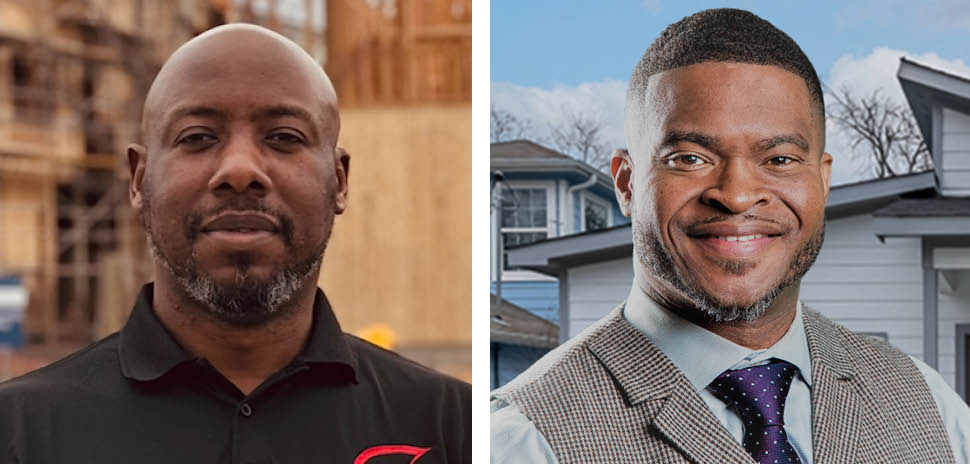

Brent Ball has joined Dallas-based TDI as president and partner.

TDI, a Class A multifamily investment platform with roughly $3.7 billion of multifamily assets, said Ball will lead efforts to maximize the value of its existing portfolio, expand focus on attainable housing geared for educators, first responders, and other essential workers, and provide third-party capital through preferred equity and tax-exempt bond investments.

“We have a growing housing affordability crisis for moderate-income households that is perpetuating,” Ball said in a statement. “Our passion is to help serve this middle-income tier of families in all cities throughout Dallas-Fort Worth through the state approved Housing Finance Corporation (“HFC”) legislation. I appreciate that TDI has already exhibited their commitment toward this effort by structuring its developments in Anna, Fort Worth, and McKinney to serve such households.”

Ball previously was SVP of Asset Management for Willow Bridge Property Co., leading asset management efforts nationally for the company’s owned portfolio. He brings more than 35 years of experience in investment management, acquisitions, and development with an emphasis on underwriting, operational guidance, and strategic planning.

Multifamily portfolio management expertise

Before Willow Bridge, Ball served at Trammell Crow Co., CBRE’s development subsidiary, where he established an asset management function overseeing a $5.5 billion multifamily portfolio of developed and committed pipeline assets.

Ball also served in multiple capacities at Fairfield Residential Co. for over 20 years, including his position as one of the firm’s principals.

At Fairfield, Ball designed and directed the company’s national asset management division to support its development and acquisition/rehab business lines from point of underwriting through monetization on a portfolio of up to 65,000 units. He also led Fairfield’s disposition activities, property management company, and condominium formation and sales platforms.

Before Fairfield, Ball spent seven years at Archon Group, a wholly-owned subsidiary of Goldman Sachs, where he directed the acquisition, asset management, and asset repositioning of the multifamily business line in the Western and Southwestern United States.

TDI is a multifamily investment and operating company owned by Bobby Page, Ron Ingram, and Brad Taylor, the former owners of JPI.

While at JPI, they led the company to develop 115,000 apartment homes across 380 communities representing $18 billion of value.

Having recently sold the JPI operating company platform to Sumitomo Forestry America Inc. in November, TDI retained 31 real estate projects with a total valuation of $3.7 billion.

![]()

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.