A report released today by the Federal Reserve Bank of Dallas is headlined “Texas modestly grows with soft landing likely.” Here are 10 takeaways from the report:

- Texas firms reported below-average output growth to start 2023.

- Employment and wage gains remained elevated despite indications of a softening labor market.

- Price and wage inflation are expected to slow in 2023 but remain above historical averages.

- Employment growth is expected to slow in 2023, but the state is likely to avoid a recession.

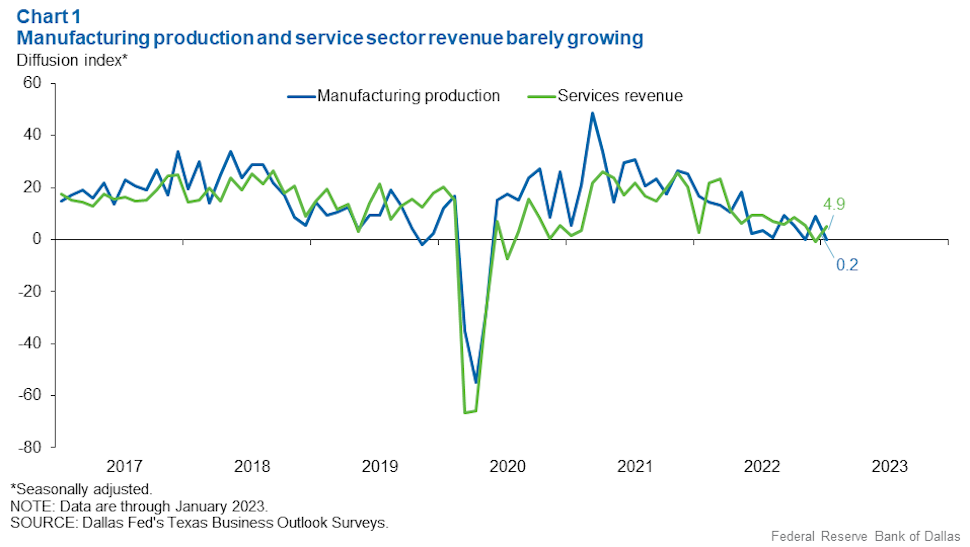

- Services and manufacturing are barely in expansionary territory coming into 20223, with the Dallas Fed’s Texas Business Outlook Surveys (TBOS) manufacturing production index near 0 since mid 2022.

- New orders for manufacturing have declined, but the pace has slowed.

- Revenues for services have weakened, with most industries noting high inflation and rising interest rates.

- The TBOS employment indexes remain elevated, but the share of firms looking to hire has fallen.

- A majority of firms are still understaffed, and many opt not to hire. But others report being overstaffed with no planned layoffs, which could be an indication of hoarding labor.

- Risks are weighted to the downside, with Texas businesses concerned over weakening demand and labor market tightness.

Read more in today’s Dallas Fed report.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.