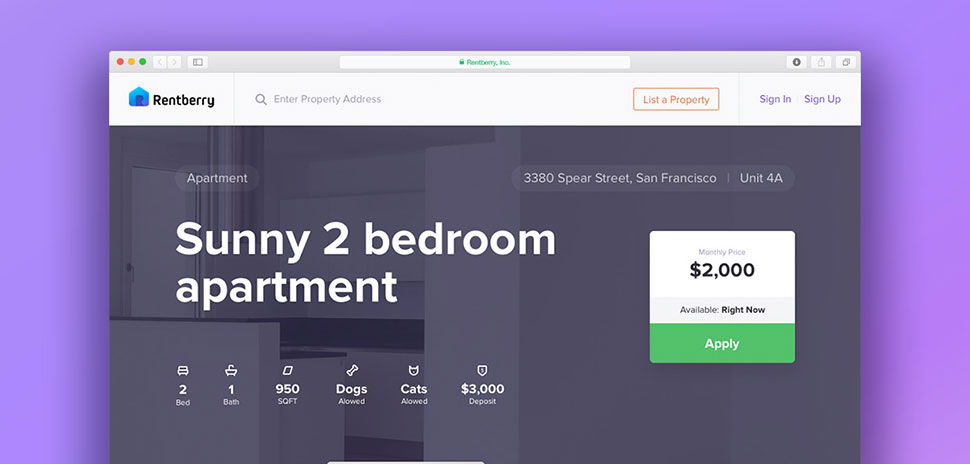

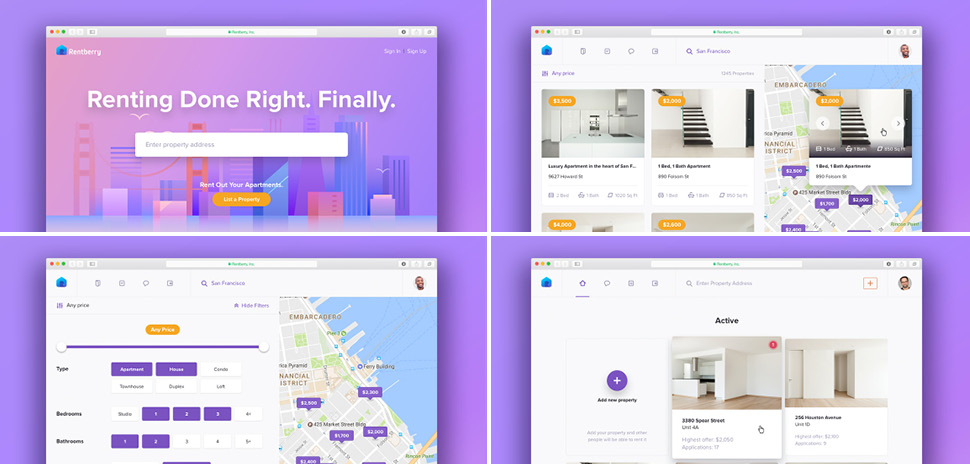

Rentberry has already disrupted the home rental business in North Texas, creating a one-stop platform where tenants can bid on homes, pay rent, and conduct other transactions through an app.

Now, the Bay Area company wants to introduce blockchain and cryptocurrency to revolutionize the home rental deposit market.

Rentberry has expanded to about 5,000 cities nationwide with about 1,000 live listings in North Texas alone.

Most rental homes are owner occupied so they don’t offer the ability for tenants to pay rent through an app or sign an electronic contract. Rentberry solves that problem for landlords and renters.

Rentberry has expanded to about 5,000 cities nationwide with about 1,000 live listings in North Texas alone, said CEO Alex Lubinsky. Overall, the company has 250,000 properties listed.

RENTBERRY PLANS TO LAUNCH BLOCKCHAIN IN SECOND QUARTER

More than $500 billion is tied up in traditional rental deposits at any given time as part of an inflexible system that doesn’t reward tenants for good behavior, Lubinsky said.

When someone buys a new car, the interest rate on the loan is based on their credit score.

“The same logic should apply to the rental market because all tenants are different,” Lubinsky said. “If the likelihood that you will damage the place is very small and you have a good rental history, you should be rewarded by not having as high a rental deposit as somebody else.”

Rentberry will launch the blockchain in the second quarter.

In December, Rentberry launched an initial coin offering that will last through Feb. 28. The ICO raised $3 million in 48 hours and has already surpassed the $30 million mark.

HOW BLOCKCHAIN WORKS WITH RENTBERRY

By using the blockchain, it’s a decentralized process completely removed from the traditional deposit system.

With Rentberry, the renter pays 10 percent of the deposit, but it must be paid through cryptocurrency. The remaining 90 percent is funded through a global crowdsourcing blockchain system where anyone can bid on the chance to invest by paying a portion of the deposit. The investors get an interest rate based on their cost of capital.

And the renters have a profile that shows whether they are good tenants so the investors know the potential risk.

The 10 percent security deposit, the crowdsourced funding, and interest are all funded through the cryptocurrency in the blockchain.

Rentberry users aren’t required to use the blockchain, but the deposits and application fees will be lower to encourage people to use it instead of the traditional method, Lubinsky said.

The 10 percent security deposit, the crowdsourced funding, and interest are all funded through the cryptocurrency in the blockchain.

U.S. dollars can be exchanged to cryptocurrency via various exchanges. It is not handled by Rentberry.

After the terms of the lease, the security deposit is returned to the renter and the investors who crowdfunded it.

So, if the deposit is $1,000, the renter will pay $100 of that for the 10 percent deductible, and the remaining $900 will be paid by investors who bid through the blockchain. The renter’s entire transaction is done through cryptocurrency, including the monthly interest payment to the investors.

At the end of the lease, the renter gets the $100 back (assuming the rental house is in good shape) and the investors get their money back plus interest.

BREAKING NEW GROUND

The Rentberry concept isn’t without controversy, though. This article by The Mercury News warns that the haggling over rent could spark bidding wars that push prices even higher.

However, Lubinsky said his goal is to make the process more transparent and cheaper for renters. They could actually end up with a lower price and save money by doing things electronically, he said.

Rentberry was named one of the Top 10 Initial Coin Offerings to watch in 2018 by Inc. Magazine.

Image: Rentberry

![]()

Get on the list.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.