Dallas’ Rising Phoenix Capital Appoints Director of Capital

Ben Fujihara will be responsible for overseeing capital strategy, investor relations, and business development at Rising Phoenix, the investment firm said.

Rising Phoenix Capital Director of Capital Ben Fujihara [Photo: Rising Phoenix Capital]

Dallas-based investment firm Rising Phoenix Capital has appointed Ben Fujihara as director of capital, a role in which he will be responsible for overseeing capital strategy, investor relations, and business development.

Rising Phoenix specializes in the energy and real estate sectors.

“We’re pleased to welcome Ben onboard the Rising Phoenix team,” said Jace Graham, CEO and founder of Rising Phoenix Capital. “His experience in capital markets and his deep understanding of the energy industry will make him an invaluable asset to our organization, and he’ll play a pivotal role in driving our growth and delivering exceptional value to our investors.”

The firm said Fujihara brings a wealth of experience, having held senior positions in the financial services industry.

“I’m excited to join Rising Phoenix Capital and contribute to the firm’s continued growth,” Fujihara said in a statement. “The current market conditions present a unique opportunity for investors to benefit from our direct sourcing of opportunities in the real estate and energy sectors. I look forward to working with our existing investor base and attracting new investors to our compelling investment opportunities.”

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

R E A D N E X T

-

Mobility startups from coast to coast—including those focused on innovative ideas to transport people or goods—are invited to apply. The unique accelerator program supports startups in the automotive ecosystem, ranging from AI-powered industry solutions and transportation infrastructure to dealer support and related services.

-

In 2023, founders searching for venture capital found fewer investors and less money. Pitchbook reports that the number of U.S. deals in the first three quarters of 2023 was just slightly higher than the number made during the same period in 2018. In North Texas, it was a similar story. But even as investment markets have tightened, Dallas-based Beyond Capital is working to reverse that trend by investing in more startups. In the first quarter of 2024, it’s opening its third fund to new investors. Beyond Capital looks for startups in need of Seed to Series A investment. What…

-

In a world reshaped by remote work and virtual services, do Americans still believe that owning a car is essential to getting ahead? Researchers investigated how vehicle ownership impacts upward mobility post-pandemic—from employment to social benefits.

-

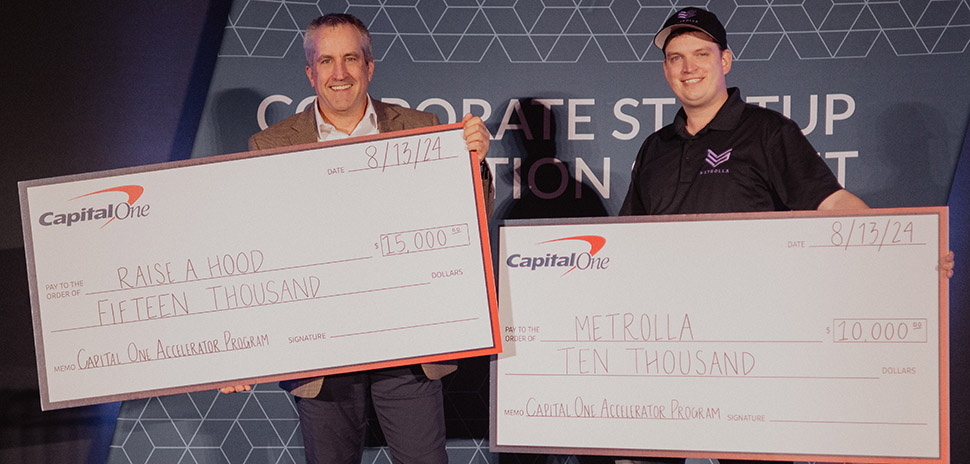

The Capital One program — one of few mobility-focused accelerators in the country — empowers visionary founders to enhance their startup expertise, expand their networks, and attract investors. The latest cohort wrapped up with standout pitches and notable wins.

-

In April, Bloomberg reported that Citation Capital aims to raise $850 million for its debut fund, which would be one of the largest-ever inaugural PE firm raises in Texas. Founded in 2023, the Dallas firm snagged a majority stake in "better for you" snack manufacturer Cibo Vita last October.

![]()