Dallas real estate investment firm Crow Holdings has closed its largest fund to date, securing $3.1 billion in fresh commitments from both existing and new investors, the company announced today.

The fundraise for Crow Holdings Realty Partners X LP marks a nearly 35 percent increase from its predecessor $2.3 billion fund raised in 2019, nodding to investor confidence in Crow’s value-add strategy even amid current market uncertainty.

More than 70 percent of previous fund investors rejoined for Fund X, while new investors include global banks, sovereign wealth funds, insurance companies, pension plans, family offices, and high-net-worth individuals.

“We believe this fundraise represents not only our partners’ confidence in the series’ performance, but also an appreciation of the growth in the platform,” Crow Holdings CEO Michael Levy said in a statement.

Crow Holdings aims to augment and expand its offerings and complementary strategies to enhance value for its investment partners, the CEO said.

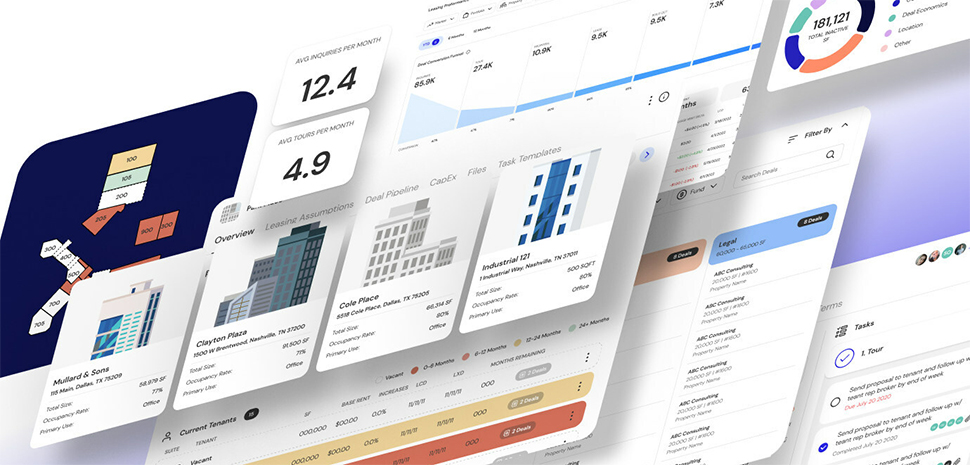

Fund X is managed by Crow Holdings’ investment management company, Crow Holdings Capital.

Co-invest agreements secured

In addition to investments in the primary fund, Crow Holdings said the fund manager secured co-invest agreements totaling nearly $600 million in equity capital, resulting in the potential for about $3.7 billion in total investable equity for the strategy.

According to Crow Holding Capital CEO Bob McClain, the fund will make selective investments in real estate assets that can benefit from long-term trends supporting ongoing income growth. It will focus primarily on industrial and multifamily properties located in high-growth markets across the country.

McClain said the firm has “conviction about the current opportunities and possibilities,” noting that his investment team has a track record of “high performance in multiple real estate cycles.”

Investment targets

The fund said it intends to invest in value-add real estate assets across the United States, primarily in industrial and multifamily, as well as in specialty sector opportunities, including manufactured housing, convenience retail, self-storage, and student housing.

Crow Holdings said that more than 25% of Fund X’s capital to date has been committed across 14 investments.

“Our successful fundraise, especially in the current challenging equity market environment, is a testament to the faith our returning and new investors have in our ability to identify and secure attractive real estate investments in our core focus areas,” Coe Juracek, Crow Holdings Capital senior managing director of investor coverage, said in a statement.

Crow Holdings said the close of Fund X brings the total amount of capital raised across all 10 vintages of the U.S. Diversified Value-Add Real Estate Funds to more than $15.6 billion since 1998.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.