bigBANG! says it’s Dallas’ longest-running event for game-changing social innovation. The theme of this year’s bigBANG! event is inclusivity, focusing on the deep conversations that encourage innovative solutions for positive change in Dallas. bigBANG! hopes to serve as an incubator for people working to close equity gaps and move North Texas toward greater inclusivity.

The tenth annual bigBANG! event hosted conversations on cross-sector collaborations and innovative social solutions to shift the needle towards an inclusive economy. Barriers to an inclusive economy like incarceration, impact investing, and equitable investing were at the forefront of the conversations.

The co-producers at bigBANG! believe in the power of cross-collaboration to create fairer and more just systems that provide equal opportunity for all.

bigBANG! 2019 concluded in a fast-pitch competition from three for-profit, for-good startups for the chance to win social impact capital. Here some other highlights from the two-day event:

Opening Remarks

The President of Paul Quinn College, Michael Sorrell gave his opening remarks over the role Paul Quinn College plays in an inclusive economy. The historically black college in southern Dallas is making strides for inclusivity by donating 15 percent of everything they grow to the community, creating a network of urban work colleges across the country, and PQCx—a cost-effective pathway for workers to become re-skilled.

“My point to you is bigBANG! and Paul Quinn College are the places where hope resides,” said Sorrell during the event, “and hope resides here because we tackle the problems that need tackling.”

Matthew Randazzo, President and CEO of the Dallas Foundation, offered important data during his opening remarks. Randazzo included data on the increasing number of Dallas residents, the enticing Fortune 500 climate in Dallas, and the region’s ranking amongst the most charitable communities in the U.S.

He juxtaposed the area’s encouraging data with some harsh statistics on child poverty, racial wage gaps, and wealth gaps in Dallas. Randazzo ended his opening remarks with a thoughtful story on his personal experience with generational poverty: “To think about what it takes—the heavy lifting, the collaborative work of government, the social sector, and the private sector to break generations worth of poverty.”

“That is why we cannot admire the problem. We need to use data as a flashlight, not an intellectual tool to admire the amount of people that live in poverty in our community,” said Randazzo. “We need to err towards action, we need to take risks, we need to make mistakes. We need to be willing to put on the line all of our notions of what works and what it takes. And we also have to disrupt the preconceived notions we have about what poverty looks like, and what got people in poverty.”

Plenary Session 1: What Is An Inclusive Economy

Alfreda Norman, senior VP at the Federal Reserve Bank of Dallas, spoke about what an inclusive economy is from the perspective of the Dallas Federal Reserve. She prompted audience members to write down what an inclusive economy meant to them.

Audience member Brilliance Jones shared with the room, “I would say an inclusive economy is one that prioritizes the equal or equitable valuing of human beings, that also has processes and systems that best supports the success and thriving of every human that’s present.”

Norman shared more statistics on Dallas and what it meant for the economy.

“One of the things discovered through research is that the communities that were rebounding, the post-industrial cities that were rebounding, were rebounding because of this very important piece we have got here, community-based collaborative leadership,” she said. “When communities get together, the leaders as public, private, and nonprofit, get together around the table and have a shared vision of what they want to do, they can really move the needle.”

Plenary Session 2: How Prosperity Can Be Accessible To All

Michael Tanner, senior fellow at the Cato Institute, spoke about his most recent book, The Inclusive Economy: How to Bring Wealth to America’s Poor. Tanner listed five areas where he thought reforms would have a significant impact in reducing poverty including criminal justice reform, education reform, housing reform, banking/financial reform, and economic approaches to growth while accounting for the barriers that keep people poor.

Evan Smith, CEO of the Texas Tribune, joined Tanner on stage to interview him. Smith added three more areas of interest to the discussion—education, healthcare, and transportation. The conversation revolved around alternatives to traditional education systems, community, and public school health centers, and the transportation density problems in an expanding urban city.

The key to inclusivity is that it needs a cross-sector approach to being successful, according to Smith. “Every single thing you mentioned intersects with every other thing you mentioned,” said Smith. “This is not really a blanket, it’s a quilt.”

“I think the problem is that we rely too much on the government to fix things and I think ultimately, the government’s not going to change unless we move from the grassroots up and we demand changes at the grassroots level. You have to actually be involved to be active,” said Tanner.

