McKinney-based Encore Wire—a leading manufacturer of copper and aluminum for residential, commercial, and industrial wire needs and one of the city’s largest companies—is being acquired by Italy-based Prysmian in a deal valued at more than $4.15 billion.

A public company, Encore Wire is listed on Nasdaq under the ticker symbol WIRE. The acquisition is being financed via a mix of cash and newly committed debt facilities, Prysmian said.

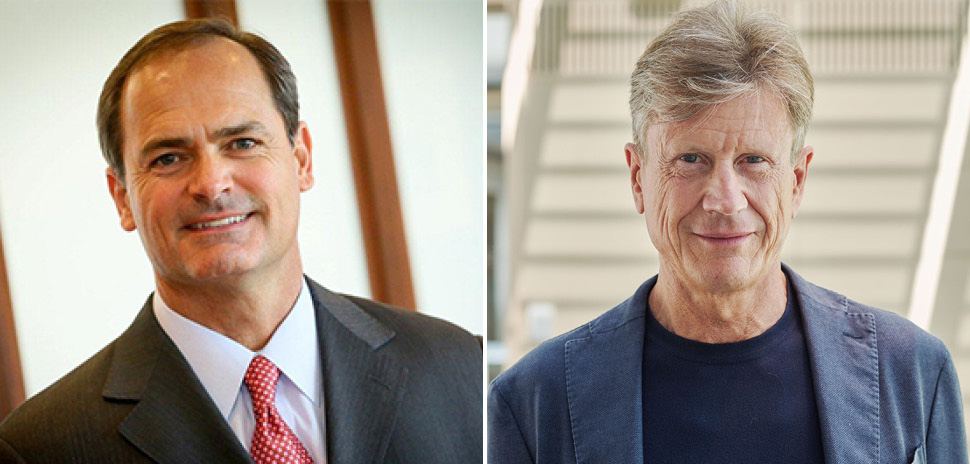

“We’re pleased to have reached an agreement that reflects the remarkable value Encore Wire has created with our expansive single-campus model, low-cost production, centralized distribution and product innovation,” Daniel L. Jones, Encore Wire’s chairman, president, and CEO, said in a statement. “This transaction maximizes value for Encore Wire shareholders and provides an attractive premium for their shares.”

Jones said that the two businesses complemented each other extremely well, pointing toward a bright future for both companies. He also expected the deal to bring more opportunities in the future for employees “whose dedication and hard work made this transaction possible.”

“We look forward to working with Prysmian to complete this value-enhancing combination and realize the significant benefits that we expect it will bring to all of our stakeholders,” he said.

Prysmian set to maintain ‘a significant presence’ in McKinney

After the deal closes, Prysmian said it expects to maintain a significant presence at Encore Wire’s vertically-integrated, single-site campus in McKinney.

“The acquisition of Encore Wire represents a landmark moment for Prysmian and a strategic and unique opportunity to create value for our shareholders and customers,” Massimo Battaini, Prysmian designated group CEO, said in a statement. “Through this acquisition, Prysmian will grow its North American presence, enhancing its portfolio and geographic mix, while significantly increasing the exposure to secular growth drivers. We look forward to welcoming the Encore Wire team to Prysmian and benefitting from the combined company’s enhanced product offerings and customer relationships.”

Benefits of the deal

Encore Wire is highly complementary to Prysmian’s strategy, the company said. In particular, the transaction will allow Prysmian to:

- Increase its exposure to secular growth drivers

- Enhance its exposure to North America

- Leverage Encore Wire’s operational efficiency and best in class service across Prysmian’s portfolio

- Broaden Prysmian’s product offering enabling the combined company to better address customers’ needs in North America

The transaction is expected to close in the second half of this year.

Nasdaq reported that Encore Wire’s stock surged more than 11% Monday morning on the news. It ended the trading day up nearly 12%.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.