So, you went on a family trip a few years back and paid for your brother-in-law’s hotel room. He promised to reimburse you as soon as he got his tax refund, but the refund arrived—and the year slipped by—and he still owes you the dough. Now, every Thanksgiving, there’s tension along with the turkey and cranberry sauce.

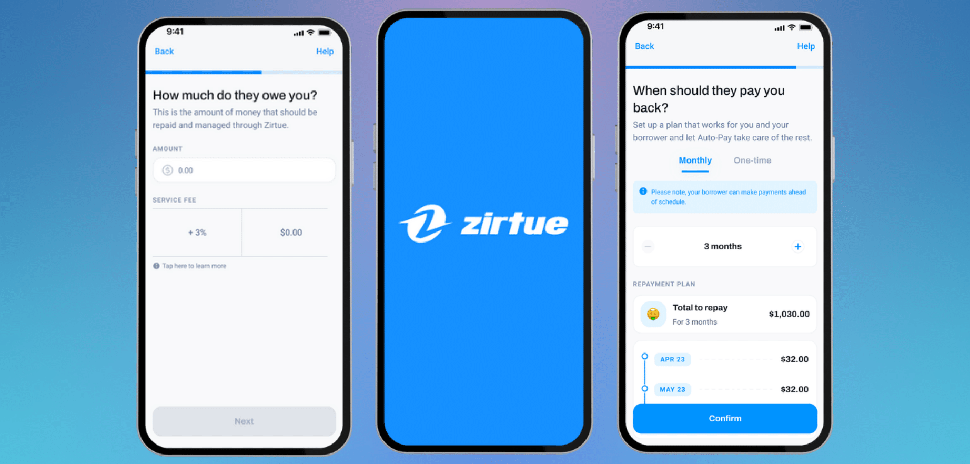

Resolving uncomfortable situations like that just became easier after Zirtue, a Dallas startup for relationship-based lending, announced it was expanding its technology platform to include a “repayment request” function. The new feature is aimed at people with an existing loan with a friend or family member that might have put a strain on their relationship.

The expansion enhances the company’s basic offering, which facilitates new low-interest loans between family members and friends, to allow moving “paper-napkin IOUs”—outstanding, pre-existing, non-digital loans—to Zirtue’s AI-driven app. The platform then manages the loan, prioritizing efficiency and helping preserve relationships, according to Zirtue.

Dennis Cail, CEO and co-founder of Zirtue [Photo: Zirtue]

Dennis Cail, the fintech’s CEO and co-founder (along with CFO Michael Seay), says the new feature was added in response to requests from the platform’s most active users.

Typically, he explains, many of Zirtue’s lender-users are successful individuals who’ve been hit up repeatedly for money and would like to start getting repaid, since today’s stock market is less favorable than it was four or five years ago.

“There are a lot of lenders out there that have multiple people that they’ve loaned money to,” he says. “And they’re like, ‘Look, if I have a chance of getting one of those loans paid back, it’s worth it.’”

According to a survey and analysis by comparison website Finder, Americans borrow an estimated $184 billion from friends and family members each year, with an average loan amount of $3,329. The top reasons for such transactions are to pay utilities, other bills, and rent, the survey showed.

An alternative to high-interest credit cards and payday loans

Zirtue, founded in 2018, says it’s the first platform to provide structure and accountability for peer-to-peer loans, creating transparency between borrowers and lenders by offering manageable payment schedules, loan tracking, an autopay feature, and recurring payment reminders for borrowers.

It also offers an “alternative payment solution” to enterprise businesses like AT&T and Reliant Energy that enables their customers to pay their bills directly through the app. With “a couple of dozen” corporate partners, the B2B option now accounts for about 60 percent of Zirtue’s business, Cail says.

With a total of 21 employees, the company has processed “close to $80 million in loans” and has more than 300,000 registered users so far, he adds. It’s also raised nearly $7 million from investors including Morgan Stanley, Northwestern Mutual, and Houston-based Mercury Fund.

Touted by Cail as “driving financial inclusion and equity,” Zirtue is positioned as an alternative to high-interest credit cards, risky check-cashing services, and onerous payday loans for unbanked or underbanked individuals.

That’s increasingly important these days, the company contends, with interest rates soaring and consumer debt at a record-high $16.9 trillion at the end of 2022, according to the Federal Reserve Bank of New York.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.