reported.

Neiman Marcus did not announce the size of its investment, but said it won’t be selling the pre-owned fashion merchandise itself, the Morning News said. The acquisition gives Neiman Marcus an inroad to the preowned handbag market, however.

Dallas’ Goldcrest Capital raising $11M for a new fund

Goldcrest Capital, a Dallas venture capital firm that invests in private technology companies, is raising up to $11 million for a new fund, according to a federal filing.

According to the Dallas Business Journal, Goldcrest was founded by Daniel Friedland, who sits on the board of the electric scooter company Bird. The publication said Goldcrest is participating in a new round of funding for Bird.

TPG invests in jewelry brand APM Monaco

TPG, a global alternative assets firm with headquarters in Fort Worth and San Francisco, has led a consortium of investors that has agreed to invest in APM Monaco, a contemporary jewelry brand.

The amount of the investment was not disclosed.

APM Monaco was founded in Monaco and has grown its global footprint, especially in Asia, according to a release. TPG’s investment comes via TPG Capital Asia, its Asia-focused private equity platform.

PE firm PetroCap Partners raises $300.2M for its third fund

PetroCap Partners, a Dallas private equity firm that focuses on oil and gas drilling projects said in a filing that it has raised over $300.2 million for its third fund, the Dallas Business Journal reported.

The DBJ said the company, which was founded in 1992, invests between $25 million to $75 million in onshore U.S. drilling ventures.

PetroCap is involved in deals from the Permian in West Texas to East Texas shale, the Texas Gulf coast, and Oklahoma, the DBJ said.

Other Funding

Dallas-based Jollitot, a data company that collects and sends insights to expecting mothers and parents about their baby that can be shared with their doctors, has received an undisclosed amount in a pre-seed round, according to Cruchbase.

MERGERS & ACQUISITIONS

California firms buys Securadyne Systems; to establish DFW headquarters

California security firm Allied Universal is buying Dallas-based Securadyne Systems and will establish a security technology headquarters in North Texas, according to a report in The Dallas Morning News.

The acquisition of Securadyne will create the nation’s fourth-largest security services company, according to the Morning News, with combined yearly revenue of more than $7 billion. The new company, which will be renamed Allied Universal Technology Services, will employ 500 people in Dallas, the Morning News reported.

Qorvo buys Richardson-based Active-Semi International

Richardson-based Active-Semi International Inc. is being acquired by North Carolina-base Qorvo, a maker and supplier of semiconductors.

No details of the deal were released. Active-Semi designs, develops, makes, and sells digital and programmable power management and digital motor drive integrated circuits.

According to a report in the Triad Business Journal, Active-Semi will become part of Qorvo’s Infrastructure and Defense Products group. The deal is expected to close on June 29.

Elite Electronics acquired by Chicago company

Richardson-based Elite Electronics, which specializes in automotive diagnostic and repair services, has been acquired by LKQ Corp.

The acquisition puts Chicago-based LKQ into the vehicle services market by melding its parts and distribution business with Elite’s services.

Dallas-based middle-market investment banking firm Transitus Capital served as exclusive financial adviser on the transaction.

READ NEXT

Follow the Money: Nimbix Gets $4M, Energy Spectrum Raises $867M; Sentrics Acquires SeniorTV

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.