“I would say though that if we’re going to have an inclusive economy, it may need to start with an inclusive political system. In other words, not expecting Austin to solve problems for all of us, but for us to become the ones who solve those problems in Austin,” Smith countered.

Cry Havoc Theater

Cry Havoc Theater, founded by Mara Richards Bim, presented a reading from Crossing the Line. The reading comes from the documentary-style play, which turns the voices of immigration into a script from personal interviews at the Texas-Mexico border.

Breakout Sessions

The conference broke for smaller sessions including those on Workforce of the Future and For All, Equity Starts With Us, Comprehensive Environmental and Climate action plan, The Modern Workforce and Emerging Leaders, Transportation Equity, and Immigrants in the Dallas Economy.

The Comprehensive Environmental and Climate Action Plan (CECAP) breakout session was moderated by James McGuire, director of the Office of Environmental Quality and Sustainability for the City of Dallas. The panelists were David Marquis from the Oak Cliff Nature Preserve; Dex Beyene, the assistant VP at the Federal Reserve Bank of Dallas; and Rita Beving from Public Citizens Texas.

The CECAP initiative creates a comprehensive plan that outlines goals and actions for the City of Dallas to help mitigate and adapt to the impacts of climate change. The Federal Reserve Bank of Dallas has conducted some groundbreaking research, according to McGuire, including research on the macroeconomic risks associated with climate change.

The panelists spoke about local government and community engagement, how Dallas has and will continue to be a leader in climate change, and what CECAP will do for Dallas.

“It’s up to us, as cities, to take the initiative to make the difference on climate change,” said Rita Beving.

“CECAP is a really important piece of that because it puts Dallas in a leadership position among cities in this area,” said David Marquis. According to him, urging for community engagement in CECAP is vital because climate change disproportionately effects marginalized individuals.

Opening Remarks Day 2

The second day of bigBANG! was hosted at the Federal Reserve Bank of Dallas. Roy Lopez, assistant VP and community development officer at the Dallas Federal Reserve, gave a warm welcome to the returning audience.

Speaking to the audience, Lopez asked what do these shapers and visionaries have in common? He proceeded to answer, “from my observation, it was three things. They were all willing to collaborate and use the art and science of collaboration to move from a vision to reality. Two, they all use data that led to their strategy—not the other way around. And three, they all had an eye towards racial equity as they developed their interventions.”

“We promote the issues of economic mobility and resilience. That is why this concept of economic inclusion strikes at the core of what we do,” said Lopez.

Tynesia Boyea-Robinson, president and CEO of CapEQ, also gave opening remarks about the important intersection of impact investing and inclusion. Robinson talked about the changing market forces that make impact investing here to stay by pressuring businesses to try and position themselves as big impacts.

“The first is $30 trillion of wealth changing hands from old investors to their children. Children that care about impact, more than just return,” she said. “Second, 66 percent of consumers are going to pay a premium on sustainable goods. The last market force is millennials. Seventy-seven percent of millennials refuse to work anywhere that doesn’t have a social mission and a for-profit mission.”

Burckart gave an opening keynote on how ‘not all impact is created equal.’ [Image: Erin Gilliatt]

Morning Keynote

William Burckart, president & co-founder of The Investment Integration Project, gave an opening keynote over ‘Not All Impact Investing is Created Equal.’

Burckart presented the five phases of impact investing and the challenges of impact investing.

“The latest statistics that came out of Global Sustainable Investment Review, which was in 2015, basically suggested that at least here in the U.S., one in four assets under management are now considered sustainable impact considerations.”

From L to R: Tynesia Boyea-Robinson, Avi Deutsch, Nick Jean-Baptiste, Rob Tashima. The panelists discussed equitable investing and business funding in an inclusive economy. [Image: Erin Gilliatt]

Plenary Session 1

Tynesia Boyea-Robinson moderated the panel discussion on equitable investing and business funding. Avi Deutsch, managing partner at Vodia Ventures; Rob Tashima, chief growth officer at Village Capital; and Nick Jean-Baptiste, founder and managing partner of Jacmel Growth Partners, joined the conversation on equitable investing and its role in an inclusive economy.

The conversation revolved around the importance of a diverse portfolio, the blindspots of venture capital funding, and private equity equitable investing.

“We know that the financial performance is there, even when you layer on that equitable lens, and if anything, there’s such a preponderance of research that suggests that it can be stronger if we take a look at those measures of things like equity and diversity for publicly listed companies,” said Tashima.

