In April, we told you that Dallas-based Spectral MD—a predictive AI company focused on medical diagnostics and treatment guidance in wound care—plans to be listed as Spectral AI on Nasdaq through a SPAC merger with Rosecliff Acquisition Corp I. With its Nasdaq listing now slated for September 8 or 11, the company has offered updates in an investor video that reveal insights into how such SPAC mergers work.

Spectral MD plans to delist from the AIM market of the London Stock Exchange—where it was first listed in 2021—as part of the proposed transaction and shift to Nasdaq through the SPAC merger, pending shareholder approval.

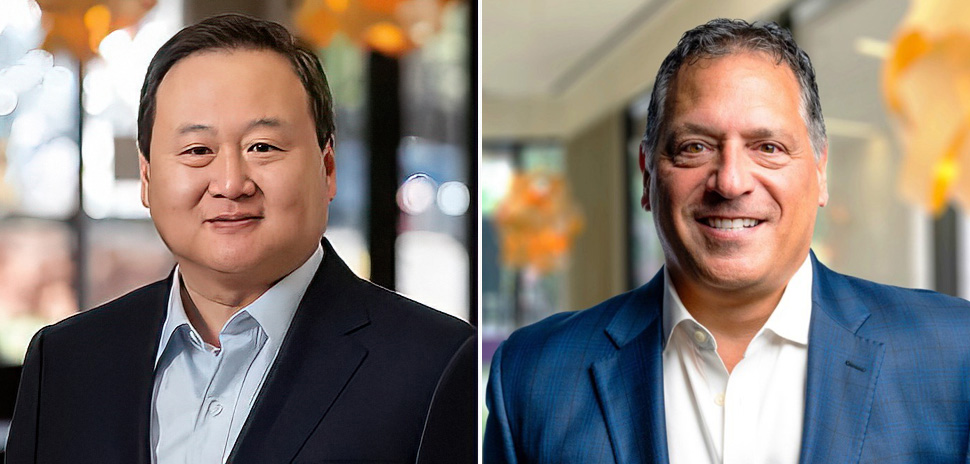

As we told you in April, once the listing goes live, Spectral MD is expected to operate under the name Spectral AI and be listed under the symbol MDAI. At the time, Spectral MD CEO Wensheng Fan said the transaction is an “excellent strategic move” for the Dallas-based company founded in 2009.

“For the past 10 years, the Spectral MD team and our key partners have been developing cutting-edge AI solutions that have demonstrated tremendous promise and are now on the cusp of delivering for healthcare providers and patients,” Fan said in an April statement.

Spectral MD’s DeepView platform predicts wound healing

Spectral MD’s DeepView system looks beneath the skin’s surface. [Photo: Spectral MD video]

Spectral MD’s DeepView platform uses proprietary algorithms to predict wound healing and assess whether a wound will heal to inform healthcare providers of next-step treatment protocols. It has been designated as a Breakthrough Device by the U.S. Food and Drug Administration due to its potential to provide more effective treatment or diagnosis of life-threatening or irreversibly debilitating diseases or conditions.

The hardware, software, and AI for DeepView were all built in-house at Spectral MD’s Dallas office, the company said.

Spectral MD says it has raised $130 million to date in non-dilutive contracts from the U.S. government to support its technology as a surgical-triage tool for burn victims in a mass casualty event. “We have conducted the biggest burn image clinical trial to date. The trial involved 12 U.S. burn centers and we enrolled 250 subjects,” the company said.

Claiming that its AI is currently “92% accurate,” Spectral AI says there are currently no devices on the market that “can give a Day One prediction if a wound will heal or not,” as the DeepView platform is designed to do.

Moving into the ‘De-SPAC merger’ process

In the investor video, Steve Darling of Proactive Investors interviews Vince Capone, general counsel for Spectral MD Holdings. Capone explains that with the SPAC merger well underway, his company is now in the process of a “De-SPAC merger”—a process that will turn the combined company into Spectral MD alone, speeding its way to reemerge as Spectral AI.

“Our approach is to complete a De-SPAC merger with Rosecliff Acquisition where we are the surviving entity,” Capone explains in the video. “We will become a holding company of Rosecliff. Rosecliff will change their name to Spectral AI. The ticker will be changed on Nasdaq from RCLF to MDAI.”

Capone said that receiving SEC clearance was “really the last major hurdle for us in this transaction.”

“We were quite excited when we got the news that we had cleared the SEC examiner’s review,” Capone said. “Rosecliff was able to file its Form 424 Monday morning. At this point, we’re really looking at advancing the ball for their shareholder meeting and ours to complete the transaction in early September.”

Process can take ‘three or four months to complete’

Capone noted that these transactions “generally take three to four months to complete, and the SEC has done three reviews of our joint S4 filing with Rosecliff. It’s their filing, but obviously a lot of it talks about us.”

“I actually think we got through the process in a little bit of an expedited fashion,” Capone added, “We’re looking at a short window to hold their shareholder meeting and to hold ours and to complete the transaction so we can list on Nasdaz. Our goal is September 8, and then we will delist from the AIM market (delist AIM:SMD) at the same time.”

Capone said Spectral MD’s shareholder meeting is scheduled for August 31.

“We’re going send out a notice to our shareholders tomorrow of the annual meeting. Rosecliff is going to hold their shareholder meeting on September 6. We should have everything in order after their meeting. We will be in a good place. And we anticipate listing on Nasdaq, say, September 8—or maybe the start of the market opening on Monday, September 11.”

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.