Irving-based multifamily community developer JPI announced that the acquisition of its operating platform by Sumitomo Forestry America Inc. has been completed.

We first told you about the deal in October. No financial details were released.

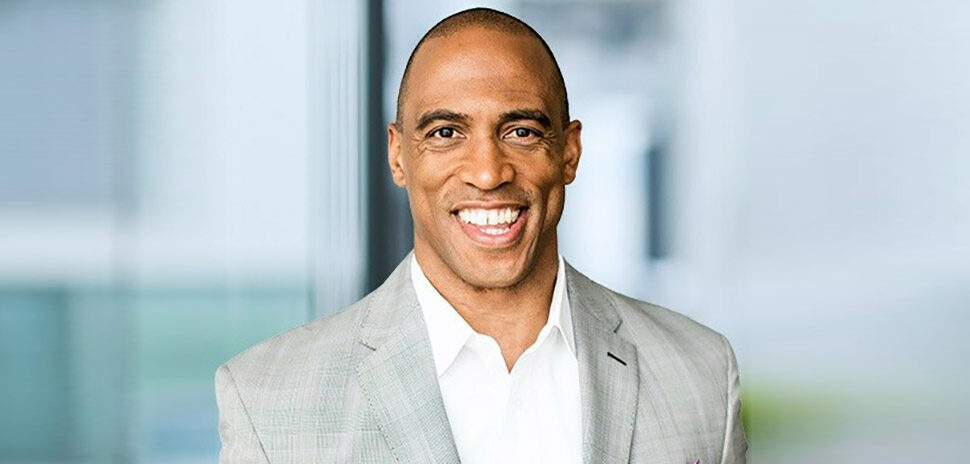

“This partnership marks a pivotal moment for JPI and I’m very excited for two primary reasons,” JPI Chief Executive Officer Payton Mayes said in a statement. “This partnership not only establishes a resilient structure that supports JPI’s long-term vision and legacy but also involves a significant infusion in JPI’s working capital. This strategic move will tremendously enhance our business plan and drive future growth and sustainability.”

Sumitomo Forestry America is a comprehensive housing and wood products subsidiary of Japan-based Sumitomo Forestry Co. Ltd.

JPI said that as the No. 1 fastest-growing developer and No.2 fastest-growing builder in the United States, as recognized by NMHC, JPI has established itself as a leader in the multifamily development sector.

The company said it continues to lead the way with more than 8,000 homes under construction in Texas and California, with a robust pipeline of projects under development.

“As a long-term partner, Sumitomo Forestry has made tremendous investments in JPI projects over the past four years,” Mollie Fadule, chief financial and investment officer for JPI, said in a statement. “Their deep respect for our company culture and team has been evident throughout our collaboration. With this acquisition, we’re embarking on an exciting new journey, one that promises remarkable growth and new opportunities for JPI.”

Now the 6th largest multifamily developer in U.S.

JPI said the acquisition strategically positions Sumitomo Forestry to expand its multifamily portfolio, making it the sixth largest multifamily company in the United States, based on the annual volume of homes delivered.

“Today, we officially welcome JPI to our team,” Atsushi Iwasaki, the leader of Sumitomo Forestry’s U.S. operations, said in a statement. “As I’ve worked with JPI and their leadership, I have become very familiar with their passion for making an impact on communities, which is a value we share at Sumitomo Forestry. We are confident that this partnership, in combination with JPI’s rich history, has a bright future.”

JPI said it will retain its brand identity and continue operating from its North Texas headquarters, supported by regional offices in San Diego and Irvine, California.

The agreement includes minority interests acquired by Mayes and Fadule, who will maintain key leadership positions as CEO and CFO/CIO respectively.

Jones Lang LaSalle Securities LLC, an affiliate of Jones Lang LaSalle Americas Inc. and Norton Rose Fulbright U.S. LLP advised JPI on the transaction. Perkins Coie LLP served as legal advisor to Mayes and Fadule.

Falls River Group and Zelman Partners, a subsidiary of Walker & Dunlop, served as financial advisers to Sumitomo Forestry, and Vinson & Elkins served as Sumitomo Forestry’s legal adviser.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.