David Gassko (left) and Jeff Moredock [Photos: Kainos Capital]

David Gassko and Jeff Moredock each have been promoted to partner by Dallas-based Kainos Capital, a middle-market private equity firm that’s focused on food and consumer businesses.

Gassko and Moredock previously were principals with the firm. Each has over a decade of investing and investment banking experience in the food and consumer sectors, Kainos said.

“We’re very proud to recognize David and Jeff with these well-earned promotions,” Andrew Rosen, Kainos managing partner, said in a statement. “Both David and Jeff have steadily moved up our ranks, demonstrating impressive investment acumen and business savvy along the way. They’ve played a significant role in our deal sourcing, execution, and portfolio oversight, while enhancing our executive recruitment and broadening our industry network.”

Gassko joined Kainos in 2013 as an associate, the firm said. After attending business school, he returned to Kainos in 2018 as a vice president. He’d begun his career as an investment banker with Wells Fargo Securities.

Moredock joined Kainos in 2017 as a vice president. Previously, he was a vice president at CenterOak Partners and an associate at Brazos Private Equity Partners. He’d started his career as an investment banker with Deutsche Bank’s M&A Group.

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

R E A D N E X T

-

Mobility startups from coast to coast—including those focused on innovative ideas to transport people or goods—are invited to apply. The unique accelerator program supports startups in the automotive ecosystem, ranging from AI-powered industry solutions and transportation infrastructure to dealer support and related services.

-

In 2023, founders searching for venture capital found fewer investors and less money. Pitchbook reports that the number of U.S. deals in the first three quarters of 2023 was just slightly higher than the number made during the same period in 2018. In North Texas, it was a similar story. But even as investment markets have tightened, Dallas-based Beyond Capital is working to reverse that trend by investing in more startups. In the first quarter of 2024, it’s opening its third fund to new investors. Beyond Capital looks for startups in need of Seed to Series A investment. What…

-

In a world reshaped by remote work and virtual services, do Americans still believe that owning a car is essential to getting ahead? Researchers investigated how vehicle ownership impacts upward mobility post-pandemic—from employment to social benefits.

-

The newly established Texas Capital Foundation is following the first round of grant awards by opening again for new submissions this November.

-

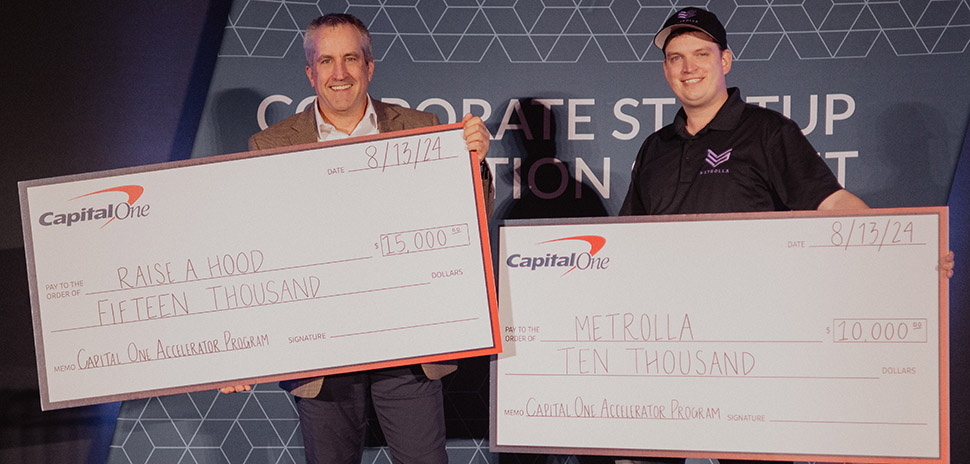

The Capital One program — one of few mobility-focused accelerators in the country — empowers visionary founders to enhance their startup expertise, expand their networks, and attract investors. The latest cohort wrapped up with standout pitches and notable wins.

![]()