Thematic investing is an old, but growing trend that offers investors a way to profit from emerging trends they believe in and are passionate about, a report in International Business Daily said.

But IBD said, do-it-yourself investors can face obstacles when investing in themes. Westlake-based Charles Schwab is hoping to change that. In 2022, Schwab rolled out a list of roughly 900 thematic stocks to self-directed investors in 2022, according to the publication. Last year, after an initial soft launch, the company opened up Schwab Investing Themes to all clients.

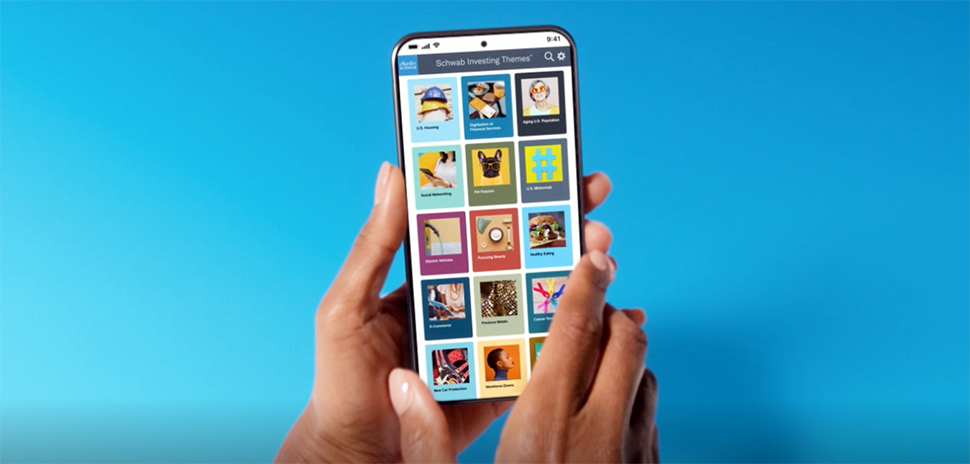

Schwab officially announced its new thematic investing platform called Schwab Investing Themes in December, which gives retail investors an easy way to put money behind their personal interests. The platform offers over 40 different investing themes covering major trends like electric vehicles, renewable energy, aging demographics, and more. Each theme contains a customized basket of up to 25 stocks related to the theme.

Linking interests and passions to investing

With the new themes, investors can now directly invest in future-focused ideas they care about with a minimum investment of $250 per theme the company said. The tool is designed to give “Main Street investors” the ability to match their portfolios to their values by giving them targeted exposure to paradigm-shifting themes in an accessible way.

[Screenshot: Charles Schwab video]

[Screenshot: Charles Schwab video]

IBD reported that the themes are “off the shelf.” But that doesn’t mean investors can’t tailor their holdings, Isaac McGuffin, director of thematic investing at Charles Schwab, told the publication. Investors can add or delete stocks or adjust the weightings of their holdings.

“It’s a really self-directed experience designed for retail investors,” McGuffin said in the publication. “It’s an interesting way for clients to engage with their investments. Maybe they’re interested in investing in cancer research or dining out is their passion; now with one click they can invest in a theme they’re excited about.”

Schwab said that it wants to help investors skip investing in themes that are nothing more than passing fads.

Investing with values in mind

Firms like Schwab are developing more tailored products to help everyday Americans put their funds where their values are.

A recent survey from Charles Schwab indicates growing investor demand for value-aligned investing. In their Retail Client Sentiment Report for Q2 2023, over 60% of clients said it is important that their investments reflect their personal values and interests. This suggests Main Street investors want their hard-earned savings to do more than just turn a profit — they want their money working to support the causes and companies they care about.

“Investors are more focused than ever on aligning how they invest with their personal passions, values and interests,” said Jonathan Craig, managing director, Head of Investor Services at Charles Schwab. “Schwab Investing Themes is a powerful new way for people to invest in ideas and areas they believe in, and as Schwab has done many times before, we’re taking something that has historically been very difficult for individual investors to do on their own and making it significantly easier, more accessible and affordable.”

AI platform assesses thematic relevance

Behind the scenes, Schwab Investing Themes utilizes advanced technology to power its thematic baskets. A specialized research team developed a proprietary natural language processing algorithm that analyzes massive data sets to identify companies relevant to each theme.

The algorithm can quickly process millions of pages of public documents, from patent grants to FDA filings, using machine learning to mimic human data analysis at scale, the company said. By scanning terabytes of text, the NLP model quantitatively determines thematic relevance scores for publicly-traded companies. It’s a process that might take a human days of work, but the algorithm can complete it in hours or minutes.

It’s a system that enables Schwab to leverage cutting-edge AI and big data capabilities to design pre-packed portfolios around forward-looking trends, the company said.

“With the launch of Schwab Investing Themes we’re making powerful investing technology and research directly available to Main Street investors while also making it incredibly easy to use with very low barriers to entry,” said Neesha Hathi, managing director, head of Schwab Wealth & Advice Solutions.

“Schwab Investing Themes is a culmination of a number of innovations and investments Schwab has made on behalf of investors — from fractional share trading to digital brokerage capabilities to AI-powered research.”

Speaking of AI, Schwab said its thematic platform caters to investors hoping to use AI to get an edge. You can find out more about the platform here.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.