Silver Hill Energy Partners has closed its fourth partnership and second institutional private equity fund, Silver Hill Energy Partners IV LP, the Dallas-based firm announced.

At closing, Silver Hill IV was oversubscribed with total capital commitments of $1.13 billion from a group of institutional investors comprised of endowments, pension funds, medical and family foundations, and family offices, the majority of which are repeat investors.

The formation of Silver Hill IV continues the company’s founding focus on the direct ownership, operation, and control of onshore oil, natural gas, and related infrastructure assets in premier basins across the U.S., Silver Hill said.

Since its founding in 2011, Silver Hill has raised $2.875 billion of cumulative capital commitments.

“The strong demand and oversubscribed interest we experienced with Silver Hill IV is reflective of institutions’ continuing appetite for compelling risk-adjusted returns in the energy sector,” Silver Hill Founder and CEO Kyle D. Miller said in a statement. “We’re proud of the high-quality portfolio we have strategically built and developed over the last several years, and we are extremely grateful for our partners and the shared sentiment they’ve shown through their support of our latest fund.”

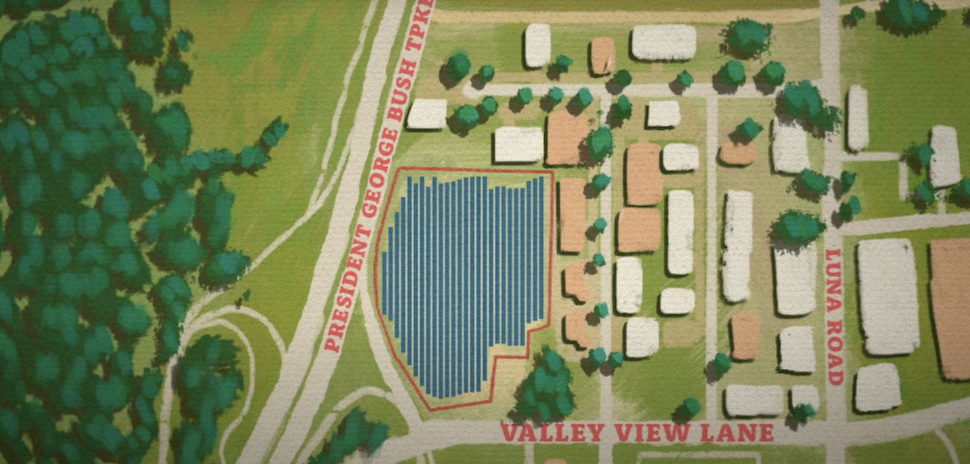

“We’ll continue to look for ways to drive value through the development of our existing Haynesville and Bakken assets while we evaluate creative ways to grow our portfolio in both current and additional operating areas,” Miller added. “Looking to the future, we remain committed to the safe and responsible development of oil and gas assets and environmentally-conscious operations evidenced by reductions of emissions and improved carbon footprints on every set of properties we have acquired.”

Silver Hill said it focuses on acquiring, optimizing, and developing oil and natural gas properties in high-quality, active basins throughout the onshore U.S.

Since August 2021, the company has completed seven large-scale upstream transactions, two midstream development projects supporting its upstream operations, and dozens of complimentary mineral and royalty acquisitions. Silver Hill said it also realized a successful full-cycle investment of its Eagle Ford assets in South Texas.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.