Last month, we told you about Dallas-headquartered Take Command Health reaching its goal of $1.5 million with the completion of a bridge funding round. Now, the health tech startup is getting the presidential treatment—the team was invited by the White House to the Rose Garden last Friday to discuss the newly established Individual Coverage HRA.

Take Command is a leader in administering qualified small employer HRAs (health reimbursement accounts) and an advocate for tax-friendly benefits solutions. An HRA is a type of employer-funded health benefit plan that reimburses employees for out-of-pocket medical expenses and, in some cases, pays for health insurance plan premiums.

Take Command said the conversation at the White House focused on expanding healthcare options for both businesses and workers via reimbursement. The President, the VP, and members of Congress were all present.

And, according to Take Command, it was the only HRA solutions provider invited there.

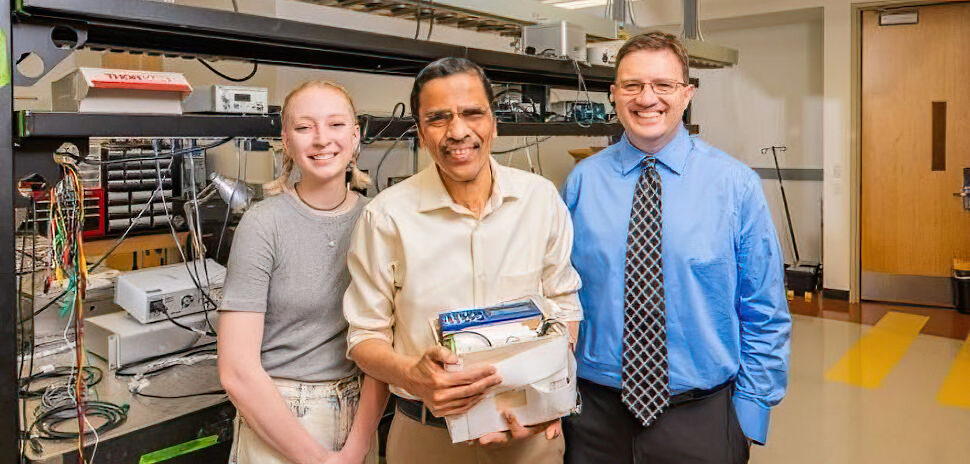

[Photo: Courtesy Take Command Health]

“As the only company that offers both HRA administration and individual insurance support, we were honored to share our unique perspective with President Trump as an advocate for businesses and workers alike,” Take Command CEO Jack Hooper said in a statement. “These new HRAs are about to change the game when it comes to benefit solutions for small businesses and their employees.”

The new Individual Coverage HRA—along with the Excepted Benefit HRA—aims to allow small businesses the ability to reimburse for healthcare premiums and qualified medical expenses tax-free. But, employees can choose the best plan for their specified needs.

The White House visit followed the news that the Trump Administration had finalized a rule to expand HRAs, intended to open more coverage options for working Americans. Hooper said the final ruling confirms what he and his team have suspected about the Individual Coverage HRA (ICHRA).

“Some employers are figuring out how to manage costs effectively: they are invested in wellness programs, engaged in high-performance network design, and interested in helping employees with chronic conditions effectively manage costs,” Hooper said. “Other employers would rather not try to manage employee healthcare spend. You can still offer generous benefits and your costs are fixed because you have no risk to manage. Let’s repeat that—ICHRA allows employers to ‘get out’ of the insurance risk game.”

Hooper’s been focused on optimizing the Take Command platform, developing the first tools on the market for the new HRAs, and growing his team. With these efforts, Hooper said Take Command will be able to help connect consumers with the more efficient, tax-friendly way to offer benefits.

Take Command’s funding fueled its momentum

Take Command said the recent $1.5M bridge funding round paved the way for the Individual Coverage HRA and the Excepted Benefit HRA.

“With another successful fundraising round behind us, we are excited to use this new momentum to prepare for an entirely new way of thinking about group benefits,” Hooper said when the news broke.

Both options are expected to be available in January. In May, details of the two new HRAs had not yet been released.

The finalized rules still aren’t available, but Take Command did recently come out with a new resource for Individual Coverage HRA, which it calls a “free, first-of-its-kind guide on a new kind of HRA slated to shake up the group benefits market in January 2020.”

For companies with 50-plus employees, ICHRA allows for benefits with fixed costs and no risk to manage. Hooper expects ICHRA to change the game in terms of group benefits, as it offers greater flexibility, affordability, personalization, and tax efficiency.

Take Command said it wants to lead that change.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.