Dallas-based CBRE Group Inc.’s property management group has formed a global strategic partnership with Deepki that will bring Deepki Ready, one of the world’s most extensive landlord-focused real estate sustainability data-intelligence platforms, to the commercial properties CBRE manages for investors worldwide.

CBRE also will make a strategic investment in the rapidly growing, Paris-based 9-year-old software-as-a- service (SaaS) company, securing a minority share. Details of the investment were not available.

“Property owners are increasingly turning to CBRE for help in meeting their decarbonization and other sustainability goals,” Emma Buckland, global president of Property Management at CBRE, said in a statement. “Deepki is a leading sustainability data-intelligence platform for real estate that provides deep insights that will enable our teams to take informed actions at the building level. This will help us embed sustainability best practices–and add real value–at properties we manage around the world.”

CBRE said it has been using Deepki for properties it manages in the United Kingdom for more than two years and that Deepki is being deployed across CBRE-managed properties throughout Continental Europe.

CBRE has plans to begin using Deepki in the Americas and the Pacific region as the next step in a global rollout.

In an exclusive reseller agreement, CBRE said it also can offer Deepki Ready directly to its property management clients in the Americas and Asia Pacific region.

Tracking sustainability goals

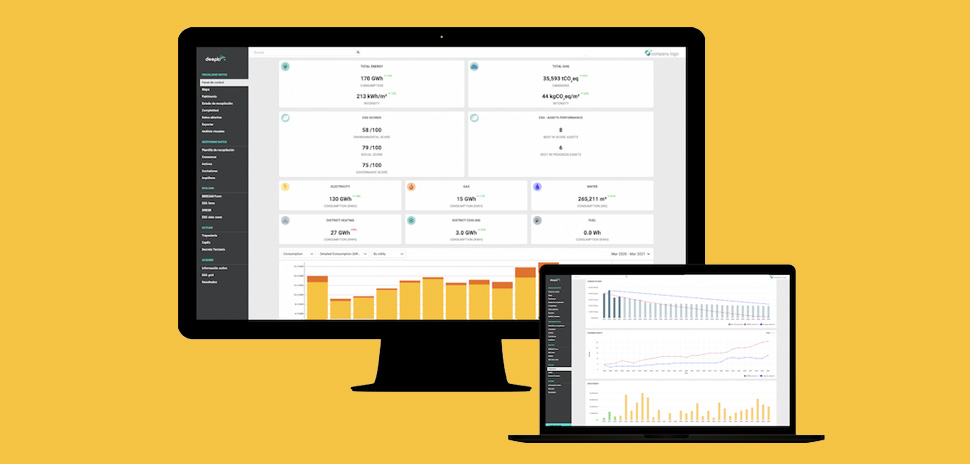

Deepki’s platform operates in 50 countries and enables its customers to collect energy, water and waste consumption data, gain a comprehensive view of environmental performance at a portfolio- and asset-level, establish investment plans to reach net zero, and measure results, CBRE said.

It provides superior capabilities for meeting increasingly stringent regulatory and other reporting requirements, as well as for voluntary sustainability initiatives.

“We are extremely proud to be partnering with CBRE, whose outstanding reputation in the real estate space speaks for itself,” Deepki co-founder and CEO Vincent Bryant said in a statement. “This partnership is a validation of our market-leading solution and marks a crucial step in our go-to-market strategy to help real estate players tackle climate change and meet net zero targets, particularly in the Americas and the Asia Pacific region.”

CBRE said that buildings reportedly are responsible for roughly 40% of the world’s carbon emissions, and many institutional investors and multinational corporations, including CBRE, have joined the global effort to combat climate change by pledging to reach net zero emissions by 2040.

In March 2022, Deepki raised €150 million in a Series C round of funding that was jointly led by Highland Europe and One Peak Partners. Other investors include Bpifrance, through their Large Venture fund, Revaia, Hi Inov, Demeter and Statkraft Ventures.

CBRE Group Inc. is a Fortune 500 and S&P 500 company and is the world’s largest commercial real estate services and investment firm, based on 2022 revenue. It has roughly 115,000 employees (excluding Turner & Townsend employees) serving clients in more than 100 countries.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.