Dallas-based CSW Industrials (Nasdaq: CSWI) has acquired Manassas, Virginia-based PSP Products in a $40 million deal.

The acquisition brings a family of superior surge protection and load management products to CSWI, the company said.

CSWI said the acquisition further demonstrates its commitment to allocate capital to leverage its HVAC/R distribution channel to extend the offering of products to customers. The Dallas company said it funded the transaction with cash on hand and borrowings under its existing $500 million revolving credit facility.

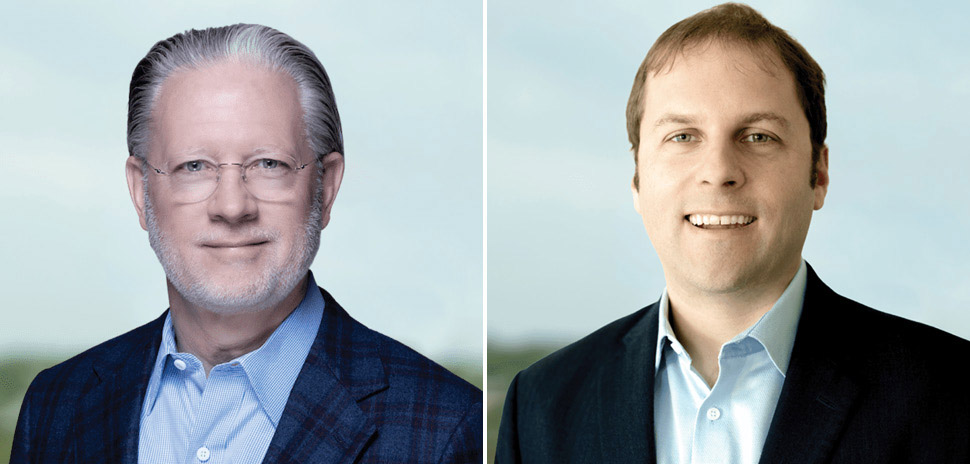

“I’m pleased to announce the acquisition of PSP to our shareholders. Adding new customers and partners into the CSWI family along with innovative products is expected to yield additional market share gains within the Contractor Solutions segment,” Joseph B. Armes, chairman, president, and CEO of CSW Industrials, said in a statement. “This new acquisition represents incremental, synergistic inorganic growth within our current end markets and aligns with our objective to drive long-term shareholder value.”

A ‘differentiated technology approach’

PSP is an industry leader in load management systems, offering novel products “which make generator installation jobs easier and more profitable.” The company says it utilizes a differentiated technology approach to its electrical management devices to ensure reliability, vigor, and strength, the company said. All PSP surge protection devices are designed, tested, and built to perform in extreme conditions for decades, the company added.

“PSP has been a great partner for CSWI in recent years, as our teams have worked hand in hand co-developing an industry-leading series of HVAC electrical products,” Jeff Underwood, SVP of CSWI and general manager, contractor solutions, said in a statement. “Bringing the PSP team into our organization will allow us to continue our pace of innovation and allows CSWI to better serve electrical distributors and contractors through the expansion of our product offering.”

CSW said the $40 million for the acquisition, including estimated working capital adjustments but excluding future earn-outs, represents a valuation of approximately 5.0x PSP’s trailing 12-month adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA).

CSW Industrials is a diversified industrial growth company with industry-leading operations in three segments: contractor solutions, specialized reliability solutions, and engineered building solutions.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.