FEATURED

The acquisitions are part of UFT’s strategy to boost regional expertise while growing its portfolio of solutions to better serve municipal and industrial customers throughout the Southeast, said the company, which was acquired by Berkshire Partners in December from H.I.G. Capital.

Irving’s United Flow Technologies Acquires Florida’s CS3 Water Works, Georgia’s Principle Environmental

by Sandra Engelland | Feb 18, 2026

The acquisitions are part of UFT’s strategy to boost regional expertise while growing its portfolio of solutions to better serve municipal and industrial customers throughout the Southeast, said the company, which was acquired by Berkshire Partners in December from H.I.G. Capital.

MORE►

by David Seeley |

Feb 18, 2026

This is the latest move in the mining sector for Caterpillar, the world's leading manufacturer of construction and mining equipment. The company has been a leader in innovative autonomous mining solutions, including its Cat MineStar Command system for autonomous hauling, drilling, and more.

MORE►

by Sandra Engelland |

Feb 17, 2026

The round follows an earlier $12 million raise announced by Uptiq in October. The McKinney-based company said the funding will help further scale and expand Qore, its flagship platform combining document intelligence, an extensive set of financial skills, multi-agent workflows, and secure integrations into a single system.

MORE►

by David Seeley |

Feb 17, 2026

Founded in 2016 "by restaurant people for restaurant people," Plein Air offers marketing, technology, and data consultation to more than 75 clients across the U.S., including True Food Kitchen, Freddy’s Frozen Custard & Steakburgers, Main Event, Tropical Smoothie Cafe, and more.

MORE►

Trinity Hunt Partners Launches Workforce Services Platform Allvia

by Sandra Engelland | Feb 12, 2026

Allvia was formed through Trinity Hunt's investment in San Jose-based Melita Group, a human resources, benefits administration, and payroll provider. Fred Pettijohn has been named as Allvia's CEO.

MORE►

by Sandra Engelland |

Feb 12, 2026

In addition to the funding, led by Boston's Glasswing Ventures, Cydelphi debuted its patent-pending DFIR platform, which is custom-built to enable organizations to recover from catastrophic breaches "in days rather than months."

MORE►

by Quincy Preston |

Feb 11, 2026

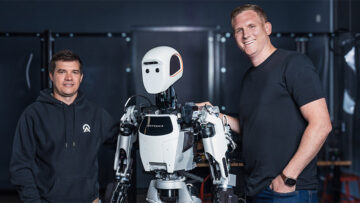

The Austin-based maker of the Apollo humanoid robot closed a $520M Series A-X extension, bringing its total Series A to more than $935M and total capital raised to nearly $1B. Dallas-based AT&T Ventures joins Google, Mercedes-Benz, John Deere, and others in the round.

MORE►

by Sandra Engelland |

Feb 11, 2026

Uptown Brands aims to help founders have a smoother path between vision and execution. The platform combines investment and integrated marketing support to help brands launch faster, with fewer handoffs and greater accountability. Consumers of those Uptown Brands' companies will find stronger storytelling, more consistent experiences across channels, and brands that grow without losing what made them resonate in the first place, the agency said.

"Uptown Brands operates on the simple belief that when we commit to building a brand, we invest alongside it and put real skin in the game," said Joseph Alexander, president and CEO of The Uptown Agency.

MORE►