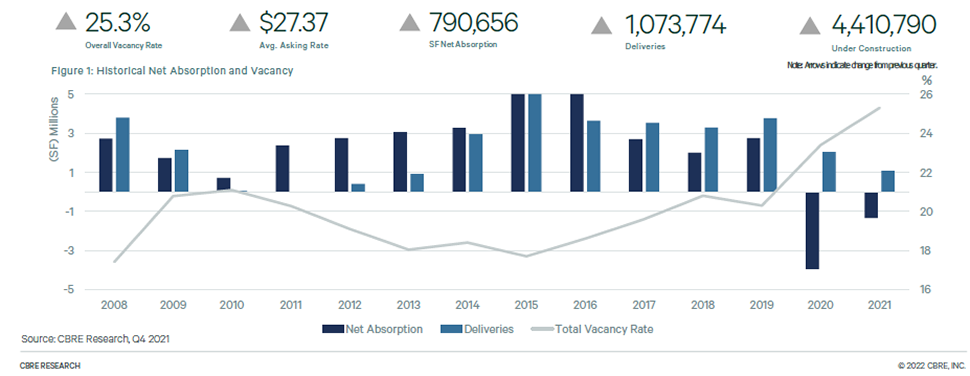

The office market in Dallas/Fort Worth showed signs of life at the end of 2021, although vacancies remained high, according to a Q4 report from CBRE.

Net absorption gained almost 800,000 square feet, a 1.4 million SF increase since Q3 2021. Despite rising absorption, vacancies increased slightly to 25.3 percent, up 20 basis points (bps) compared to 50 and 60 bps earlier in 2021. Quoted average rent rates inched up from $26.85 to $27.37.

[Image: CBRE]

Space under construction also rose in Q4, up 23.6 percent to 4.4 million SF, with nine new developments breaking ground as the year wound down. Just over 1 million SF in office construction was delivered in Q4, up 165.6 percent compared to Q3.

According to CBRE’s data, sublease availability fell slightly from 9.2 million SF to 9.0 million SF.

Among the biggest leases of the quarter are the nearly 132,000-square-foot lease to JPMorgan Chase in the Hunt Consolidated building at 1900 N. Akard St. (The financial institution plans to relocate 600 workers to the building in 2022) and the 97,000 SF to Thorofare Capital Inc. at 1919 McKinney Ave. in Uptown. The largest building sale for Q4 was the 1.9 million SF Campus at Legacy West in Plano which sold to Capital Commercial Investments.

The report said that the increases in office market absorption, construction, and deliveries indicate that “broker sentiment remains cautiously optimistic after a strong ending to a tumultuous year.”

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.