Dallas-based DataBank announced a $2 billion equity raise led by AustralianSuper, Australia’s largest superannuation fund, which committed $1.5 billion that, upon closing, will make AustralianSuper “a significant minority owner of DataBank” and see it join the company’s board of directors.

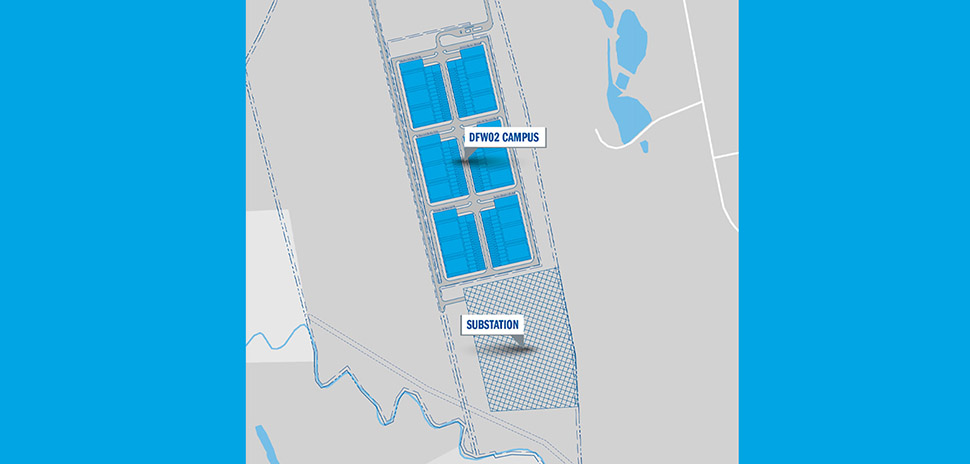

DataBank—which recently announced a planned 480MW data center campus in Red Oak, south of Dallas—is a provider of enterprise-class edge colocation, interconnection, and managed services. The transaction is expected to close by the end of the year.

“We’re delighted to have AustralianSuper join our investors,” DataBank CEO Raul Martynek said in a statement. “Along with the continued support of our existing investors, it’s a vote of confidence in our strategy and our proven ability to execute and scale the DataBank platform. This investment, and our new campuses, are a game-changer for DataBank and our customers, allowing us to bring this capacity to market now and seize the incredible opportunity ahead of us.”

DataBank said the capital raise was oversubscribed and, in addition to the $1.5 billion from AustralianSuper, included another $483 million in commitments from “existing investors.”

The investment in DataBank would be AustralianSuper’s first in the U.S. data center market and the second alongside existing DataBank investor DigitalBridge. AustralianSuper’s global real assets portfolio now totals nearly $40 billion and includes digital infrastructure assets across Australia, EMEA, and South America.

Capitalizing on ‘the unprecedented demand for cloud and AI infrastructure’

DataBank said that proceeds from the raise will be used to finance growth across DataBank’s industry-leading footprint of more than 65 data centers in more than 27 markets, including the three new campuses it has announced in the past year: the 480MW campus in Red Oak, a 192MW campus in Culpeper, Virginia, and a 120MW campus in Atlanta.

The company said those sites, as well as expansions in other markets, will add more than 850MW of power to DataBank’s portfolio, more than tripling its existing 330MW of power deployed, and enabling it to meet unprecedented demand for AI, hyperscale cloud, enterprise, and large technology workloads.

“Our investment in DataBank comes at an exciting time in its growth trajectory with strong tailwinds across the sector, coupled with DataBank’s ambitious expansion program and diverse business base,” Derek Chu, head of American Real Assets at AustralianSuper, said in a statement.

Chu said that he and his team are delighted to help Databank “capitalize on the unprecedented demand for cloud and AI infrastructure.”

“DataBank will grow and further diversify our global digital infrastructure exposure, a sector we believe will help deliver sustainable, long-term performance for more than 3.4 million members,” he added.

Jon Mauck, senior managing director at DigitalBridge, said the investment provides for new opportunities.

“DataBank’s proven track record, expansion capacity, and strong leadership, position it to take full advantage of the tremendous market opportunities in the U.S.,” Mauck said in a statement. “This investment highlights the resilience and long-term value of digital infrastructure as an asset class.”

With this transaction, DataBank said it has raised more than $4 billion in debt and equity over the past 12 months, including a $725 million credit facility announced in April, a $456 million securitization completed in February, a $345 million construction loan signed in November 2023, and a $188 million equity investment completed that same month.

BofA Securities and Citizens Capital Markets Inc. acted as financial advisors for DataBank. Citi acted as financial advisor for AustralianSuper. Simpson Thacher & Bartlett LLP acted as legal counsel to DataBank and Milbank LLP acted as legal counsel to AustralianSuper.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.