Fort Worth-based Paragon Energy Solutions—a leading supplier of safety-related products and components for the nuclear power industry and the next generation of small modular reactors (SMR)—is being acquired by Atlanta-based Mirion in an all-cash $585 million deal.

Mirion—a global provider of radiation detection, measurement, analysis, and monitoring solutions to the nuclear, medical, defense, and research end markets—is acquiring Paragon from California- and Massachusetts-based Windjammer Capital Investors. Windjammer acquired Paragon in December 2021 for an undisclosed amount.

The deal follows another Fort Worth acquisition by Mirion announced in July, when the company acquired Certrec, a regulatory compliance and digital integration firm that serves every U.S. nuclear reactor. That $81 million transaction expanded Mirion’s capabilities in software and services tied to nuclear oversight and grid reliability.

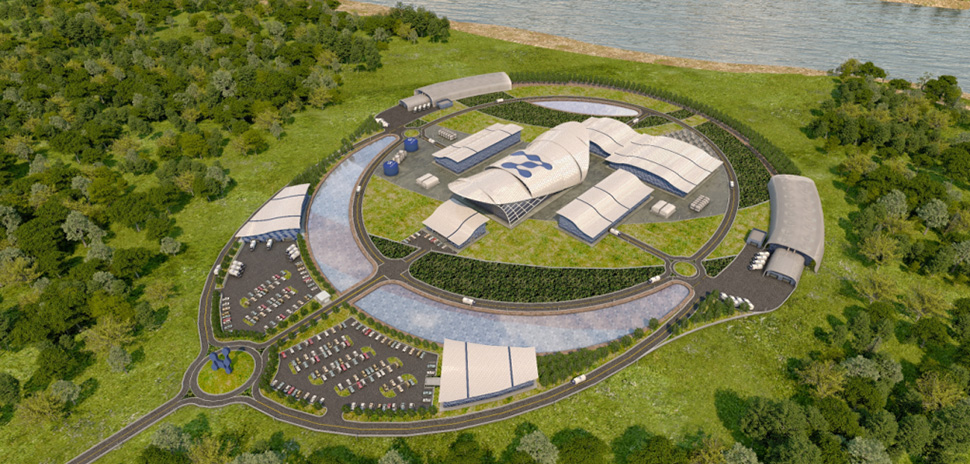

Rendering of a NuScale Power nuclear power plant [Image: NuScale]

Paragon offers a portfolio of application-specific critical nuclear systems that support both the operating nuclear fleet and the next generation of SMR projects. The company recently received a new patent for its nuclear reactor protection systems and methods. And earlier this summer, Paragon announced a partnership with Oregon-based NuScale Power, a provider of proprietary advanced small modular reactor technology and the only provider with design approval from the U.S. Nuclear Regulatory Commission.

The company’s expertise includes commercial grade dedication and qualification of nuclear parts, testing, and inspection, as well as value-add distribution via its proprietary platform.

Over 100 engineers and 20,000 proprietary parts

Paragon has a workforce of over 100 engineering professionals, and offers over 20,000 proprietary parts. Its systems and solutions are present in 100% of nuclear reactors in North America, the company said.

“Like Paragon, Mirion is focused on providing high-quality, innovative products to support the current nuclear operating fleet and the next generation of SMRs,” Doug VanTassell, Paragon’s president and CEO, said in a statement. “Together, this transaction strengthens the nuclear global supply chain needed to upgrade the operating fleet and bring the next generation of SMRs on-line.”

Mirion Chairman and CEO Thomas Logan said the acquisition will build on his company’s commitment to “to the detection, measurement, and analysis of ionizing radiation.”

“The complementary capabilities of Mirion and Paragon will provide nuclear power customers with a more comprehensive suite of product offerings and services to meet their growing needs, just as public and private support for the industry accelerates,” Logan added in a statement. “Further, Mirion’s global reach provides the opportunity to expand Paragon’s portfolio worldwide. This transaction will create a best-in-class global supplier to the nuclear renaissance underway and enhance the customer experience.”

According to a release from Mirion, Paragon is expected to generate around $150 million of revenue in 2026 with 20%-22% Adjusted EBITDA margins. The purchase price represents approximately 18x Paragon’s expected 2026E Adjusted EBITDA.

Goldman Sachs & Co. LLC is serving as exclusive financial advisor to Mirion, and Davis Polk & Wardwell LLP is serving as Mirion’s legal advisor. Goldman Sachs is serving as the sole underwriter of committed financing to support the acquisition.

Baird is serving as the lead financial advisor to Paragon on this transaction. Moelis also is serving as financial advisor to Paragon. Kirkland & Ellis is serving as legal counsel to Paragon.

Quincy Preston contributed to this report.

Don’t miss what’s next. Subscribe to Dallas Innovates.

Track Dallas-Fort Worth’s business and innovation landscape with our curated news in your inbox Tuesday-Thursday.