After a vote by its board, Dallas’ Jacobs Solutions Inc. announced it plans to separate its Critical Mission Solutions (CMS) business from Jacobs, creating two independent companies with each positioned for greater success.

Jacobs is one of the world’s largest professional services and engineering firms.

“Today’s announcement is a significant milestone in our long record of taking bold actions to drive value creation,” Jacobs CEO Bob Pragada said in a statement. “By separating CMS, we will streamline our business portfolio and transform Jacobs into a higher-growth, higher-margin company more closely aligned with key global mega trends and growth sectors.

He said that for the CMS business, the benefits from the separation are equally compelling.

“CMS has grown to be an industry leading government services provider with significant scale, differentiated services and deep client relationships. As an independent company, CMS will be better able to focus on its distinct strategy and operating needs, driving further momentum in its business. We believe the separation will create value for all stakeholders,” Pragada said.

Advantages of separating Jacobs and CMS

Jacobs said that as separate companies, it and the CMS business are expected to benefit from:

- Enhanced focus with the ability to pursue individualized strategies and operational initiatives specific to the industries in which they each operate

- Tailored capital allocation and structure, including equity, directed toward their respective growth opportunities and in line with industry-specific dynamics

- Strengthened ability to attract and retain top talent through incentive programs more closely aligned with individual business performance

- Investment profiles aligned with investor expectations and preferences for different market and business dynamics

- Proven leadership teams and dedicated employees delivering world-class services to clients

Following the separation, Jacobs said it will continue to be a premier technology-enabled solutions provider focused on addressing the world’s most complex critical infrastructure and advanced manufacturing challenges.

The streamlined portfolio will combine leading global capabilities in consulting, planning, engineering, design, and program management with data science and technology-enabled expertise to deliver differentiated end-to-end solutions for primarily state, local, and national governments and private sector clients throughout the world, the company said.

Jacobs’ leading positions in the attractive water and environment, energy transition, transportation, and advanced manufacturing sectors are each closely aligned with its three growth accelerators – Climate Response, Consulting and Advisory, and Data Solutions.

Leading provider of services to federal agencies

Excluding the businesses to be separated, Jacobs said it generated roughly $10.5 billion in revenue in fiscal year 2022.

Critical Mission Solutions, which generated roughly $4.4 billion in revenue in fiscal year 2022, is a leading provider of technical consulting, applied science research, training, intelligent asset management and program management services to federal government agencies.

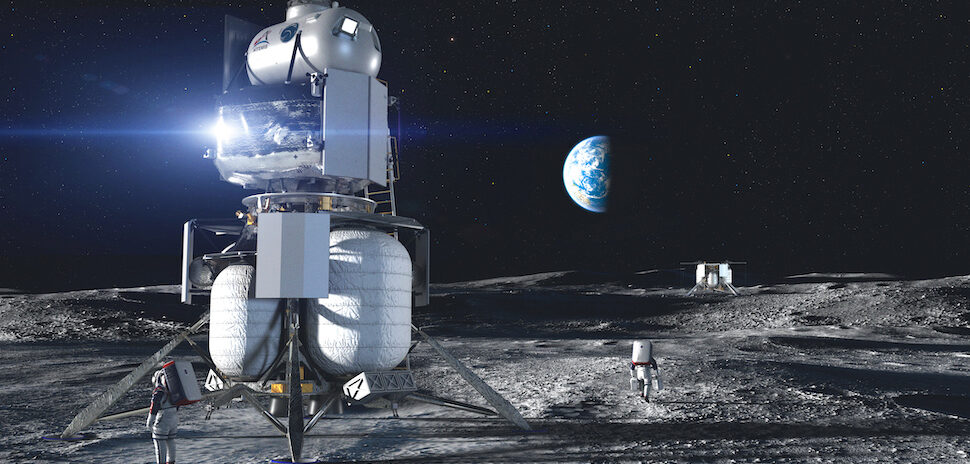

CMS delivers mission-critical technology-enabled solutions aligned to space, national security, nuclear remediation, and 5G technology. It benefits from a strong base of recurring, long-term enterprise contracts, where CMS’s distinctive capabilities and deep client relationships provide a competitive advantage.

Steve Arnette, EVP and President of CMS, will continue to lead CMS, Jacobs said.

Jacobs said it is committed to maintaining an investment grade profile following the separation. The proposed capital structure, governance, and other matters relating to CMS are still being determined and will be communicated at a later date, Jacobs said.

The company said it is targeting completing the separation in the second half of fiscal year 2024 through a distribution that is intended to be tax-free to Jacobs shareholders for U.S. federal income tax purposes.

Completion of the separation transaction is subject to final approval by Jacobs’ board of directors and other customary conditions, including the receipt of a private letter ruling from the Internal Revenue Service, opinions from tax advisers, and the filing and effectiveness of a registration statement with the U.S. Securities and Exchange Commission.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.