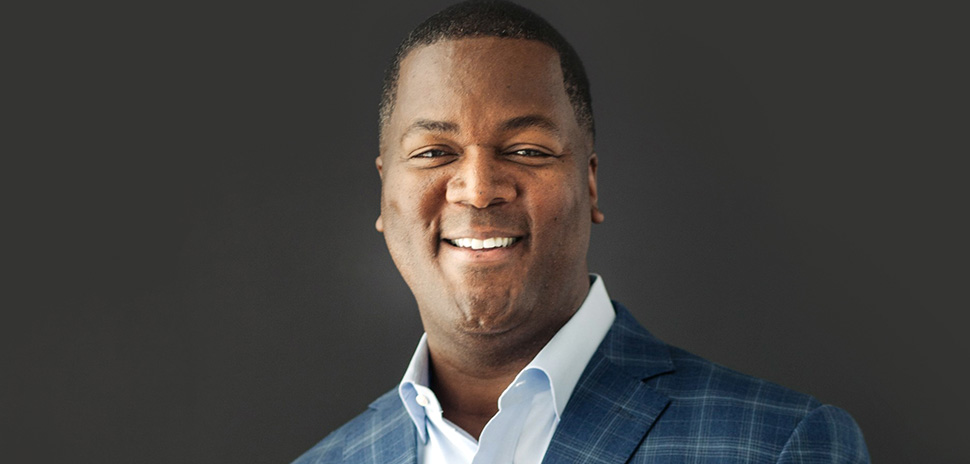

Dennis Cail calls his startup, Zirtue, a “radically different” fintech platform. It takes the awkwardness out of lending and borrowing money from friends and family while tracking how much is owed with a digital paper trail, the CEO and co-founder says.

Zirtue’s game-changing relationship-based lending app launched in Android and iOS last year, making it the first of its type to simplifies loans between friends and family with automatic monthly loan payments, Cail told Dallas Innovates. Then it added hundreds of thousands of users plus a partnership with MasterCard to launch a Zirtue Debit Card for those with little or no bank access.

The patent-pending app encourages transparent and equitable lending options for all people.

Zirtue’s patent-pending relationship-based lending app has been downloaded by hundreds of thousands of users.

“Zirtue exists to drive financial inclusion,” Cail says. Low income and military personnel are primary targets for predatory and payday lenders, according to the entrepreneur.

The startup gathered more than $1 million in funding from several sources last year, including Dallas Cowboys Jaylon Smith’s Minority Entrepreneurship Institute and the Google for Startups Black Founders Fund. The funding followed a $1 million seed round in 2019. Most recently, Zirtue got $500,000 from Revolution’s 2020 Rise of the Rest pitch competition.

As part of the Google award, ongoing access to the tech giant’s engineers will help Zirtue to scale faster with continuous product improvement, Cail says.

Zirtue is lending, reinvented

Cail launched the company in March of 2018 with co-founder Michael Seay, a Dallas financial executive and entrepreneur who serves as Zirtue’s CFO. He aims for a business strategy that includes social impact.

Cail began working with technology while serving in the Navy, then earned a computer science degree and MBA from Southern Methodist University. Before founding Zirtue, he served as Senior Director of Corporate Services at IBM Global Services, Managing Director at Uptown Financial Group and at PwC, and Managing Partner at Convince Capital Partners.

Over the years, he found he had limited success getting money back when lending to family and friends. He set out to solve that problem with Zirtue. “The essence of Zirtue is to provide a fair, transparent solution that empowers underserved individuals to change the way they lend, borrow, and bank with friends and family,” Cail says.

The company takes a “user-first” approach, pivoting from a monthly subscription fee toward a frictionless no-fee model with a focus on a B2B revenue stream, he says. It also introduced another patent-pending innovation that lets borrowers pay their creditors directly using borrowed funds

A virtuous circle

Cail is doubling down on the company’s focus on purpose, partnerships, and profit. “In that order,” he says.

Zirtue’s impact could be profound by helping to “close the wealth gap nationally and abroad,” says the co-founder who was a finalist in D CEO and Dallas Innovates 2021 Innovation Awards.

The company initiated a COVID-19 Relief Program in the pandemic, waiving its monthly subscription fee so users got no-cost access to borrowed funds from friends and family. He calls the big challenges of 2020, COVID-19 and racial injustice, the collision of “two perfect storms,” prompting his team to look for ways to be “part of the solution.”

Cail says, “We see purpose and profit as a virtuous circle to do what is right to help, not hurt an already painful situation.”

Common purpose creates resilience

As for most, the move to WFH in the pandemic “has been a huge adjustment,” Cail says. He makes it a point to encourage check-ins on the personal side of life as well as business.

“We give our team the time and space they need during these difficult times to focus on the things and people that matter to them most,” he says.

The company’s mission is to drive financial inclusion, one relationship at a time. That common purpose is shared by the Zirtue team—along with shared objectives to care about something outside of yourself, he adds.

“The majority of our resilience stems from our ability and privilege for Zirtue to facilitate financial lifelines from friends and family in times of need, especially during this pandemic,” he says.

What’s next for Zirtue

Cail says the Zirtue team has laid the groundwork for a pivotal year in 2021: “We spent 2020 preparing for it by setting the foundation required to build something meaningful and impactful,” he says.

Zirtue will continue to reinvent and reimagine lending, borrowing, and bill payments, Cail says.

“We’re using breakthrough technology to solve systemic problems in a profitable and scalable way.”

A version of this story was originally published in Dallas Innovates 2021: The Resilience Issue.

Read it online

Our fourth annual magazine, Dallas Innovates 2021: The Resilience Issue, highlights Dallas-Fort Worth as a hub for innovation. The collective strength of the innovation ecosystem and intellectual capital in Dallas-Fort Worth is a force to be reckoned with.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.