Two Dallas fintechs have joined forces to extend their reach among unbanked and underbanked borrowers.

Zirtue, a startup for relationship-based lending, said Wednesday that it’s partnering with money-transfer powerhouse MoneyGram International to enable these consumers to borrow funds from their loved ones.

Under the partnership, unbanked and underbanked consumers can borrow money from friends and family with Zirtue, then access those funds in cash at participating MoneyGram locations throughout the U.S., or—for underbanked borrowers with a bank account or debit card—via the Zirtue app, the startup said.

Previously, all Zirtue borrowers had to link either their bank account or their debit card to their profile before requesting a loan or receiving funds.

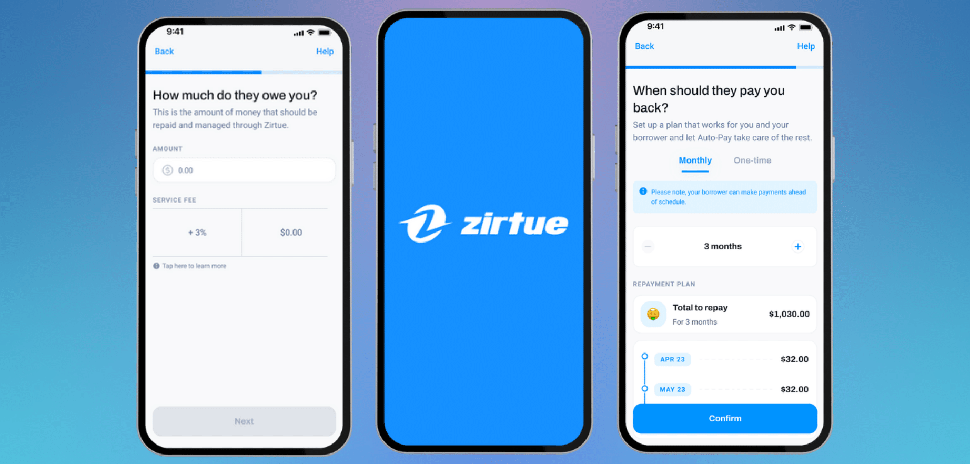

Zirtue, founded in 2018, calls itself the first relationship-based, peer-to-peer lending application with direct payments to creditors. The company facilitates new low-interest loans between family members and friends by offering manageable payment schedules, loan tracking, an autopay feature, and recurring payment reminders for borrowers.

“Our collective goal for global impact with MoneyGram is to help communities reimagine their lives by giving people a hand up, instead of a handout,” Dennis Cail, co-founder and CEO of Zirtue, said in a statement. “Now, millions of underserved individuals can receive the financial lifelines they need on their own terms—ultimately creating greater financial equity and inclusion.”

An alternative to payday loans, check-cashing services

An estimated 4.5% of U.S. households—or about 5.9 million households—were considered unbanked in 2021, according to a survey by the Federal Deposit Insurance Corp. Unbanked rates were higher among low-income and less-educated households and among Black, Hispanic, and single-mother households, the agency said.

Lacking access to checking or savings accounts at a bank or credit union, the unbanked instead turn frequently to pricey options like payday loans and check-cashing services, often creating still more financial hardship.

MoneyGram said in a statement that the Zirtue partnership is a way to enhance the financial system for global consumers. Luther Maday, MoneyGram’s head of fintech strategy and innovation, called Zirtue “a forward-looking company that shares our mission to drive financial inclusion for all.”

MoneyGram, the second-largest money-transfer company behind Western Union, according to U.S. News & World Report, has more than 430,000 locations around the world, including more than 20,000 in the U.S.

Zirtue, with more than 20 employees, says that it’s raised $6.6 million in VC funding, and that more than $50 million in loans for bills and personalized IOUs have been processed on its platform so far. User growth and loans are up 113% from 2022 to 2023, Cail says.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.