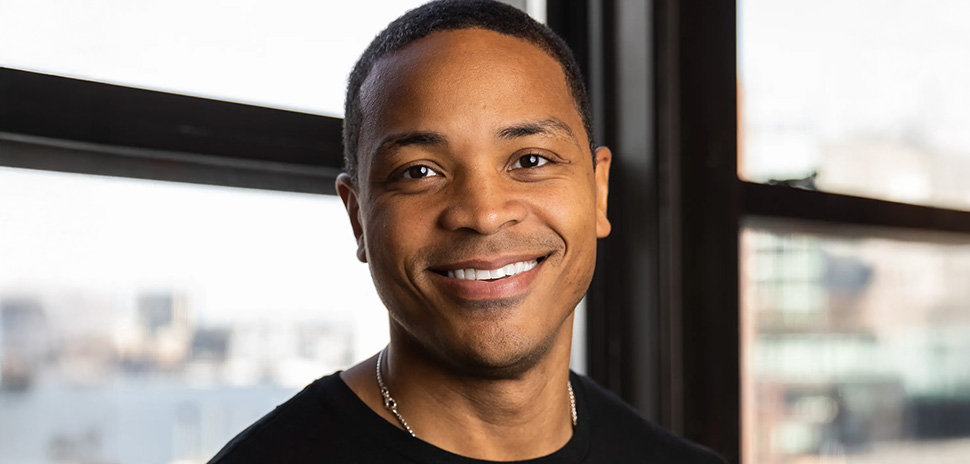

Croft Young [Photo: CBRE]

Croft Young, a senior investment banker, will join Dallas-based CBRE Group as chief investment officer in July, the company announced.

The real estate services and investment company said that its global Corporate Development and Strategy teams will report to Young.

CBRE said it has enhanced its market position over the last several years through a combination of organic growth and mergers and acquisitions (M&A). With $4.8 billion of liquidity at year-end 2022, CBRE is positioned to make further strategic gains in M&A under Young’s leadership, the company said.

“We are excited that Croft has decided to join CBRE,” Bob Sulentic, CBRE’s president and chief executive officer, said in a statement. “He has an exceptional M&A track record in the real estate sector and couples this with strong strategic and leadership skills.”

Young is coming to CBRE from Morgan Stanley, where he is a managing director in the Real Estate Investment Banking Group.

Over the past 14 years, Young has been integrally involved in $175 billion of strategic and capital transactions, including M&A such as the sale of Industrial Properties Trust to Prologis and the sale of Fairmont Raffles Hotels International to Accor SA, CBRE said. His clients include public and private real estate investors, operators, service providers, and investment managers.

“It feels fantastic to be joining an industry leader recognized for its innovation and deeply committed to excellence and growth,” Young said in a statement. “I look forward to working with my new colleagues to leverage CBRE’s many strengths across its diversified global platform to create value for all our stakeholders.”

CBRE said that Young will join its global Executive Committee and will report directly to Sulentic.

CBRE Group Inc. is a Fortune 500 and S&P 500 company. It is the world’s largest commercial real estate services and investment firm (based on 2022 revenue).

Get on the list.

Dallas Innovates, every day.

Sign up to keep your eye on what’s new and next in Dallas-Fort Worth, every day.

R E A D N E X T

-

Shaul Kuba has been appointed chief investment officer by Dallas-based CMCT, a real estate investment trust that owns, operates, and develops premier multifamily and creative office assets. CMCT said that Kuba will direct the continued expansion of CMCT’s portfolio of highly amenitized, premier multifamily and creative office assets in dynamic, high-barrier-to-entry markets across the nation. Kuba is a CMCT board member as well as a co-founder of CIM Group. The company said that he brings a wealth of experience in creative office, multifamily, and mixed-use investment, and development in leading CMCT's investment strategies which focus on next-gen assets and partnering…

-

Jim Lake and Amanda Moreno are turning 40,000 square feet of real estate in downtown Cedar Hill into a mixed-use development with offices, restaurants, residential, and retail space. The $14 million project, which has yet to be named, builds on Jim Lake Companies' Bishop Arts success.

-

CBRE said the acquisition complements its existing global Integrated Laboratory Solutions capabilities for occupier clients in the fast-growing research and laboratory equipment sector. The deal "positions CBRE to self-deliver an impressive range of scientific laboratory maintenance and repair services," says John Dunstan, CEO of GWS/Enterprise at CBRE.

-

Pathlock's recent mergers, acquisitions, and capital raises have enabled the company to address the increasing risk in application security while establishing its leadership position as the industry's most complete 360-degree platform for application security and controls automation.

-

Fort Worth-based convenience store operator Yesway, has appointed Thomas W. Brown as its new chief real estate officer. Yesway was founded in 2015 by Brookwood Financial Partners, a Massachusetts private equity real estate firm. Brown has a long-standing tenure with Brookwood, during which he made exceptional contributions as a member of the senior management team. According to Tom Trkla, chairman and CEO of Brookwood and chairman, president, and CEO of Yesway, Brown is highly respected in the private equity, commercial real estate, and convenience retailing sectors for his expertise and experience. "Over the course of his long-standing tenure at Brookwood,…

![]()