“The revenue profile is stabilizing while the financial profile is improving.”

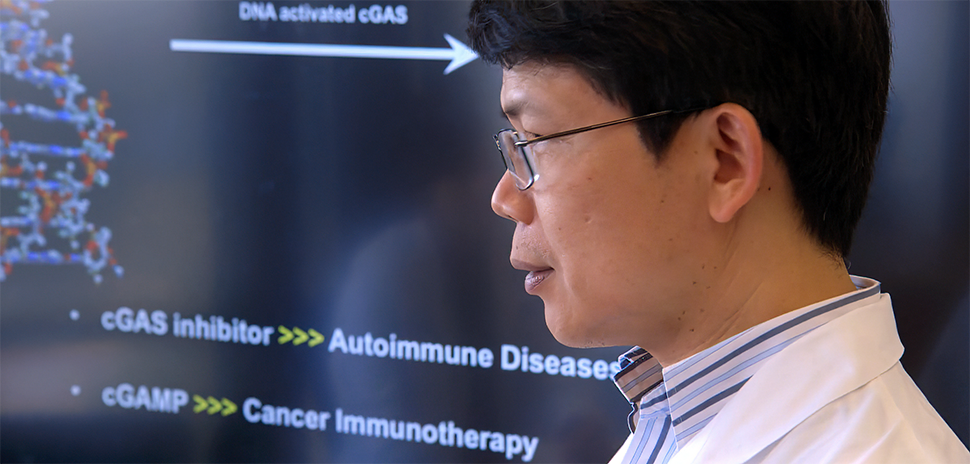

Sammy Abdullah

Founder, Chair, and Managing Partner

Blossom Street Ventures

… …on the state of SaaS, via LinkedIn

![]()

Dallas-based investor Sammy Abdullah says his firm has tracked every SaaS company that has gone public since Q4 2017. Its latest analysis of the 37 that remain publicly traded shows median year-over-year revenue growth holding steady at 16% for four consecutive quarters, with net dollar retention stabilizing at 109%.

In a LinkedIn post, he points to median operating margins climbing from roughly -30% in early 2022 to mid-single-digit losses today. More than half of public SaaS companies (55%) now generate an operating profit.

For entrepreneurs eyeing fundraising, Abdullah’s data offers some benchmarks. Median payback period sits at just 0.6 years, and companies are generating $1.73 of incremental revenue for every $1 of operating loss. Keep payback under 1.5 years with NDR above 100%, he notes, and “investors are generally comfortable funding losses to grow ARR.”

The Rule of 40—a popular benchmark holding that a SaaS company’s growth rate plus profit margin should total at least 40%—gets a thumbs down from Abdullah. “We believe it’s a useless and antiquated rule,” he writes.

For the full data and historical comparison charts, check out Abdullah’s analysis.

For more of who said what about all things North Texas, check out Every Last Word.

Don’t miss what’s next. Subscribe to Dallas Innovates.

Track Dallas-Fort Worth’s business and innovation landscape with our curated news in your inbox Tuesday-Thursday.