“The benefit of building an inclusive economy is there’s a market opportunity. You’re missing investment towards certain businesses—that means there’s a whole bunch of pipeline that other people aren’t tapping into. The second thing is the market opportunity because there are problems. That means there are solutions that can be invested in,” said Boyea-Robinson.

“We found that every business that we’ve invested in are all opportunities on investments. Looking at opportunity zones and investing in businesses that have a lot of people can bring opportunities to folks who really need it,” said Jean-Baptiste.

“I think the thing I would draw attention to more than anything, is the idea of intentionality. Once you’re made aware of a problem, you don’t have the right to pretend it doesn’t exist,” said Deutsch.

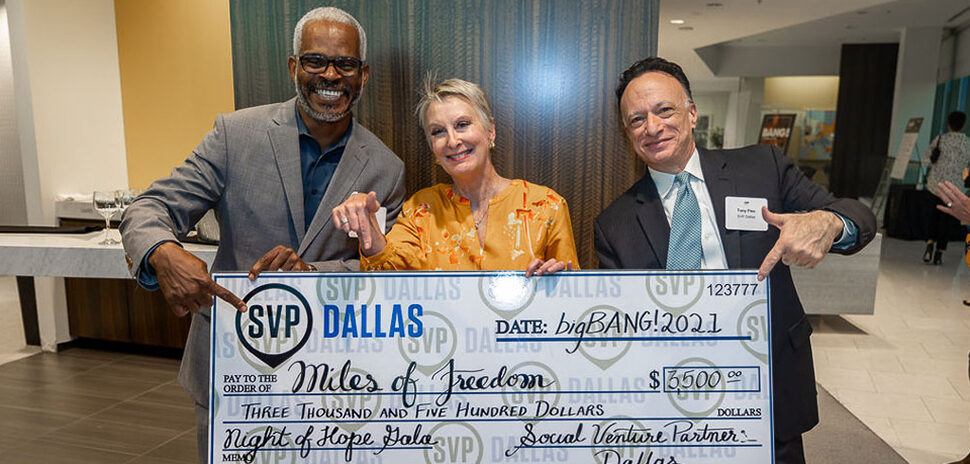

From L to R: Courtney Caldwell, Dr. Tye Caldwell, and Tony Fleo discuss the entrepreneur’s journey. [Image: Erin Gilliatt]

The Entrepreneur’s Journey

Tony Fleo, CEO of Social Venture Partners Dallas, interviewed the founders of ShearShare, Courtney and Dr. Tye Caldwell. The conversation included the lack of minority investment, the importance of industry knowledge when creating a business, and sharing the economic pie.

“We’ve had to educate about community over competition, we’re all sharing in this huge economy that is a global trillion-dollar economy and it’s not going anywhere. We build a lot of trust and spend a lot of time building that whole process around community over competition,” said Courtney.

Tye spoke about the important factors investors should consider.

“Look at the fact that we know what we’re doing, we’re building a dynamic company, we’re helping jobs stay open. The beauty industry is a multi-billion dollar industry, and we are building an ecosystem,” Tye said.

Afternoon Plenary Session

Benjamin J. Vann, founder and CEO of Impact Ventures, led the discussion on equitable investing in Dallas and how it ties into an inclusive economy. “We really believe strongly that genius is evenly distributed across zip codes, however, access and opportunity is not,” said Vann.

“If our intent and our core purpose here is to close the inequity gaps within the community, how are we going to accomplish this goal if our internal processes, procedures, behaviors, cultures, and beliefs don’t actually align with our values?,” he said.

Vann presented six key steps to help implement and prioritize racial equity within your firm: assess who allocates capital, support people of color (POC) lead organizations, support funds targeted at POC communities, address sectors or systems that disproportionately impact POC, set internal racial equity goals and new policies, and lastly, be the change, be an advocate, and be the movement.

Star Carter competing in the Fast Pitch competition. [Image: Erin Gilliatt]

Fast Pitch Competition

bigBANG! and SVP held the fast pitch competition for “for-profit” social good companies to win social impact capital. The participants included FastVisa US, Kanarys, and TrustFund Inc.

The co-founders of Kanarys, Mandy Price and Star Carter, took home the prize due to their winning pitch on Kanarys’ social impact and its potential to change the workplace.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.